Stocks on the Rise: Understanding Market Patterns for 2025

Exploring stock market patterns can feel daunting. Terms like 50-day moving averages and head-and-shoulders formations might seem overwhelming. However, there’s a key pattern that’s simpler and vital for investors: Over the long haul, the S&P 500 increases two out of every three years, translating to about a 66% chance of annual gains.

Given this historical pattern, it makes sense to consider whether the stock market will rise in 2025. Betting on an upward trend appears to be the most sensible approach. Ignoring this pattern could lead to missed opportunities, prompting me to think seriously about Nvidia (NASDAQ: NVDA) for my portfolio. Here’s my reasoning.

Understanding the Market Dynamics

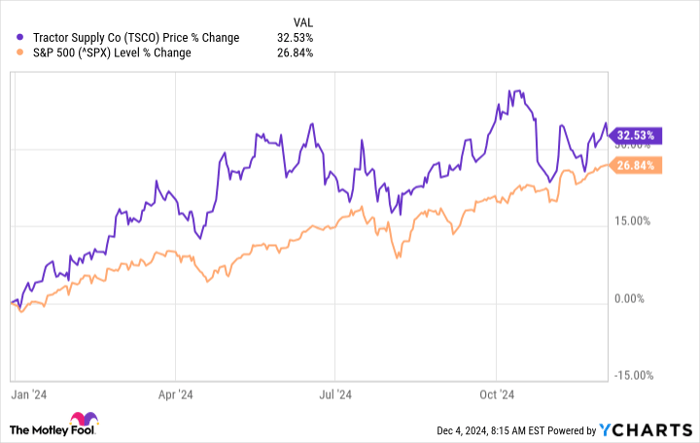

For instance, Tractor Supply (NASDAQ: TSCO) stood out to me at the beginning of 2024. Although I hesitated, waiting for a better price, I ultimately lost out on its impressive 33% year-to-date gains, well above the

TSCO data by YCharts.

Renowned investor Peter Lynch once said, “Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.” This sentiment resonates with my experience.

At the year’s start, I could justify many reasons for expecting a market correction. Despite having factual support for my thoughts, my predictions were incorrect.

Hypothetically, if I had invested $10,000 in Tractor Supply, expecting a 20% price drop, I would have faced a $2,000 loss. In contrast, I would be up $3,300 in reality. Delaying my investment, which I assumed was prudent, has cost me more than any potential correction.

Looking at the bigger picture, Tractor Supply exemplifies the type of strong business investors should pursue. With approximately 2,300 locations and nearly 10% operating margins, it displays reliability and growth potential. Over half of its sales stem from livestock and pet products—less discretionary purchases—further strengthening its business model as it expands into the pet market.

Rather than waiting for corrections, a more effective strategy might be dollar-cost averaging—slowly buying shares over time. Given the historical trend, investors should confidently expect the market to trend upward.

Nvidia: A Solid Bet for 2025

I have previously expressed concerns that Nvidia stock had climbed too quickly, with investors expecting significant long-term growth. Regardless, I never doubted the strength of its business, which may possess a more substantial competitive edge than I had previously acknowledged.

Nvidia’s graphics processing units (GPUs) drive significant advancements in artificial intelligence (AI). Its net-profit margin is an impressive 55%, driven by soaring demand for its GPUs.

NVDA Profit Margin data by YCharts.

Interestingly, Amazon founder Jeff Bezos noted, “Your margin is my opportunity.” I anticipated Nvidia’s high margins would attract fierce competition, especially given that its clients are tech giants. My assumption was that some would develop their own GPUs.

However, competition has not yet materialized, leading to the belief that Nvidia can retain its advantage. For example, the CEO of Amazon’s cloud division acknowledged the development of their own chip but deemed it a complement to Nvidia’s GPUs rather than a competitor.

While Nvidia stock has soared over 2,600% in five years, historical data shows resilience: the top S&P 500 stocks often continue their performance into the following year. In fact, the top stock within the S&P has risen 80% of the time in the subsequent year. Currently, Nvidia leads this pack, suggesting another rise ahead.

Overall, the prevailing trend indicates it’s wise to bet on a market increase in 2025. Instead of waiting for price drops, consider a disciplined investment strategy, dollar-cost averaging into established companies like Tractor Supply and Nvidia. Given Nvidia’s performance, it remains reasonable to anticipate continued success in the coming year.

Explore New Opportunities in Stock Investments

If you’ve ever felt like you missed the chance to invest in top performing stocks, there’s good news.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies poised for growth. If you’re concerned you’ve missed your opportunity, now may be the optimal time to invest before it becomes too late. Consider these impressive returns:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $369,349!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,990!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $504,097!*

We are currently issuing “Double Down” alerts for three exceptional companies, and this opportunity might not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, and Tractor Supply. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.