Nvidia Faces Stock Slump Amid Booming AI Market

Nvidia (NASDAQ: NVDA) has emerged as the dominant player in the artificial intelligence (AI) sector over the past two years. Since the beginning of 2023, its stock price has surged more than 600%, elevating its market capitalization to approximately $3 trillion.

However, recent trends show a shift in Nvidia’s stock performance. Year-to-date, shares have declined about 16%. An 8% drop occurred last Thursday after the company released its earnings report, even while surpassing profit estimates and issuing strong guidance. In the fourth quarter, Nvidia reported revenue growth of 78%, reaching $39.3 billion—exceeding the expected $38.2 billion. Adjusted earnings per share (EPS) rose from $0.49 to $0.89, above the forecast of $0.85. Additionally, Q1 guidance predicts revenue of around $43 billion, higher than the analysts’ expectation of $42.05 billion.

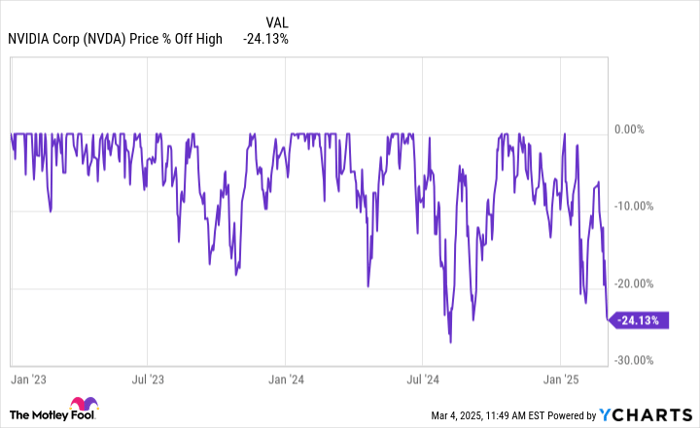

Investor sentiment appears to be shifting. Concerns over President Donald Trump’s new tariffs and allegations of illegal chip exports to China have contributed to the share price decline. Currently, Nvidia’s stock trades 27% below its recent peak and is at its lowest since September 2024.

For many investors, Nvidia’s stock retreat raises questions. Some may consider selling their shares after substantial gains, especially as the company’s momentum slows and the macroeconomic outlook appears more uncertain. It may be beneficial to review Nvidia’s recent history for better insight into potential future movements.

Nvidia’s Historical Volatility

Volatility is typical in the semiconductor sector, and Nvidia’s ascent to a top market position has not been without challenges. The below chart illustrates the company’s drop from its peak amid the current AI boom, which began in 2023.

NVDA data by YCharts.

Historical data reveals only one other significant pullback in the last two years for Nvidia. This episode began in July 2024 when broader concerns arose regarding the potential slowdown in AI infrastructure investment. Major cloud providers like Microsoft and Alphabet faced scrutiny over their high expenditures on data centers and Nvidia chips, raising alarms about overall valuations within the AI sector.

Even though Nvidia experienced a double dip during that period, the stock returned to all-time highs by October 2024, several months after the downturn commenced.

A longer view of Nvidia’s performance displays similar patterns. The chart below showcases how the stock has experienced declines of 50% or more twice in the past decade.

NVDA data by YCharts.

In 2018, Nvidia’s stock faced significant challenges as rising interest rates, tensions with China, a decline in cryptocurrency mining, and slowing demand for semiconductors pressured the market. During 2019, Nvidia’s revenue contracted amidst these concerns; however, the stock rebounded to its previous highs in about 18 months, more than doubling from its lowest point.

A similar decline occurred in 2022 alongside the broader tech market crash as revenues diminished due to decreased demand for cryptocurrency-related products. Nevertheless, rising enthusiasm for AI enabled the stock to recover to its all-time highs within approximately 18 months once again.

Implications for Nvidia

Determining the duration and extent of the current downturn in Nvidia’s stock remains uncertain. Nonetheless, demand for its latest Blackwell chips continues to surpass supply. The company maintains a considerable competitive edge in data center graphics processing units (GPUs) crucial for AI applications, with cloud computing giants planning to increase capital expenditures (capex). Additionally, growth toward artificial general intelligence (AGI) is projected to persist despite economic headwinds.

This is favorable for Nvidia. The stock now trades at a forward price-to-earnings (P/E) ratio of approximately 25, aligning with the S&P 500, even as Nvidia’s growth rate significantly outpaces the broader index.

While Nvidia will always entail a degree of risk, the company is poised for recovery from its recent losses. Historical trends suggest the stock has bounced back from more severe downturns before. Further, its technological leadership and strategic positioning suggest it could sustain growth. Therefore, with its current valuation, Nvidia appears to be an attractive buying opportunity.

Is Now the Right Time to Invest $1,000 in Nvidia?

Before making a decision to invest in Nvidia, it’s worth noting that:

The Motley Fool Stock Advisor analyst team recently identified their top ten stocks for current investment, with Nvidia not among them. The selected stocks are expected to yield significant returns in the coming years.

Reflecting on Nvidia’s past recommendations: if you invested $1,000 when it made the list on April 15, 2005, it would now be valued at $718,876!

Stock Advisor offers investors a comprehensive roadmap for success with guidance on portfolio building, regular updates from analysts, and two new Stock picks each month. The Stock Advisor service has substantially outperformed the S&P 500 since its inception in 2002.*

*Stock Advisor returns as of March 3, 2025.

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Jeremy Bowman holds positions in Nvidia. The Motley Fool is invested in and recommends Alphabet, Microsoft, and Nvidia. The Motley Fool also recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. For more information, refer to the Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.