“`html

Understanding Options Trading: How Spreads and Pricing Work

In recent discussions, we’ve focused on ticks, spreads, and trading costs in the equities markets. Today, we shift our attention to options trading, which operates under different principles and pricing structures compared to stocks.

The Role of Option Greeks in Pricing

The introduction of the Black-Scholes model marked a turning point in pricing options. This model examined crucial factors such as time until expiry, moneyness (the distance from the strike price to the underlying price), and volatility, illustrating how these elements influence an option’s fair price.

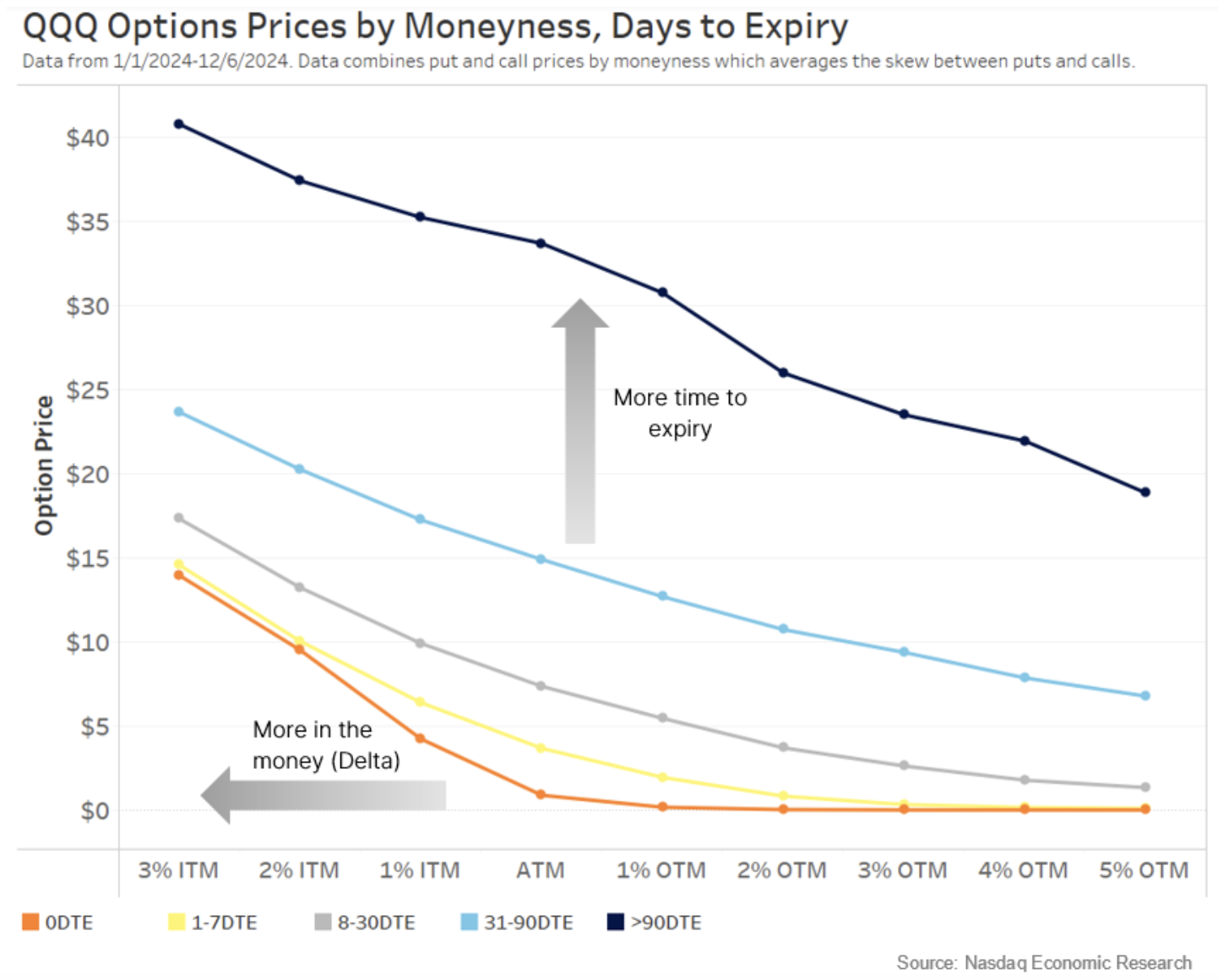

By observing real-time prices, we can see the effects of these factors. As shown in Chart 1, options that are in the money (delta) tend to have higher prices. Additionally, options with more time until expiry also command higher prices.

Chart 1: Options prices are largely determined by the option’s moneyness and time to expiry

This aligns with our expectations—an option with greater delta (moneyness) is more likely to be exercised. Moreover, a longer time until expiry increases the likelihood of price changes, which can put the option “in the money.”

However, the “non-linear” characteristics of option prices complicate the comparison of spread costs among options linked to the same underlying asset.

Evaluating Spreads as a Percentage of Option Price

The following charts illustrate how bid-ask spreads vary for options on the QQQ ETF, which is currently priced around $500.

When analyzing trading costs for stocks, it is common to compare stock spreads as a percentage of the stock price. For the QQQ ETF, the average spread of 2 cents translates to less than half (0.5) basis points (or 0.005%).

However, options on this $500 stock have varying strike prices, which leads to significant price differences. For instance:

- A $475 call option is already $25 in the money, suggesting that its extrinsic value will likely make it worth more than $25.

- Conversely, a $525 call with one day until expiry has a high chance of expiring worthless, meaning it might only be valued at a few cents.

Even when both options are highly liquid with a 1-cent spread, this 1-cent would represent a greater “cost” for an option worth just a few cents compared to one priced over $25.

Chart 2 demonstrates this trend:

- Out of the money options exhibit lower prices, causing their spread to become a larger percentage of the option’s price.

- Options nearing expiry (orange dots) lose extrinsic value quicker, leading their percentage spread costs to rise faster.

- Interestingly, options with higher theta (blue dots) see their prices decline more slowly, as there’s a greater chance they will end up in the money. This results in a slower increase in their spread costs.

Chart 2: Options relative spreads are higher for less expensive strikes and lower for more expensive ones

Examining Spreads in Dollar Terms

When we analyze spreads in dollar terms, a different pattern emerges. Strikes that appeared wide (in percentage) actually display smaller spreads (in dollars).

Chart 3: Options spreads in dollar terms follow trends similar to their prices

Since each option corresponds to 100 shares of the underlying stock, a $1 spread equals 1 cent per share, akin to the spread on the ETF.

The observations from the chart indicate that:

- Once an option has intrinsic value (in-the-money), its delta increases, aligning its spread more closely with that of the underlying stock. Market makers hedge using the underlying stock, anticipating price movements.

- However, for options lacking intrinsic value that are unlikely to yield profit, adverse selection diminishes, causing spreads to tighten (in cents). Specifically, short-dated out-of-the-money strikes quickly drop in price (in cents).

- In contrast, options with extended expiry times have better chances of expiring in the money, even if they are out of the money now; hence, their spread costs are elevated.

What Are the Implications?

The dynamics of options trading highlight how leverage, through varying strikes (moneyness) and time to expiry, influences spreads both in percentage and dollar terms.

While we’ve noted the importance of understanding spread costs for trading stocks, these costs remain relatively stable over time. In contrast, the pricing complexities of options, as illustrated in Chart 1, make it challenging to compare spread costs across different options trades linked to the same underlying asset. This variance complicates Transaction Cost Analysis for options, sometimes making it seem nearly impossible.

“`