UiPath Inc. (PATH) reported robust financial health with approximately $1.4 billion in cash and cash equivalents and no outstanding debt as of its fiscal third quarter. This debt-free status allows the company to fully invest its cash reserves in innovation, product development, and acquisitions, positioning it strongly in the evolving Robotic Process Automation (RPA) market.

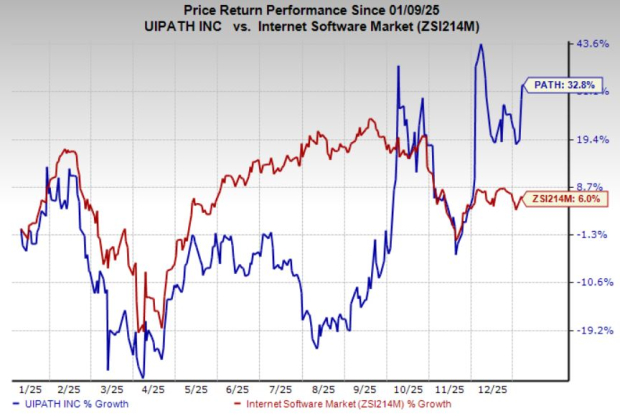

PATH’s liquidity metrics indicate a current ratio of 2.65, significantly higher than the industry average of 1.94. This strong ratio provides a cushion for meeting short-term obligations, reducing operational risk amid economic volatility. Over the past year, UiPath’s stock has increased by 33%, with a forward price-to-earnings ratio of 23.74, below the industry’s average of 32.89.

As the company continues to focus on AI enhancements and global expansion, its solid financial position offers increased strategic flexibility to navigate a competitive landscape, defend market share, and sustain innovation without financial strain.