“`html

As of September 17, the American Association of Individual Investors reported that 41.7% of surveyed investors are bullish on stocks while 42.4% are bearish, indicating a nearly even split in sentiment amid new all-time highs in the S&P 500.

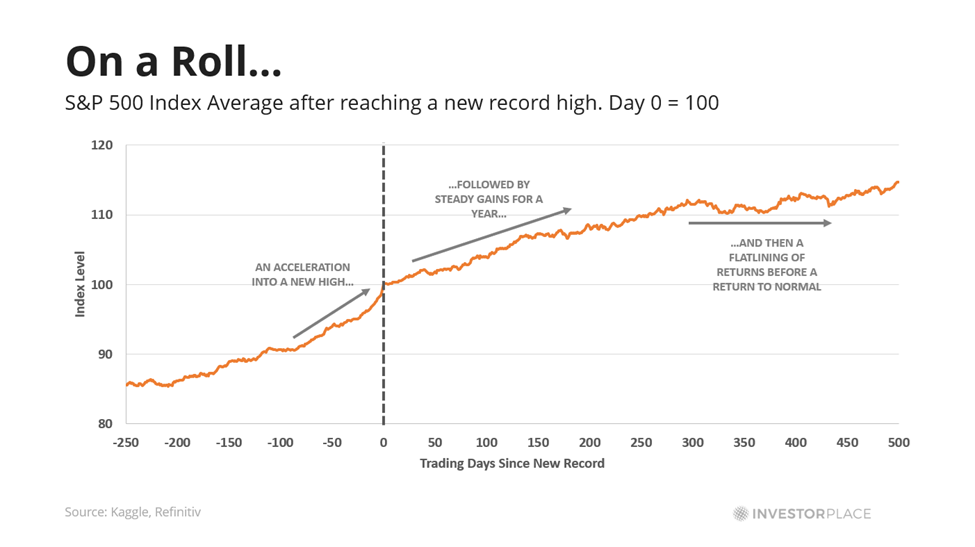

Historical data since 1927 shows that following a record high, the S&P 500 has an average return of 9.9% over the next year. However, market volatility increases significantly after new peaks, complicating the investment outlook.

Experts suggest that while record highs typically reflect strong corporate earnings and potential for further gains, they also invite greater risks, as seen in past market crashes. Investors are urged to be cautious, particularly with emerging sectors like artificial intelligence.

“`