Tesla Stock Faces 30% Decline Amid Market Correction

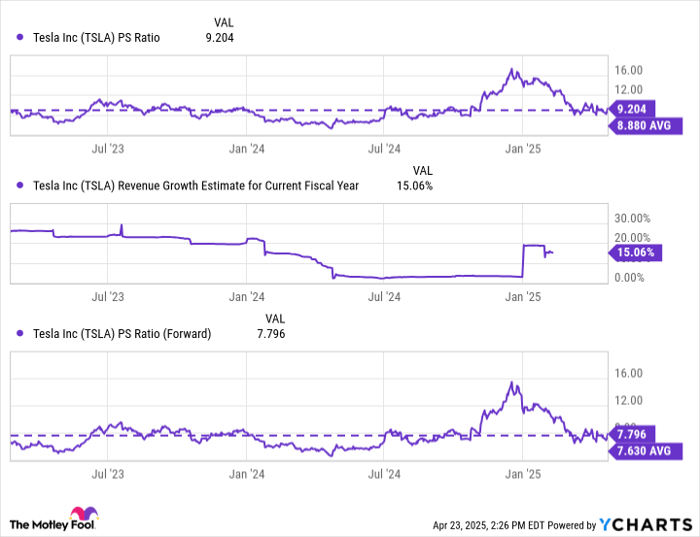

Tesla’s (NASDAQ: TSLA) stock has significantly declined since the start of the year. Currently, shares are approximately 30% lower, with the price-to-sales ratio dropping from over 15 to just 9.2. While on paper this suggests a compelling value, investors need to consider an important factor before investing.

Understanding Tesla’s Valuation Post-Correction

It’s clear that Tesla’s stock price has decreased significantly compared to four months ago. However, looking at the broader context reveals that this decline has returned Tesla’s valuation closer to its historical trading average. Over recent years, Tesla’s valuation typically ranged between 5 and 10 times sales. By late 2024, it surged to over 16 times sales. The recent correction has adjusted the valuation back towards historical norms, yet even after this adjustment, the price-to-sales multiple remains above the long-term average, which accounts for the unusually high levels seen at the end of 2024 and early 2025.

TSLA PS Ratio data by YCharts. PS Ratio = price-to-sales ratio.

Since the end of 2024, Tesla’s growth forecast has improved. However, even with anticipated sales growth reflected in its forward price-to-sales multiple, Tesla shares are still trading higher than their long-term averages. It’s important to remember that these averages also include the elevated levels noted in late 2024 and early 2025.

Long-Term Investment Outlook for Tesla Shares

Does this mean Tesla represents a bad investment for long-term shareholders? Not necessarily. However, the stock may not be as inexpensive as it seems following the recent downturn, since the decline began from a high valuation level.