Nvidia Faces Market Challenges Amid Soaring AI Demand

Shares of Nvidia (NASDAQ: NVDA) experienced a downturn last month as pressures from the broader market affected the AI chip leader. Despite strong performance in earlier months, Nvidia’s stock was impacted by signs of declining demand for AI infrastructure and overall economic uncertainty.

No significant news directly harmed Nvidia, but signs suggested a slowdown in AI demand. Concerns surrounding a potential economic recession, exacerbated by weakening consumer sentiment, tariff uncertainties, and declining growth forecasts, played a role in the stock’s decline. Late in March, the lukewarm reception of CoreWeave, an AI-focused cloud computing platform closely partnered with Nvidia, reflected a dip in investor enthusiasm for AI-related stocks.

Stay Informed with Breakfast News! Get the latest financial updates delivered to your inbox every market day. Sign Up For Free »

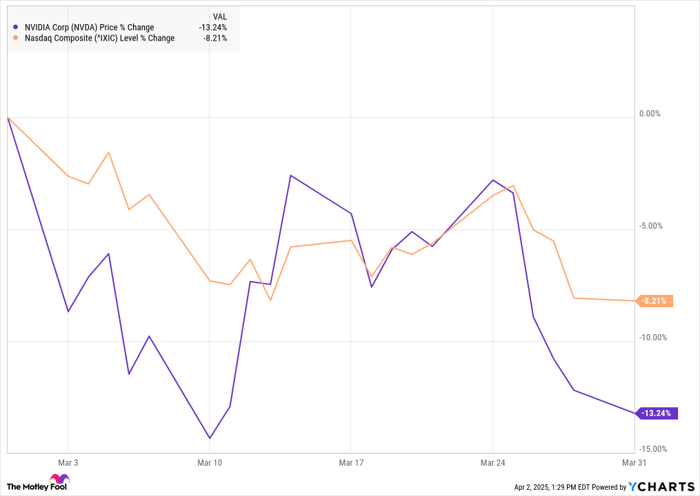

As a cyclical sector, the semiconductor industry has seen remarkable growth over the past two years. Nonetheless, investors are becoming cautious regarding the potential recession’s impact on Nvidia. By the end of March, Nvidia’s stock had fallen 13%, per S&P Global Market Intelligence.

As illustrated in the chart below, Nvidia’s stock displayed volatility throughout the month, generally following the trends of the Nasdaq Composite index amid macro-level news events.

NVDA data by YCharts

Nvidia’s Recent Developments

At the close of February, Nvidia reported robust fourth-quarter results; however, this led to a pullback in stock price, suggesting that investor interest may be shifting away from the AI chip leader—a trend that persisted into March.

The highlight of the month for Nvidia was its annual GTC conference in the third week. However, even CEO Jensen Huang’s key address—highlighting that AI infrastructure spending could reach $1 trillion by 2028—failed to buoy the stock. Shares of Nvidia decreased by 3.5% on March 18, coinciding with his keynote.

As March concluded, stock performance declined further due to President Donald Trump’s announcement of auto tariffs and the impending “Liberation Day” of reciprocal tariffs on April 2. Additionally, Nvidia took action to support CoreWeave’s IPO by purchasing $250 million in shares at $40, aiming to enhance investor confidence in the new platform.

Image source: Nvidia.

Looking Ahead for Nvidia

Nvidia’s stock pullback seems rooted in the changing macroeconomic landscape rather than any weakening of the company’s fundamentals. Therefore, this shift should not alter any fundamental investment thesis regarding the stock.

At present, Nvidia appears attractively priced, trading at a forward P/E ratio of just 25. This valuation might present a solid opportunity for investors interested in a company that promises to continue playing a crucial role in driving the AI revolution.

Seize New Investment Opportunities

If you have ever felt like you missed the chance to invest in top-performing stocks, now is an opportune moment.

Our team of expert analysts occasionally issues a “Double Down” Stock recommendation for companies poised for significant growth. If you are concerned about having missed an investment opportunity, now may be the best time to buy before it’s too late. The data is compelling:

- Nvidia: an investment of $1,000 during our double down in 2009 would now be worth $285,647!*

- Apple: a $1,000 investment from 2008 is now worth $42,315!*

- Netflix: if you invested $1,000 in 2004, you would have $500,667!*

We are currently issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not arise again soon.

Continue »

*Stock Advisor returns as of April 1, 2025

Jeremy Bowman holds positions in Nvidia. The Motley Fool also holds positions in and recommends Nvidia. The Motley Fool follows a strict disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.