Key Economic Indicators Signal Optimism Amid Tariff Uncertainty

Despite ongoing tariff discussions and economic concerns, several important indicators show positive trends, including:

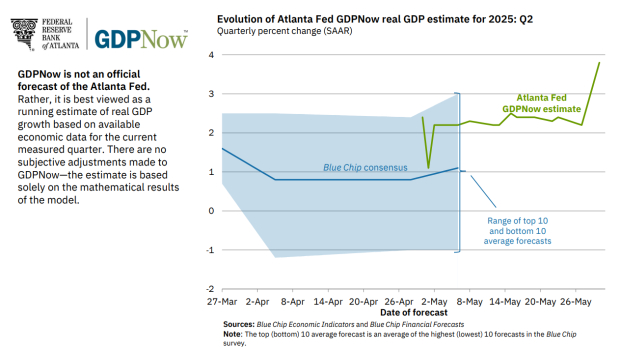

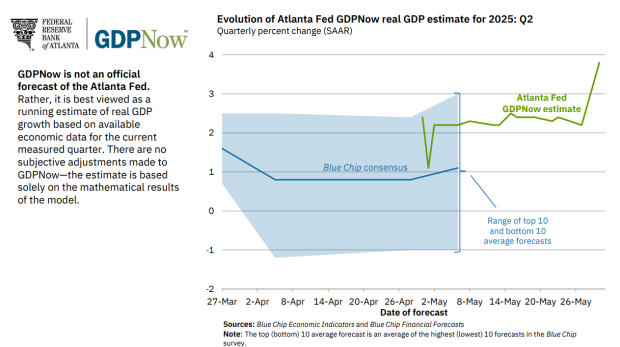

Atlanta Fed GDPNNow Estimates 3.8% Q2 GDP Growth

The Federal Reserve Bank of Atlanta’s GDPNow Model estimates a robust 3.8% growth in Q2 2025, up from 2.2%. This data-driven approach helps investors cut through biases amid fears generated by negative GDP readings and trade tensions.

Image Source: Federal Reserve Bank of Atlanta

PCE Inflation Cools, Approaches Fed’s Target Level

The latest Personal Consumption Expenditures (PCE) Price Index shows a 2.1% increase year-over-year, softer than forecasts, marking a four-year low in the key inflation rate.

Image Source: FRED

Furthermore, “Supercore PCE,” which tracks core services, reported its first negative reading since the pandemic. With PCE nearing 2% target, investors may anticipate rate cuts in 2025, a potentially bullish scenario for stocks.

The AI Revolution is Intact

Bull markets thrive on high-growth sectors, and the artificial intelligence (AI) industry currently stands as the most promising. Nvidia (NVDA), a leader in semiconductors, is central to this growth, as its GPUs are essential for AI advancements.

Nvidia’s late May earnings report showed a 69% year-over-year revenue increase to $44 billion, despite a $4.45 billion charge due to export restrictions to China. Analysts predict continued healthy growth in the double digits.

Image Source: Zacks Investment Research

Other AI companies, like CoreWeave (CRWV), reported Q1 revenues of $982 million, marking a fourfold increase. Amazon’s AWS also noted significant growth, stating that AI cloud sales have reached billions.

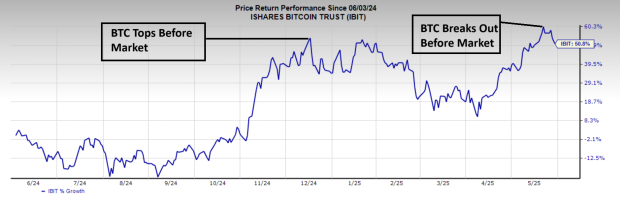

Bitcoin & Other Risk-on Assets Present Bullish Clues

Bitcoin and related assets like the iShares Bitcoin ETF (IBIT) are valuable indicators for investors. Notably, IBIT reached a peak on December 17, 2024, ahead of major index movements. It is now breaking out to new highs, possibly signaling further gains for equity indices.

Image Source: Zacks Investment Research

Additional risk-on sectors show resilience, with quantum computing leader D-Wave Quantum (QBTS) up nearly 70% year-to-date.

Image Source: Zacks Investment Research

Stocks Continue to Brush Off Tariff/China News

Recently, President Trump stated that China violated its agreement with the U.S. While earlier this news would have caused a market drop, stocks opened lower by about 1% but quickly rebounded to finish the session in positive territory. This resilience suggests a bullish market trend.

S&P 500 Bull Flag Pattern Signals Market Strength

The S&P 500 is forming an ideal daily bull flag pattern.

Image Source: TradingView

Market Control by Bulls

Strong economic indicators, the rise of artificial intelligence, and a resilient market suggest that bulls dominate current trading conditions.

Semiconductor Industry Overview

Global semiconductor manufacturing is expected to grow from $452 billion in 2021 to $803 billion by 2028. A newly highlighted semiconductor stock shows promising earnings growth and an expanding customer base, positioning it well to meet increasing demand for AI, machine learning, and IoT technologies.

This information is based on materials originally published by Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.