Analysts See Potential Growth for ActivePassive U.S. Equity ETF

At ETF Channel, we’ve been analyzing the performance of various ETFs. Our latest evaluation focused on the ActivePassive U.S. Equity ETF (Symbol: APUE). Based on the average 12-month forward target prices from analysts, the implied target price for APUE stands at $40.55 per unit.

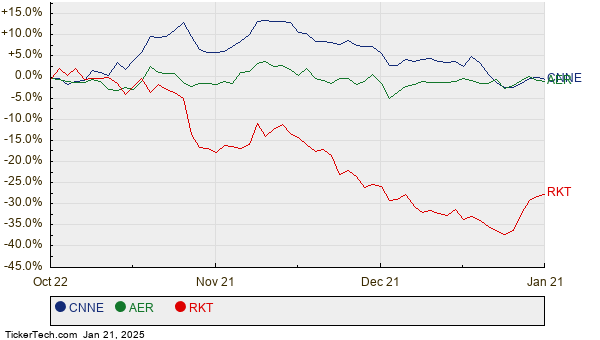

Currently, APUE is trading at around $36.48 per unit. This suggests an expected upside of 11.17% according to analyst forecasts for its underlying holdings. Notably, three key holdings within APUE present substantial upside potential: Cannae Holdings Inc (Symbol: CNNE), AerCap Holdings NV (Symbol: AER), and Rocket Companies Inc (Symbol: RKT). Cannae, with a recent trading price of $19.06 per share, has an average analyst target of $28.00, indicating a considerable upside of 46.90%. AerCap shows a target of $112.33 per share, which implies 17.38% upside from its current price of $95.70. Meanwhile, Rocket Companies has a target of $13.31 per share, representing a 12.11% increase from its recent price of $11.87. Below is a twelve-month price history chart comparing the performance of CNNE, AER, and RKT:

Here is a summary of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ActivePassive U.S. Equity ETF | APUE | $36.48 | $40.55 | 11.17% |

| Cannae Holdings Inc | CNNE | $19.06 | $28.00 | 46.90% |

| AerCap Holdings NV | AER | $95.70 | $112.33 | 17.38% |

| Rocket Companies Inc | RKT | $11.87 | $13.31 | 12.11% |

Whether analysts are justified in their optimistic predictions or are excessively hopeful remains an ongoing debate. Investors should critically evaluate the analyst targets, especially in light of recent developments in the companies and industries these stocks represent. A lofty target price can indicate confidence in future growth, but it may also hint at potential downgrades if projections are out of touch with current trends. These considerations warrant further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding MVLA

• Institutional Holders of EVP

• GRSV Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.