Vale Limited Faces Challenges Amid Declining Commodity Prices

Vale (NYSE:VALE) Stock has experienced a modest rise of about 10% year to date. In contrast, rival ArcelorMittal (NYSE:MT) surged 36%, while United States Steel Stock (NYSE:X) increased by 26% during the same timeframe. What is influencing VALE’s performance, and what trends could shape the company’s future?

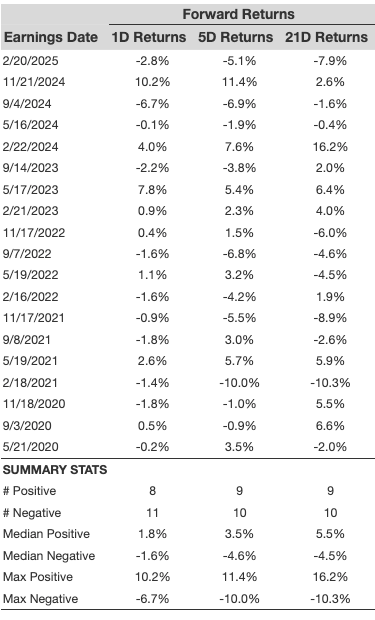

Weak Q1 earnings

Weak Q1 earnings

Recently, Vale reported its Q1 2025 earnings. The results showed a decline in iron ore prices, despite efforts to enhance operational efficiency. Revenue for the quarter reached $8.12 billion, reflecting a 4% decrease year-over-year and falling short of the $8.39 billion consensus estimate. Net income dropped to $1.39 billion, down 17% from $1.67 billion in Q1 2024. Free cash flow was $504 million, a sharp decline from $2.2 billion in Q1 2024. Iron ore production fell by 4.5% to 67.7 million metric tons due to adverse weather conditions in Brazil. However, sales volumes increased by 3.6% to 66.1 million tons due to inventory drawdowns. The average realized price for iron ore was $90.80 per ton, nearly a 10% decrease year-over-year. Notably, copper production rose 11% to approximately 90,900 tons, while nickel production also climbed by 11% to about 43,900 tons.

Despite the pressures of declining commodity prices and weather-related challenges, Vale’s commitment to cost efficiency and strategic project development may help it weather current market fluctuations. The company aims to continue its focus on operational optimization and diversification to bolster performance in upcoming quarters.

Global Tariff Landscape and Vale’s Position

In April 2025, the U.S. reinstated a 25% tariff on steel imports, affecting global trade flows, especially in the steel sector, which is closely tied to iron ore demand. However, Vale’s CEO Gustavo Pimenta noted that the company has not yet seen significant impacts from these tariffs, mostly because Vale does not export large quantities of iron ore to the U.S. Nonetheless, he cautioned that a potential global economic slowdown, spurred by increasing trade tensions, could indirectly affect commodity markets, including iron ore.

Strategic Acquisitions and Agreements

Vale has completed the acquisition of the remaining 50% stake in the Baovale iron ore project from its Chinese partner Baosteel, gaining full control of the Agua Limpa mine in Minas Gerais, Brazil. Furthermore, the company has entered into agreements with Eneva and Origem Energia to procure natural gas under free market conditions, supporting its strategy to source 90% of its natural gas from the free market by 2025.

Is VALE Stock a Good Value?

The company is targeting a 15% reduction in cash costs by 2025 compared to 2024. This strategy includes optimizing logistics, minimizing waste, and leveraging automation to maintain profitability amid rising trade barriers. In Q1 2025, Vale increased shipments to Europe by 18%, benefiting from the European Union’s carbon border adjustments that prefer low-emission suppliers. High-grade iron ore (65% Fe content) now represents 45% of traded volumes, up from 30% in 2023, addressing mills’ needs for efficiency to reduce energy costs.

Vale’s current price-to-earnings (P/E) ratio currently stands at 6.6, significantly lower than the 9.3 ratio observed in 2020. This suggests a potential undervaluation compared to peers such as ArcelorMittal, which has a P/E ratio of 17.4, and United States Steel at 22. Vale’s stock price appears to be considerably below multiple intrinsic value estimates, indicating it may represent good value. However, investors should remain mindful of commodity market volatility.

While VALE is a solid Stock, investors seeking even lower volatility with upside potential might consider other options.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.