Tesla’s Stock Performance: Key Insights and Future Outlook

Tesla (TSLA) has recently become one of the most searched stocks on Zacks.com. Investors should consider various factors that could influence the Company’s stock performance in the near future.

Shares of this leading electric vehicle manufacturer have gained +6% in the past month, contrasting with the Zacks S&P 500 composite’s decline of -3.9%. Within the Zacks Automotive – Domestic industry, Tesla has outperformed, as this sector saw a loss of 0.3%. The key question now: What direction might the Company’s stock take in the upcoming period?

News reports and speculation about changes in business outlook often trigger market activity. However, fundamental factors remain crucial in driving long-term investment decisions in stocks.

Earnings Estimate Revisions

At Zacks, we consider earnings projections as a primary factor influencing a company’s stock value. The present value of future earnings is essential in establishing a fair stock price.

Our analysis focuses on how sell-side analysts adjust their earnings estimates based on the most recent business developments. An increase in earnings estimates generally leads to a higher fair value for a stock. Consequently, when the estimated fair value exceeds the current market price, investor demand often causes the stock price to rise. Historical data shows a strong relationship between earnings estimate revisions and short-term stock price trends.

Tesla is projected to report earnings of $0.45 per share for the current quarter, reflecting no change from a year earlier. Over the last 30 days, the Zacks Consensus Estimate has decreased by -18.1%.

The consensus estimate for earnings for the current fiscal year stands at $2.65, indicating a year-over-year increase of +9.5%. However, this estimate has declined by -14.6% in the past month.

For the next fiscal year, the consensus estimate is $3.50, reflecting an anticipated growth of +31.8% compared to last year’s figures. This estimate has decreased by -6.1% over the last month.

Utilizing our proprietary stock rating tool, the Zacks Rank, we provide a more comprehensive view of a stock’s price direction. Given the recent shifts in consensus estimates and three other relevant factors, Tesla currently holds a Zacks Rank #5 (Strong Sell).

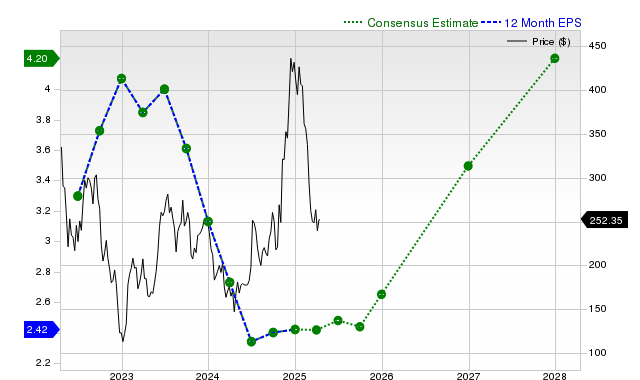

The chart below illustrates the progression of the company’s forward 12-month consensus EPS estimate:

12-Month EPS

Revenue Growth Forecast

While earnings growth is a key indicator of financial health, revenue growth is equally essential. Sustaining earnings growth without increasing revenues is nearly impossible over the long term, making potential revenue growth critical to assess.

For Tesla, analysts project a consensus sales estimate of $21.85 billion for the current quarter, representing a year-over-year increase of +2.6%. Estimates for the current and next fiscal years are $104.78 billion and $123.71 billion, indicating anticipated growth rates of +7.3% and +18.1%, respectively.

Last Reported Results and Surprise History

In its most recent quarter, Tesla reported revenues of $25.71 billion, which marks a year-over-year increase of +2.2%. The company’s earnings per share (EPS) for this period was $0.73, compared to $0.71 a year prior.

Despite these figures, the reported revenue fell short of the Zacks Consensus Estimate of $27.5 billion, reflecting a surprise of -6.53%. The EPS surprise was -2.67%.

Over the last four quarters, Tesla has only exceeded EPS estimates once, and it has likewise only met revenue expectations on one occasion within that timeframe.

Valuation

A comprehensive investment decision requires evaluating a stock’s valuation. Assessing whether a stock’s price reflects the intrinsic value of the business and its growth prospects is crucial for predicting future price movements.

Comparing a company’s valuation multiples, including price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), to historical values enables investors to ascertain if a stock is overvalued, fairly valued, or undervalued. Additionally, comparing these metrics relative to peer companies provides context for determining a stock’s valuation.

As part of Zacks Style Scores, the Zacks Value Style Score assesses both traditional and unconventional valuation metrics. This system categorizes stocks from A to F based on their value propositions, aiding investors in identifying overvalued, fairly valued, or undervalued stocks.

Tesla received an F grade on this front, indicating that it is currently trading at a premium compared to its peers. Click here to review the values of the valuation metrics that determined this rating.

Bottom Line

The insights discussed here along with other resources from Zacks.com may guide investors on whether to heed the market conversations surrounding Tesla. However, the Zacks Rank of #5 suggests that Tesla may underperform compared to the broader market in the short term.

7 Best Stocks for the Next 30 Days

Just released: Experts have curated a selection of 7 elite stocks from the current roster of 220 Zacks Rank #1 Strong Buys, which they believe are “Most Likely for Early Price Pops.”

Since 1988, this full list has consistently outperformed the market by more than 2X, with an average gain of +23.9% annually. Therefore, consider giving these top 7 stocks your immediate attention.

For the latest recommendations from Zacks Investment Research, download the report on the 7 Best Stocks for the Next 30 Days. Click here to access this free report.

Tesla, Inc. (TSLA): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.