Gold Prices Surge Despite Stock Market Struggles in 2025

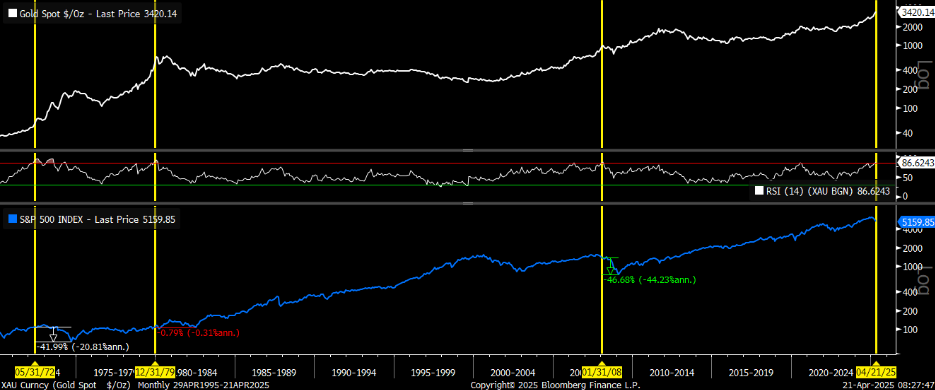

Investors seeking relief in a turbulent market may find it in gold. As of early 2025, gold prices have increased more than 30%, reaching unprecedented levels above $3,400 an ounce. This rally is one of the fastest in gold’s history.

However, this surge comes with a strong warning sign.

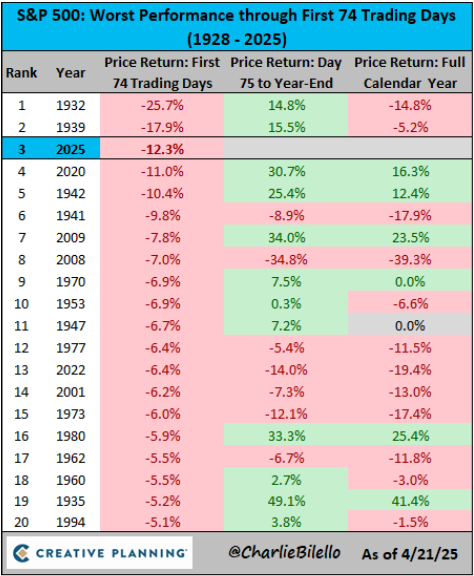

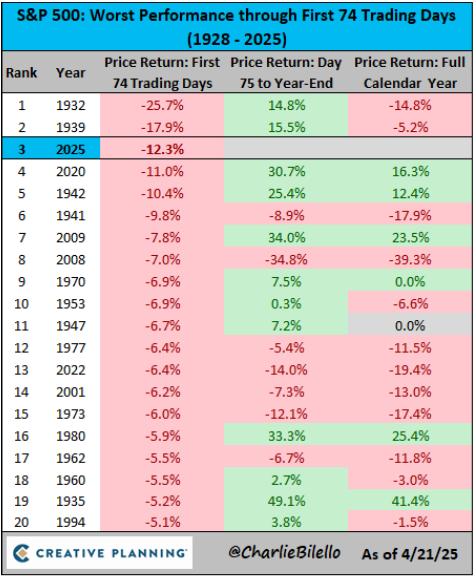

In stark contrast to gold’s gains, the S&P 500 is down over 12% in the first 74 trading days of the year. This drop marks the third-worst start to a year on record, overshadowed only by the Great Depression years of 1932 and 1939. Other years with similarly dismal beginnings include 1941, 1942 (during World War II), 2008, 2009 (the financial crisis), and 2020 (the COVID-19 pandemic).

When market conditions reflect those historical periods, it signals significant trouble ahead.

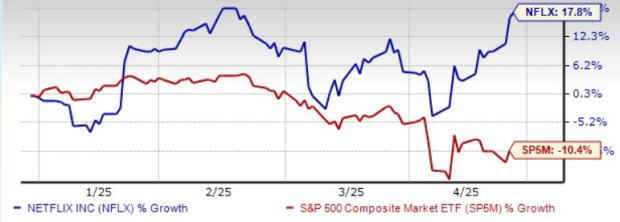

While stocks struggle, gold is experiencing a remarkable “golden hour.” This performance is not merely positive; it is reaching parabolic highs and dominating headlines.

From a technical perspective, today’s gold market is one of the most overbought conditions ever recorded, sending critical signals to the stock market.

Assessing Gold’s Overbought Status: The RSI Indicator

How severe is this market move? Gold’s relative strength index (RSI), a momentum indicator that evaluates asset conditions, has risen above 85 on a monthly basis.

For context, any RSI reading above 70 indicates an overbought condition. An 85 or higher is a strong signal of extreme market enthusiasm.

In the last 55 years, gold has only achieved this level of overbuying three times:

- In 1972, shortly after Nixon implemented price controls and pressured the Federal Reserve to lower rates, leading to a decade of hyperinflation.

- In December 1979, as then-Fed Chair Volcker began aggressive rate hikes to combat hyperinflation.

- In January 2008, right at the onset of the U.S. housing market collapse that triggered the great financial crisis.

These instances represented critical turning points in economic history.

The Correlation Between Gold Surges and Stock Market Declines

Historically, gold’s significant rallies have preceded declines in the stock market.

After the 1972 spike, the stock market fell approximately 40% in the subsequent two years. Following the peak in 1979, stocks stagnated for three straight years. After the early 2008 gold surge, stocks plummeted by 45% over the next year.

Every time gold has reached such technical overbought conditions, it has been a precursor to stock market downturns.

A surge in gold prices typically signals an underlying fear in the market, often rooted in troubling economic conditions.

Thus, gold’s impressive rally should be interpreted as a warning signal rather than just a bullish indicator.

Current Investor Sentiment Toward Gold in 2025

In light of today’s political and economic climate, it is no surprise that investors are gravitating toward gold. The current dynamics suggest a continued need for caution as market sentiments evolve.

Market Reactions to Economic Turmoil: Gold Surges Amid Trade Tension

The current economic climate resembles what some may call an economic world war, marked by tariffs imposed against nearly every significant trading partner. This situation threatens to undermine the global trade framework established after WWII, leaving markets in confusion and causing unease among corporations and investors.

During this uncertainty, many turn to gold as a safe haven. Although gold does not produce dividends or engage in innovation, it does not face the risk of bankruptcy. It simply remains a steady asset while other investment opportunities falter. As panic rises, gold often gains traction as a precautionary measure.

This leads to an interesting point of discussion – while gold may signal warning signs, previous surges have indeed correlated with stock downturns.

However, we assert that panic is unwarranted. Despite the historical parallels, this time is different.

The driving factors behind the current gold rally are not structural issues like failing banks, rampant inflation, or energy crises. Instead, the rise stems from a chaotic policy environment, particularly stemming from a White House navigating self-induced uncertainty.

Compared to inflation or recession, uncertainty can dissipate quickly with favorable news headlines.

Potential for Trade Agreements to Alter Market Dynamics

We observe a growing pressure on the Trump administration to alleviate its aggressive trade stance and achieve meaningful agreements.

The 90-day pause on Trump’s “Liberation Day” tariffs was positioned as a stepping stone toward advancing negotiations. Yet, weeks have passed, and no agreements are in place, resulting in waning investor confidence.

If the White House fails to demonstrate progress soon, markets could experience additional declines.

Conversely, the establishment of trade agreements could rapidly shift market narratives.

- Trade agreements lead to decreased global friction.

- Less friction translates to diminished inflation risks.

- Lower inflation risks prompt potential Fed rate cuts.

- Fed rate cuts can ignite a rally in equities.

Under such circumstances, gold would likely become less essential, favoring a resurgence in stock attractiveness.

Understanding the Gold Rally Without Catastrophe for Stocks

While the phrase “this time is different” can often be a red flag in investing, it is essential to consider the current context.

Historically, during the lead-up to the 1972 presidential election, President Nixon pressured Fed Chair Arthur Burns to maintain low interest rates to bolster the economy and his reelection bid. This interference undermined the Federal Reserve’s credibility, paving the way for subsequent inflation trouble.

By 1979, inflation surged to double digits, driven by factors such as skyrocketing oil prices and lax monetary policies. Fed Chair Paul Volcker had to intervene with aggressive interest rate hikes, which pushed the federal funds rate to over 20% to curb inflation.

In 2008, a financial crisis loomed due to risky lending practices, primarily in the subprime mortgage market, leading to a collapse as home prices fell.

Today, however, these scenarios do not hold true.

- The Fed has not yet implemented artificial rate cuts; their actions have been calculated and purposeful despite pressure from the Trump administration.

- Inflation isn’t spiraling. Data indicates a cooling trend, with core CPI rising only 0.1% in March, lower than the expected 0.3%. Month-over-month, overall CPI even dipped by 0.1%, marking its first decline since May 2020.

- The banking sector is stable, with strong balance sheets. Many major banks reported positive earnings for the first quarter, such as JPMorgan Chase (JPM), which posted record annual profits, and Bank of America (BAC), whose revenue increased by 6% year-over-year to $27.4 billion.

- Employment statistics remain robust, with the Bureau of Labor Statistics recording the unemployment rate at 4.2% in March, a slight increase from 4.1% in February, but still consistent within the range maintained since May 2024.

What we observe is not an economic decline, but rather an anxiety spiral. This form of anxiety can vanish almost as quickly as it emerges.

Shifting from Anxiety to Opportunity in the Stock Market

If and when this policy-driven panic subsides – and we believe it eventually will – gold prices will likely stabilize, creating favorable conditions for a potential V-shaped recovery in stocks.

As contrarian as it may seem, this period presents a significant opportunity to invest in stocks.

We are particularly interested in sectors such as high-beta tech and small-cap equities—those that typically decline during fearful market conditions but can surge following periods of relief.

Although gold has recently performed impressively, prompting declines in stocks historically, the current context suggests a break in this trend.

This rally in gold, while significant, is driven by policy volatility rather than systemic collapse or uncontrollable inflation risks. Policy uncertainties are more susceptible to rapid changes.

Therefore, while we recognize the warning signals, we also avoid overreacting. We are observing closely, anticipating a time when the trade war eases and the Federal Reserve begins rate cuts, at which point we intend to invest heavily in the rebound.

Moreover, promising opportunities may emerge in the realm of advanced AI technologies, dubbed AI 2.0. This includes intelligent systems capable of adapting and solving challenges autonomously—technology that major players in the tech sector are racing to innovate.

We perceive a forthcoming wave of immense potential within the AI sector and have pinpointed exceptional methods to capitalize on its growth trajectory.

As of the publication date, Luke Lango did not hold any positions in the securities mentioned in this article.

For any questions or feedback regarding this article, please reach out at [email protected].