Understanding the High-Low Method: A Simple Way to Estimate Costs

The high-low method is a tool in cost accounting that helps businesses figure out their fixed and variable costs. By analyzing the highest and lowest levels of activity, this method provides a quick look at how costs change in relation to production. It serves as a valuable resource for both companies and investors interested in understanding cost behavior without getting lost in complex financial details.

What Is the High-Low Method?

The high-low method is a cost estimation technique that identifies a company’s variable and fixed costs by examining just the highest and lowest points of activity. These activity levels could be based on the number of products made or customers served, among others. By using these extremes, the method calculates the variable cost per unit and the overall fixed costs.

Analyzing the highest and lowest data points enables the creation of a cost model that can anticipate expenses when production levels change. However, it assumes a direct correlation between costs and activity levels, making it most reliable in environments where costs are stable.

3 Steps for Using the High-Low Method

To effectively use the high-low method for cost calculations, follow these three steps:

1. Calculate the Variable Cost Component

To find the variable cost per unit, use the formula:

Variable Cost = (Highest Activity Cost – Lowest Activity Cost) ÷ (Highest Activity Units – Lowest Activity Units)

Here, the “highest” and “lowest” refer to periods of maximum and minimum activity, such as the number of units produced. This time frame could be a month or a quarter.

2. Calculate the Fixed Cost Component

After determining the variable cost, apply it in the following formulas to find the fixed costs:

Fixed Cost = Highest Activity Cost – (Variable Cost × Highest Activity Units)

Fixed Cost = Lowest Activity Cost – (Variable Cost × Lowest Activity Units)

3. Calculate the Total Cost Using the High-Low Method

Use the variable and fixed costs to establish the total cost at a particular activity level:

Total Cost = Fixed Cost + (Variable Cost × Units of Activity)

Putting the High-Low Method into Practice

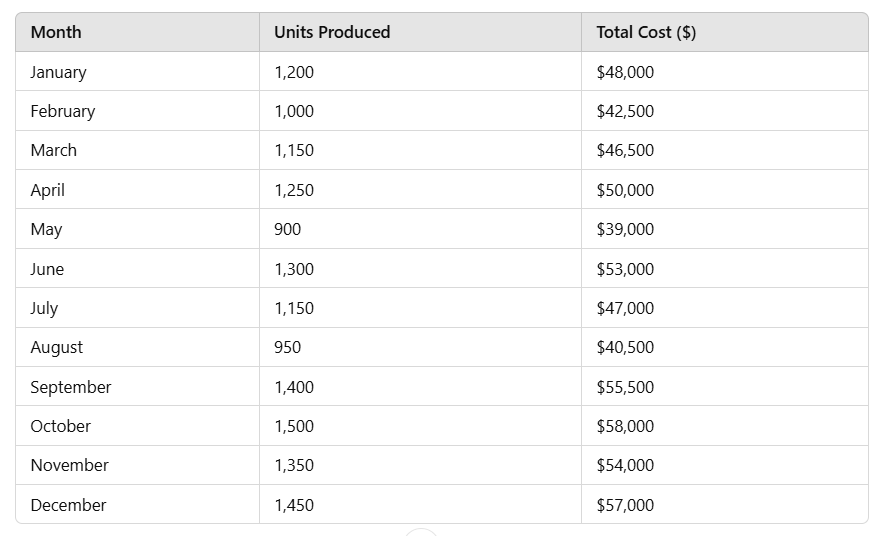

For instance, imagine a company that tracks its monthly production costs. Here’s a sample breakdown:

In this example, October had the highest activity with 1,500 units produced at a cost of $58,000. Conversely, May recorded the lowest activity with 900 units produced at a cost of $39,000.

1. Calculate Variable Cost per Unit

Using this information, the variable cost can be calculated:

Variable Cost = ($58,000 – $39,000) ÷ (1,500 – 900)

Variable Cost = $19,000 ÷ 600

Variable Cost = $31.67 per unit

2. Calculate Fixed Costs

Next, determine the fixed costs using either the high or low point. Starting with the high point:

Fixed Cost = $58,000 – ($31.67 × 1,500)

Fixed Cost = $58,000 – $47,505

Fixed Cost = $10,495

Now, using the low point:

Fixed Cost = $39,000 – ($31.67 × 900)

Fixed Cost = $39,000 – $28,503

Fixed Cost = $10,497

The fixed costs are nearly identical from both calculations, indicating accuracy in the method.

3. Construct the Total Cost Equation

For an estimated production of 2,000 units, the total cost equation using the high point is:

Total Cost = $10,495 + ($31.67 × 2,000)

Total Cost = $10,495 + $63,340

Total Cost = $73,835

This calculation illustrates how to project costs at different production levels using known variable and fixed costs.

What We Can Learn From the High-Low Method

The high-low method provides businesses a fast approach to estimate costs, enabling them to predict future expenses across varying production levels. This technique is particularly valuable for companies with seasonal production changes, assisting them in establishing cost baselines and understanding the impact of costs on overall spending.

Limitations and Other Considerations

Despite its usefulness, the high-low method has limitations. It depends solely on the highest and lowest values, ignoring other activity levels which can result in inaccuracies. Additionally, it assumes a straightforward relationship between costs and activity, which may not accurate in every situation. Businesses facing irregular cost structures may find other estimation methods more reliable.

Common Uses for the High-Low Method

This method proves especially beneficial for small business owners, financial analysts, and accountants who require a straightforward way to estimate fixed and variable costs. When detailed data is lacking, the high-low method allows for quick assessments of cost behaviors, aiding in budgeting and financial planning.

“`html

Understanding the High-Low Method: A Simple Tool for Cost Estimation

The high-low method is a straightforward approach to help both individuals and businesses distinguish between fixed and variable costs, making budgeting easier and planning more effective.

The Basics of the High-Low Method

In budgeting, whether for personal use or within a business, the high-low method separates fixed costs—like base fees—from variable costs that change based on usage. For instance, individuals can break down their utility bills to identify which costs are consistent and which fluctuate with consumption. Small businesses can gain insights into delivery or production expenditures, aiding smarter planning.

This method also informs decision-making. By evaluating how costs may shift in various scenarios, it helps investors understand a company’s cost structure, providing clues about its efficiency and growth potential. Mastering the high-low method allows readers to better comprehend cost dynamics and make informed decisions regarding planning or investment opportunities.

Frequently Asked Questions

What Are the Advantages of Using the High-Low Method?

A key advantage of the high-low method is its simplicity. It requires only the highest and lowest activity levels, along with their corresponding costs, to estimate both variable and fixed cost components.

How Does the High-Low Method Compare to Regression Analysis?

Regression analysis utilizes all data points to create a more accurate picture of cost behavior, capturing nuances that the high-low method might miss. However, regression is more complex, often requiring statistical software. In contrast, the high-low method is a quicker option, though it sacrifices some accuracy.

Bottom Line

The high-low method proves valuable for estimating fixed and variable costs, enabling businesses to foresee how expenses vary with different activity levels. Despite some drawbacks, it provides a quick and accessible method for analyzing cost behavior, aiding investors and business owners in making better financial plans and investment choices.

Tips for Financial Planning

- Consider working with a financial advisor to help manage risk in your portfolio. Finding one can be simple. SmartAsset offers a free tool that connects you with up to three vetted financial advisors in your area. You can also have a free introductory call with each potential advisor to find the right fit. If you’re ready to pursue your financial goals with professional guidance, start your search now.

- Use SmartAsset’s federal paycheck calculator to better understand your take-home pay after accounting for withholdings and taxes.

Photo credit: ©iStock.com/fizkes, ©iStock.com/Miljan Živković, ©iStock.com/MangoStar_Studio

The post How the High-Low Method Works and How to Calculate It appeared first on SmartReads by SmartAsset.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`