New Expiration Options Boost Liquidity Without Fragmentation

Adding more expirations in the options markets has been shown to increase overall liquidity. This convenience allows investors to better customize, hedge, and roll their positions across various expiry cycles. Traditionally, many symbols only had one options expiry per month, limiting flexibility for traders.

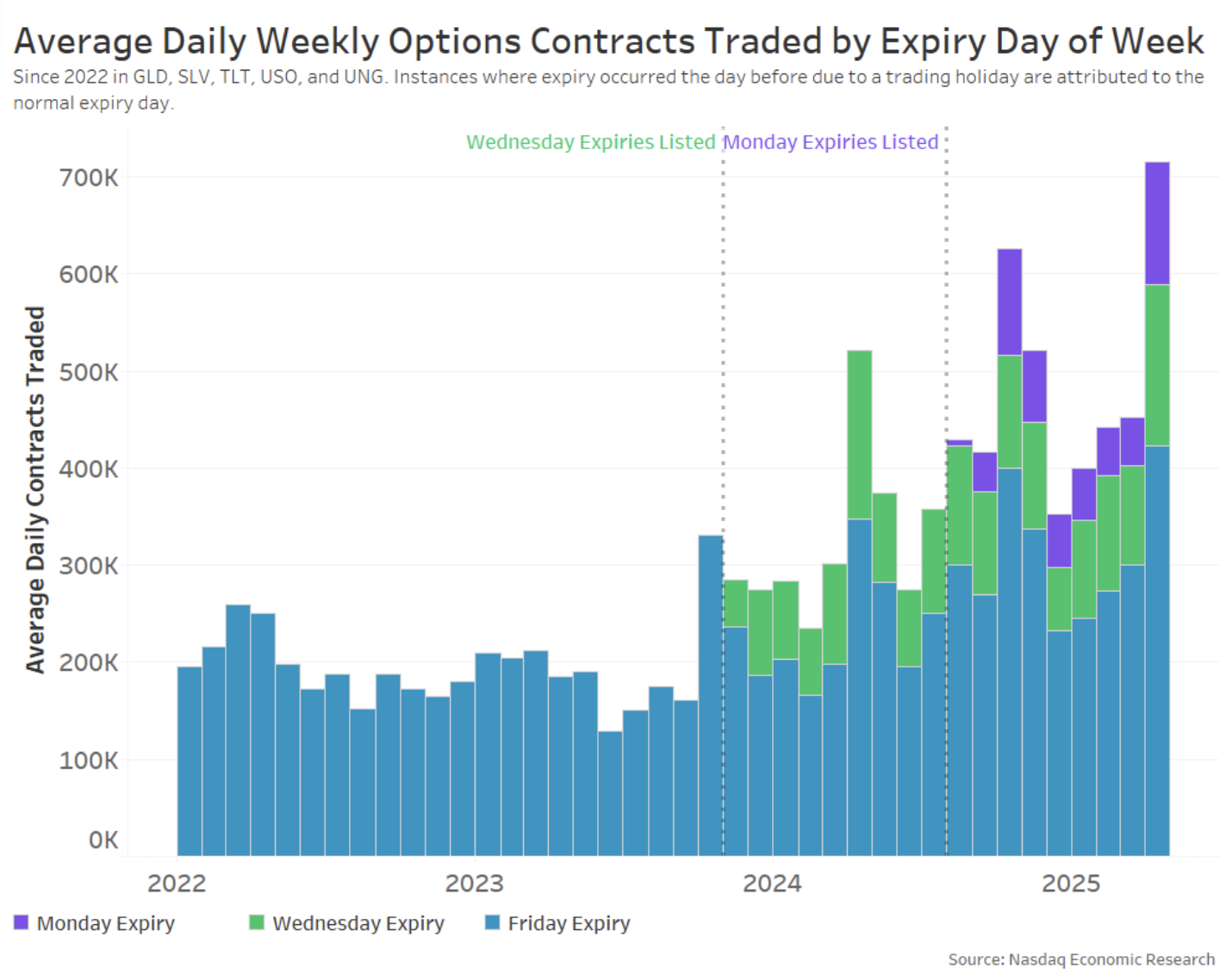

In 2023, five exchange-traded funds (ETFs) representing gold, silver, interest rates, oil, and natural gas incorporated additional Wednesday expirations. Following that, in 2024, the gold, silver, and treasury rate ETFs further expanded to include Monday expirations.

In this analysis, we will investigate these symbols with multiple expirations throughout the week and assess their liquidity profiles.

Expiries Add Volume, Not Fragment It

A common concern with introducing more expiries is the potential for liquidity fragmentation. This could occur if volumes move from established expiries, such as Friday, to the new midweek options.

However, when midweek expiries were launched, total volumes increased instead of being redistributed. Observably, even Friday’s volume gained. Traders are now better positioned to respond to specific events, like economic reports or commodity variations, without holding onto exposure longer than necessary. This surge in activity indicates renewed interest in trading, rather than simply dividing existing activity.

Chart 1: More Expiries Drive Volume Growth

Additional Strikes Result in Higher Open Interest

Examining open interest can provide insight into the impact of new expiries. Open interest indicates the total number of open positions at the close of a trading day. If investors trade mainly on expiry day, changes in open interest may be minimal. However, if the new expiries assist with hedging or more complex trading strategies, open interest should increase.

After the introduction of midweek expiries, open interest rose across all five symbols. This trend suggests that investors are actively managing their positions over multiple days or weeks, rather than limiting trading to the day of expiry.

Chart 2: Open Interest in Weekly Options Increased Post-Listing

Volume Distribution Remains Stable Despite More Expiries

The rise of short-day expiry trading (referred to as “0DTE”) has raised concerns regarding market stability. Critics worry that increasing the number of expiries could amplify volatility by increasing the share of 0DTE trades.

However, this has not been observed. While total volume increased, the percentage associated with 0DTE trades remained stable. This suggests that the new expiries cater to various trading horizons, not just emphasizing short-term trades.

Chart 3: Volume Distribution Across an Option’s Lifespan Remains Consistent

Implications of the Findings

The data consistently demonstrates the benefits of listing new expiries throughout the week:

- Increases volume in those symbols.

- Drives open interest higher.

- Does not significantly change the share of 0DTE trades.

This suggests that the new expiries effectively fill a gap for investors, enhancing customization without distorting market quality.