# NVIDIA Positions Itself as Quantum Leader Amid Market Turbulence

Quantum computing has dominated discussions lately, and it’s easy to see why. Major players in Big Tech, including Alphabet Inc. (GOOG), Microsoft Corporation (MSFT), and Amazon.com, Inc. (AMZN), are making significant investments. They are developing quantum chips capable of performing computations in mere seconds, tasks that traditional computers would take thousands of years to finish.

Among these tech giants, NVIDIA Corporation (NVDA) stands out as a frontrunner. This will be evident on Thursday, March 20, during NVIDIA’s Quantum Day, or “Q Day.” I anticipate that the company will announce a major development that could propel it to new heights, potentially triggering a market rally. (If you want more details on the event, click here to watch a replay of my summit, The Next 50X NVIDIA Call.)

However, it’s also essential to keep an eye on broader market dynamics. Recent developments, particularly regarding tariffs, have caused concerns among investors.

On Tuesday, March 4, President Trump announced 25% tariffs on imports from Canada and Mexico, alongside 20% tariffs on Chinese goods. These measures triggered a downturn in the stock market. Although the president later postponed some tariffs on Canada and Mexico until April, many investors felt it was too late to avert the crisis. Additionally, he introduced a 25% tariff on steel and aluminum and threatened a 200% tariff on alcoholic products from the European Union (EU) unless the tariff on imported American whiskey is lifted.

The back-and-forth nature of these negotiations has unsettled many in the investing community. While opinions about President Trump vary widely, his ultimate goal is to achieve free trade.

Consider this: the EU levies a 10% tariff on American cars, while the U.S. imposes only a 2.5% tariff. This disparity illustrates why trade negotiations are critical.

Much rests on the shoulders of Commerce Secretary Howard Lutnick, whom I know personally. He is an advocate for American interests, and he envisions reshaping trade policies to foster onshoring, potentially reallocating trillions.

Despite the challenges these tariff disputes pose, some encouraging economic data has helped restore investor confidence. Recent reports on the Consumer Price Index (CPI) and the Producer Price Index (PPI) have offered a glimmer of hope.

The Federal Reserve is also feeling the pressure from these developments. In today’s Market 360, we’ll analyze the latest inflation reports and their implications for future key interest rate decisions. I will also highlight how you could capitalize on the forthcoming investment opportunities that may shift market dynamics.

Consumer Price Index (CPI)

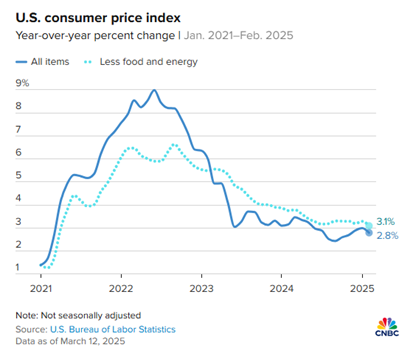

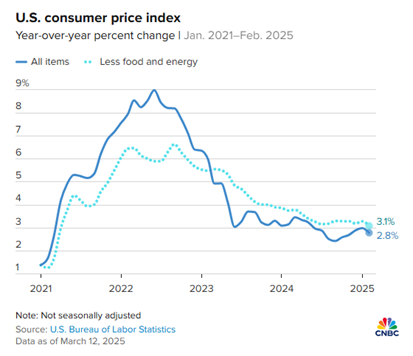

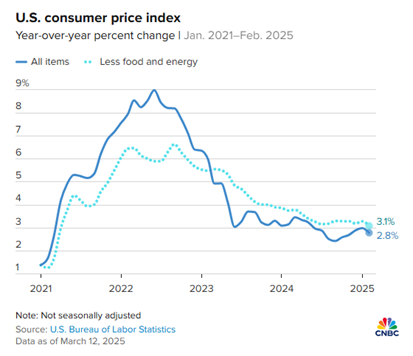

On Wednesday, the CPI report exceeded expectations, with prices rising 0.2% in February, better than the anticipated 0.3%. Year-over-year, prices climbed 2.8%, below the 3% increase in January and the projected 2.9% rise from economists.

Core CPI, which excludes food and energy prices, showed a 0.2% increase from January’s 0.4% monthly gain. Annually, core CPI rose by 3.1%, a decrease from January’s 3.3%, marking the lowest yearly increase since April 2021.

Food prices remain elevated, particularly for eggs, with the Department of Agriculture projecting a 20% increase in egg prices by 2025.

A notable decrease in the CPI last month can be attributed to a slowdown in owners’ equivalent rent, indicating that shelter costs, which have driven approximately half of inflation in past CPI figures, are stabilizing. The CPI report revealed that owners’ equivalent rent only increased by 0.3% in February, down from a 0.4% rise in January.

Producer Price Index (PPI)

Similarly, Thursday’s Producer Price Index (PPI) indicated a cooling in wholesale inflation. The PPI remained flat in February, compared to expectations of a 0.3% rise. Core PPI, excluding food and energy, actually decreased by 0.1% instead of the anticipated increase of 0.3%.

Furthermore, service costs fell by 0.2%, suggesting that a strong U.S. dollar is helping suppress wholesale inflation. January’s figures were revised upward to a 0.6% increase, making it essential to monitor these revisions. However, the current data indicates a lack of wholesale inflation.

Why Does This Matter?

The trends indicated by these reports suggest a declining inflation risk for the economy. However, the recent inflation data alone will not be sufficient for the Federal Reserve to consider cutting key interest rates in their upcoming meeting. Still, if there is a silver lining amidst the recent market turbulence, it could hint at forthcoming adjustments in monetary policy that investors should watch closely.

Treasury Yields Fall as Market Anticipates Rate Cuts Ahead

Treasury yields have experienced a significant drop recently. This shift has led to expectations that the upcoming Federal Open Market Committee (FOMC) statement will adopt a dovish stance, potentially signaling two key interest rate cuts.

Additionally, a broader decline in global interest rates is anticipated, primarily spearheaded by China and followed by other Asian nations and Europe. While the U.S. is expected to lag in implementing key rate cuts, the Federal Reserve will ultimately have to align with market rates, leaving them no choice but to lower rates.

Considering these factors, I predict that we could witness as many as four rate cuts this year.

Next Market Catalyst: NVIDIA’s Upcoming Event

With the latest inflation reports now available, it’s time to prepare for a significant market rebound, which could materialize as early as next week.

The second half of March historically tends to be a stronger period for market performance. Moreover, NVIDIA’s AI Developer’s Conference next week is creating a buzz and might serve as the next major catalyst for market growth.

Next Thursday, NVIDIA will host an event dubbed “Quantum Day,” or “Q Day.” This gathering will feature industry leaders discussing the future of quantum computing and their plans for the technology.

Excitement for this event is intensifying. In fact, quantum computing stocks surged on Friday, with gains of 17%, 28%, and an impressive 46%.

This momentum may just be the beginning. I anticipate NVIDIA will unveil a significant announcement regarding its role in quantum computing that could involve my top pick in the sector.

If you do not position your portfolio accordingly now, you may miss out by the time this announcement occurs.

Therefore, I encourage investors like you to act quickly. I cover all essential details in my latest presentation, The Next 50X NVIDIA Call.

This presentation will not be available for long, so I urge you to view it promptly before it disappears.

Click here to access the replay now.

Sincerely,

Louis Navellier

Editor, Market 360

Disclosure: As of the date of this email, I own securities mentioned in this commentary, including NVIDIA Corporation (NVDA).