Investors Brace for Impact as Tariffs Stir Concerns on Wall Street

One word is sending shockwaves through Wall Street lately: tariffs.

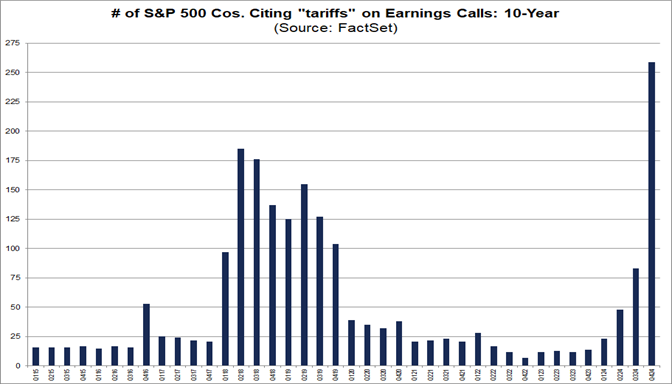

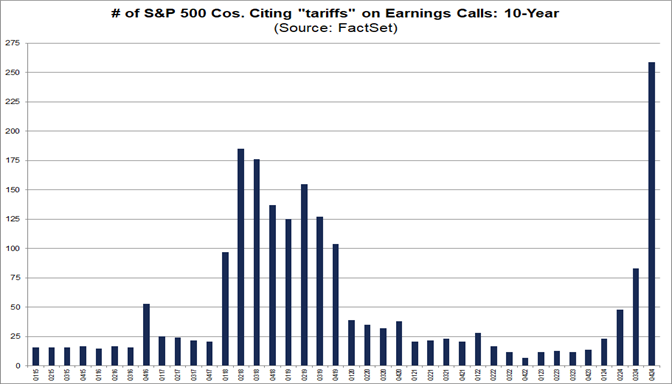

This term has investors on edge, with markets reacting dramatically. Company executives are also taking note. According to FactSet data, over half of the S&P 500 companies—259 in total—mentioned “tariffs” during earnings calls between December 15 and March 6. This marks the highest frequency in a decade.

It’s clear that the prospect of Trump 2.0’s tariffs is concerning many stakeholders. Investors are particularly anxious about their potential effects on consumer prices and economic growth. Compounding these worries is the possibility that tariffs may force the Federal Reserve to postpone key interest rate cuts.

In today’s Market 360, I will discuss ongoing tariff disputes and offer insights on their implications. Despite current uncertainties around tariffs, inflation, and economic growth, I anticipate these worries will ease soon. By April 2, dubbed “Liberation Day” by President Trump, we should gain clearer insights into the situation.

This article will explore the latest developments and outline the primary objectives behind the tariff strategies. Ultimately, I believe there’s little need for investors to panic.

The ongoing measures are part of a broader strategy aimed at altering business practices to pave the way for a U.S. economic revival. I will conclude with some positioning strategies for potential profit.

Recent Developments in Tariff Policies

Here’s a brief overview of the current state of tariffs.

Last month, President Trump implemented a 25% tariff on imports from Canada and Mexico, alongside a 10% tariff on China. While Canada and Mexico negotiated to delay implementation, these tariffs took effect on March 4.

China promptly faced a 10% tariff on February 4, later raised to 20%. Following these actions, a 25% tariff was imposed on imported steel and aluminum, prompting the European Union to threaten $28 billion in counter-tariffs on U.S. goods. In response, Trump mentioned the possibility of imposing a substantial 200% tariff on European spirits.

Most recently, Trump signed an executive order instituting a 25% tariff on oil imports from countries purchasing directly from Venezuela. He also announced a sweeping 25% tariff on foreign-made vehicles and specific auto parts.

However, there’s more to the story. The White House indicated this week that the tariffs may be more targeted than many feared, focusing on 15 countries with ongoing trade imbalances with the U.S. Treasury Secretary Scott Bessent has referred to these as the “dirty 15.”

Understanding “Liberation Day”

Investors had a nervous reaction to these developments. However, clarity came when the White House stressed that the tariffs would limit their focus. Countries targeted include China, Mexico, and Vietnam, with Mexico’s trade surplus growing in part due to its status as a subassembly site for Chinese exports under the previous NAFTA framework.

In response to U.S. tariffs, Vietnam has already announced plans to lower tariffs on certain American products, like liquefied natural gas and vehicles, signaling a willingness to negotiate rather than retaliate.

The narrative pushed by much of the financial media—that these tariffs will devastate the U.S. economy and that Trump is pursuing reckless policies—is misleading. To the contrary, these tariffs serve as tools of leverage.

Take, for instance, the 25% tariff on imported vehicles. While the tariff is broadly applied, it includes an important exemption: under the United States-Mexico-Canada Agreement (USMCA), the tax will target only non-U.S. content in vehicles. This detail incentivizes automakers to enhance domestic production.

Trump has urged manufacturers to shift operations back to the U.S. due to lower labor and electricity costs, as well as a more favorable regulatory environment. Consequently, companies like BMW, Mercedes-Benz Group AG (MBGYY), and Volkswagen AG (VWAGY) may feel increased pressure to expand their U.S. manufacturing footprint.

What’s Next in the Tariff Strategy?

The current tariff approach extends beyond the automotive sector. In total, an estimated $1.2 trillion in technology onshoring initiatives has been announced. If pharmaceutical and automotive companies follow suit, we could witness trillions in new domestic investments.

The ultimate objectives of Trump’s tariff strategy can be summed up in two main points:

- Level the playing field – “What they charge us, we charge them.”

- Encourage onshoring to eliminate tariffs entirely.

Both of these goals are aimed at strengthening the U.S. economy and appear to be making significant strides. As we approach April 2, the end of the current tariff phase, we could potentially see a more robust economic environment emerge.

Market Clarity Could Boost Stocks Amid Unease and Uncertainty

As clarity around market conditions improves, the uncertainty that has troubled investors may begin to wane. Factors such as optimism, strong corporate earnings, and the potential for lower interest rates may give stocks the momentum needed for growth.

Investment Strategy in a Volatile Market

If clarity is on the horizon but volatility remains, how should investors approach their investments? The straightforward answer is to invest in fundamentally strong stocks with high potential for recovery.

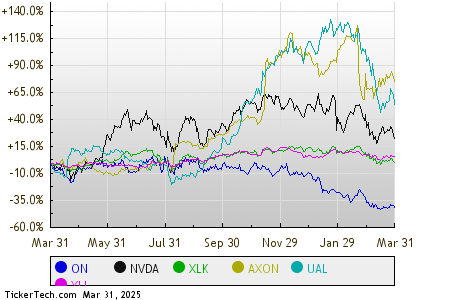

As we approach the end of the first quarter, quarter-end window dressing by institutional investors is in full swing. This practice involves fund managers cleaning up portfolios ahead of client meetings by selling off underperforming stocks and reinvesting in the best-performing names.

This is the perfect time to leverage insights from my Accelerated Profits Buy List. The stocks on this list are projected to deliver an impressive 155.6% annual earnings growth and 26.7% annual sales growth, supported by favorable analyst revisions that often lead to earnings surprises.

These stocks tend to remain resilient during market fluctuations and outperform when conditions improve.

Disregard the disruption caused by tariff discussions. This effort aims to establish fairer trade conditions, promote onshoring, and enact policies for lasting growth.

Once these initiatives are fully implemented, I anticipate significant acceleration in economic growth, especially with the anticipated reduction of regulatory barriers under Trump 2.0. Such changes could foster a wave of innovation during the ongoing AI Revolution.

I foresee a substantial intersection of Trump’s pro-business policies and the rapid advancements in AI technology. This convergence could unlock lucrative opportunities for investors.

My Stock Grader system (subscription required) has pinpointed the companies best positioned to excel in this evolving landscape. These stocks exhibit strong fundamentals and persistent buying interest from institutions.

(If you’re already an Accelerated Profits subscriber, click here to access the members-only website.)

Sincerely,

Louis Navellier

Editor, Market 360