Early Q1 Earnings Reports Show Mixed Results Ahead of Big Banks

The Q1 earnings reporting cycle officially begins on April 11th when major banks disclose their March-quarter results. However, several companies with fiscal quarters ending in February have already shared their early results. To date, these reports have been mixed, offering insights into the market’s current dynamics.

Initial Earnings Results Highlight Concerns

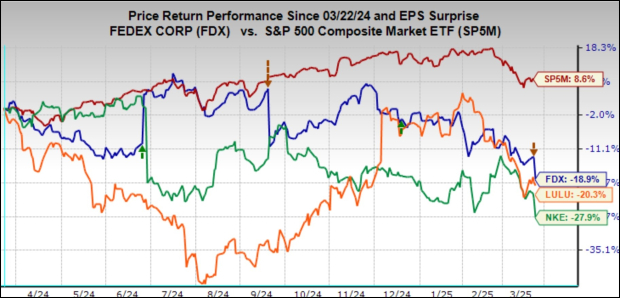

As of Friday, March 21st, 14 S&P 500 companies, including notable players like Nike (NKE) and FedEx (FDX), have reported results. Five additional companies, such as Lululemon (LULU) and Paychex (PAYX), are scheduled to release their earnings this week. By the time the major banks report, nearly two dozen S&P 500 members will have shared their Q1 results.

The market reaction to these earnings has been lukewarm. Initially, investors reacted positively to Nike’s better-than-expected results; however, the stock declined as concerns about a prolonged recovery emerged. Investor optimism likely stemmed from relief that results weren’t as poor as initially feared, rather than strong confidence in future performance.

Nike’s results matched or exceeded expectations, reflecting low anticipations, while FedEx fell short on both earnings and revenue and subsequently lowered its guidance. This marks the third consecutive quarter that FedEx has downgraded its outlook. Both companies grapple with ongoing, company-specific challenges that are coupled with a tough macroeconomic environment, hindering their stock performance.

Comparative Analysis: Lululemon’s Position

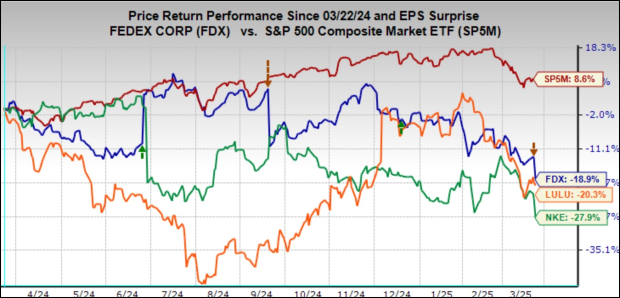

Given the struggles faced by Nike, analysts are scrutinizing Lululemon’s upcoming performance. Both companies rely heavily on consumer spending and are particularly sensitive to trade and tariff issues. Over the past year, Lululemon’s stock performance has mirrored that of Nike’s, as illustrated in the performance chart relative to the S&P 500 index below.

Image Source: Zacks Investment Research

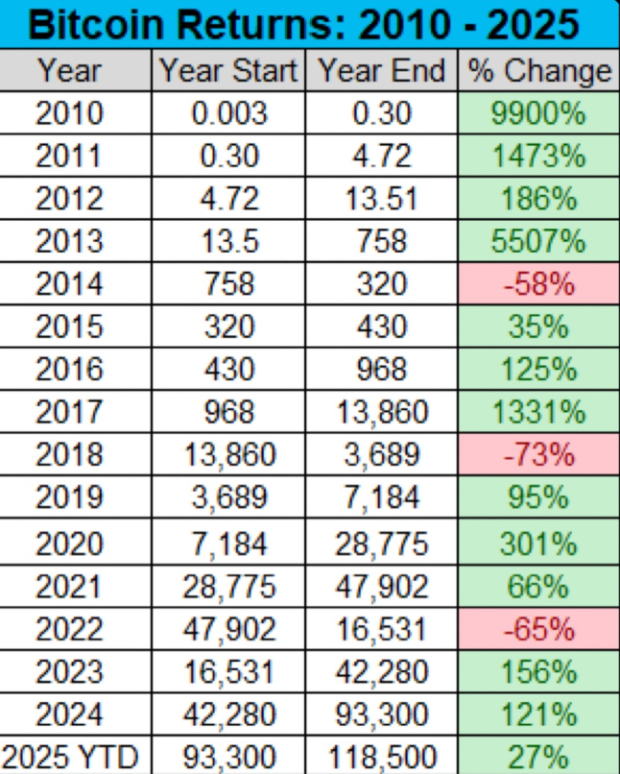

On March 21st last year, Lululemon’s quarterly release had sparked fears about its growth sustainability. This concern is echoed in the three-year performance comparison chart below.

Image Source: Zacks Investment Research

In January, Lululemon offered an optimistic outlook for the current quarter, following positive guidance in December. This outlook has positively impacted earnings estimates for the quarter, now set at $5.85 per share, a notable increase from prior estimates of $5.80 and $5.65 made two and three months earlier, respectively.

The company expects same-store sales to rise by +5.16%, up from +4% in the previous period, and exceeding estimates of +2.37%. Last year’s results also revealed strength in Lululemon’s performance, with comparable sales up by +12%, demonstrating a pattern of steady growth before the company’s recent cautious guidance.

Year-to-date, Lululemon shares have slipped by -15.6%, contrasting with a -4.2% decrease in the S&P 500 index. An improved performance in this quarter could bolster stock prices, but analysts stress that forward guidance for the fiscal year is crucial, with expected earnings and revenue growth of +6.8% and +7.5%, respectively.

Early Q1 Earnings Scorecard Overview

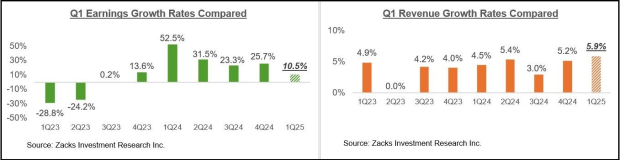

To summarize, results from 14 S&P 500 members have shown total earnings growth of +10.5% from the same period last year, alongside +5.9% revenue growth. In this group, 57.1% exceeded EPS estimates and 71.4% surpassed revenue expectations.

Image Source: Zacks Investment Research

In a historical context, the EPS and revenue growth rates for these companies illustrate the current challenges, with a noted decline in the percentage of companies beating consensus estimates, the lowest seen in the past 20 quarters. This trend warrants caution when interpreting early earnings results, considering the limited sample size.

Pressure on Q1 Earnings Estimates

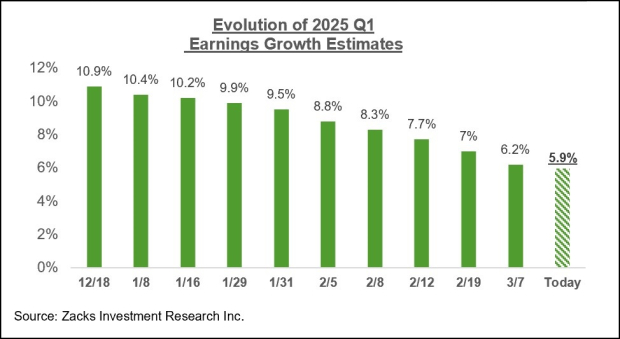

Market expectations indicate Q1 earnings will rise by +5.9% year-over-year with revenue increasing by +3.8%, following stronger growth of +13.8% in earnings and +5.4% in revenue during the previous quarter.

Image Source: Zacks Investment Research

The past few weeks have seen a notable rise in negative revisions for Q1 estimates, even before the recent wave of weak data prompted cautious guidance from various companies.

Image Source: Zacks Investment Research

This current level of negative revisions for Q1 is more significant in comparison to similar periods over the last few quarters, reflecting a cautious outlook as earnings estimates continue to be adjusted downward.

Q1 Earnings Outlook: Mixed Revisions Across Key Sectors

Throughout the early part of the year, financial projections have decreased across various sectors. Since January, estimates have declined for 13 of the 16 Zacks sectors. The largest reductions have occurred in Conglomerates, Autos, Basic Materials, Aerospace, and Consumer Discretionary, among others.

On a more positive note, three sectors have seen upward revisions for their Q1 estimates: Medical, Utilities, and Construction. However, the Technology sector, which had previously enjoyed consistent positive estimates over the past year, is now facing negative adjustments as well. Recent sentiments around the AI investment cycle took a hit following China’s DeepSeek announcement. This shift has negatively impacted AI-focused stocks throughout the year.

Despite these revisions, the Tech sector remains a vital growth driver for Q1 and further into 2025, with projected earnings rising by +12.4% and revenues increasing by +10.1%. Much of the market’s attention is focused on evolving expectations for this sector, which has been a cornerstone of growth for the last two years.

Current guidance releases have fallen short amidst growing concerns regarding the broader economic landscape. Many investors are increasingly worried about the U.S. economy’s short-term growth potential. Uncertainty surrounding the Trump administration’s tariff policies is affecting both business and consumer confidence. There are also fears that ongoing job cuts in the public sector could eventually impact private sector employment.

While acknowledging the rising near-term risks, we maintain a positive outlook and consider the current market weakness a potential buying opportunity. The U.S. economy proved resilient during the previous Federal Reserve tightening cycle and can likely manage the current uncertainty stemming from tariff issues.

Importantly, for the first time in a long while, the U.S. economy benefits from a strong Federal Reserve that has sufficient resources to stimulate growth should investor concerns materialize. As the new tariff landscape takes shape, earnings estimates may need adjustments accordingly. However, it is essential to look beyond the daily distractions that tariffs cause, as corporate earnings have been on a continuous upward trajectory in recent quarters.

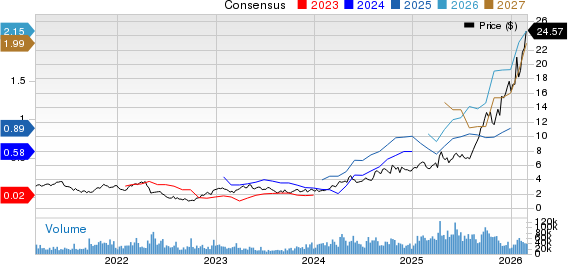

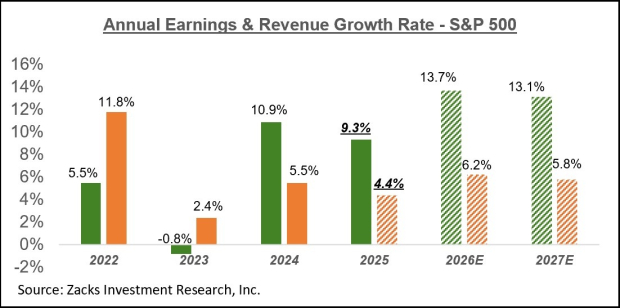

We believe the favorable growth trends will persist in the coming quarters, with growth contributors expanding beyond the Tech sector dominance of recent years. The chart below illustrates the overall earnings forecast on a calendar-year basis, showing strong growth momentum anticipated up to 2027.

Image Source: Zacks Investment Research

For more details about the evolving earnings picture, please check out our weekly Earnings Trends report here.

Access Zacks’ Insights for Just $1

We’re not kidding.

In an unexpected move, we previously offered our members 30-day access to all stock picks for only $1, with no obligation to spend more. Thousands have seized this opportunity, while others may have doubted its authenticity. The rationale behind this offer is simple: we want you to familiarize yourself with our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 256 positions with significant gains in 2024 alone.

NIKE, Inc. (NKE) : Free Stock Analysis Report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.