Wall Street’s Mixed Reactions to New Tariffs and Lobbying Efforts

Wall Street stocks have experienced a downturn this month following the announcement of substantial tariffs on foreign imports to the US. Specifically, the tariffs include charges as high as 145% on many Chinese goods and a baseline 10% tariff on nearly all imports. The implications for US firms are significant, particularly for technology companies that rely on China-manufactured parts, which will incur extra costs. Additionally, manufacturers in the automotive sector face ongoing tariffs affecting imports from Canada and Mexico, leading many vehicle manufacturers, who depend on parts from both neighbors, to anticipate rising prices in the coming months.

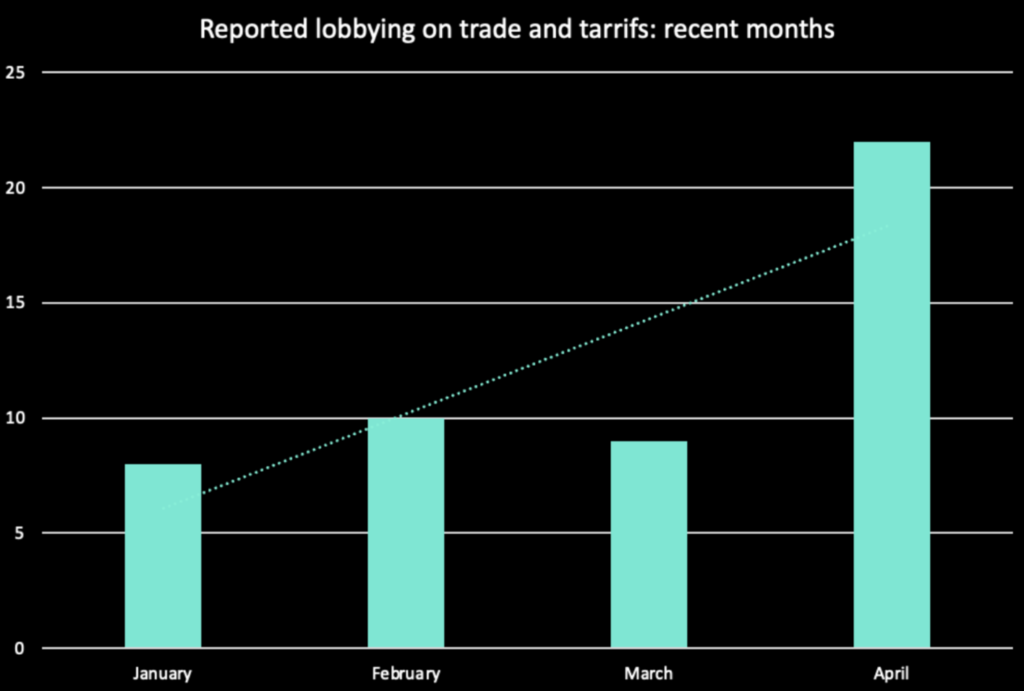

The current landscape of tariffs has shown volatility; recent adjustments include a 90-day pause on retaliatory tariffs from the European Union and a US exemption on tariffs for smartphones and electronics sourced from China. Such policy inconsistencies may be creating opportunities for businesses. Recent disclosures reveal a notable response from many major US firms through increased corporate lobbying. Lobbying related to tariffs has surged nearly 50% since March. In parallel, lobbying for trade issues, taxes, and immigration is also on the rise.

Companies that recently increased their lobbying expenditures include technology giants such as Apple, which reported $40,000 spent on trade-related lobbying in April, and global shipping leader FedEx. Other notable participants in lobbying over the past month include Microsoft ($MSFT), Walmart ($WMT), and Best Buy ($BBY).

To date, at least $800,000 has been reported in lobbying spending focused on trade issues this April. In the past, there have also been spikes in lobbying activity during significant events such as the presidential inauguration in January and the announcement of the suspension of contributions to the World Trade Organization (WTO) in early March.

Here are some key players this month regarding trade and tariff lobbying:

Among the companies taking a stand on trade-related issues is Etsy, an American e-commerce platform, which spent $40,000 on lobbying this month. Competitor eBay has also engaged in lobbying efforts related to foreign trade, reporting at least $30,000 spent on monitoring trade agreements and barriers in April. Given the importance of Chinese imports to e-commerce, the potential impact of these tariffs on US shopping websites is considerable. For example, a 2024 annual filing by Amazon indicated that nearly 50% of the top sellers in the US originate from China, which is subject to tariffs as high as 145%. Consequently, Etsy and eBay anticipate adjustments in their consumer and production outlooks as tariffs progress.

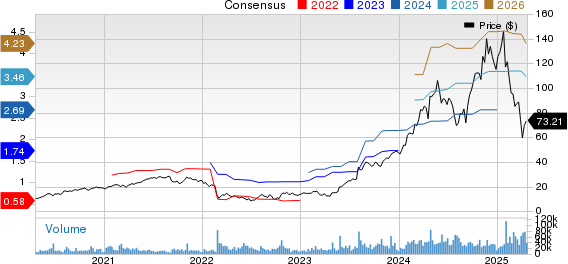

Shipping giant FedEx has reported $80,000 in expenditures for monitoring international trade issues and executive orders related to trade. Shares of FedEx ($FDX) are down 17% this month due to growing concerns over declining imports to the US.

Additionally, technology firms are also stepping up their lobbying efforts. Microsoft disclosed spending of $30,000 in April for monitoring trade agreements and immigration policies. Notably, this occurred prior to the exemption of many electronic devices, including smartphones and computers, from the “reciprocal tariffs” imposed on imports from China. Following this announcement, major tech stocks such as Microsoft, Apple, and Meta have begun to recoup losses sustained in the market downturn associated with the tariff announcements.

As tariff policies continue to evolve, expectations are high for ongoing lobbying activities focused on trade, tariffs, and foreign policy. Notably, technology companies, e-commerce platforms, and manufacturing industries are emerging as the primary players in lobbying efforts. These sectors are likely to maintain their lobbying expenditures to advocate for their interests in Washington, DC, as market conditions adapt.

All data and figures on tariff lobbying have been retrieved from Quiver Quantitative’s corporate lobbying dashboard.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.