Nasdaq Composite Enters Bear Market Following Tariff Announcement

The Nasdaq Composite (NASDAQINDEX: ^IXIC) has officially entered a bear market. After hovering near correction territory, the index fell over 20% from its peak following President Donald Trump’s tariff announcement on April 2. Trump introduced new tariffs impacting over 180 countries, with rates ranging from 10% to 99%.

Notably, these tariffs primarily target imports from countries like China, Taiwan, and Vietnam—key sources for many technology companies. Concerns about the ramifications of these tariffs have made investors increasingly cautious, leading to the Nasdaq Composite experiencing steeper declines compared to other major indexes like the S&P 500 (SNPINDEX: ^GSPC) and Dow Jones (DJINDICES: ^DJI).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

History of Bear Markets in the Nasdaq

Bear markets are not new to the Nasdaq. Including the ongoing bear market, the index has faced five such downturns since 2000. The following table shows each bear market along with the decline in the index:

| Bear Market Duration | Nasdaq Percentage Decline |

|---|---|

| Dec. 2024 to April 2025 (Current) | (23%) |

| Nov. 2021 to Dec. 2022 | (33%) |

| Feb. 2020 to March 2020 | (30%) |

| Oct. 2007 to March 2009 | (54%) |

| March 2000 to Oct. 2002 | (78%) |

Source: YCharts. Current bear market percentage decline as of April 4, the recent low point.

Understanding that bear markets are a natural element of the stock market cycle is crucial for investors. Since its introduction in February 1971, the Nasdaq Composite has seen nine bear markets. However, it remains a beneficial long-term investment.

Currently, with the Nasdaq Composite at approximately 15,600 points, here’s how much the index has rebounded post the previous bear markets (excluding the current one):

- December 2022: 45%

- March 2020: 127%

- March 2009: 1,085%

- October 2002: 1,280%

Investing Options in the Nasdaq Composite

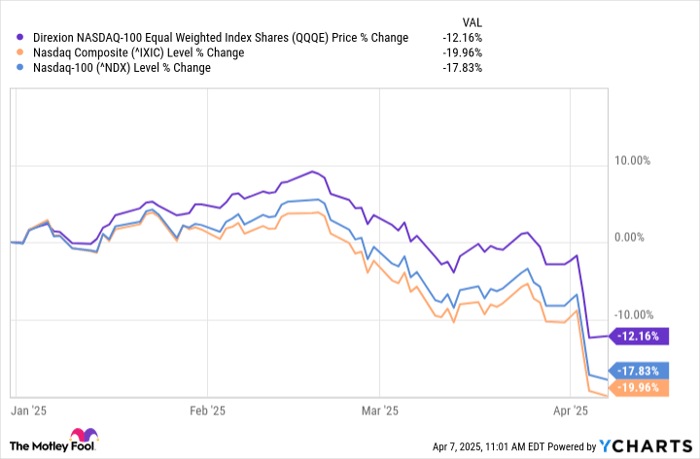

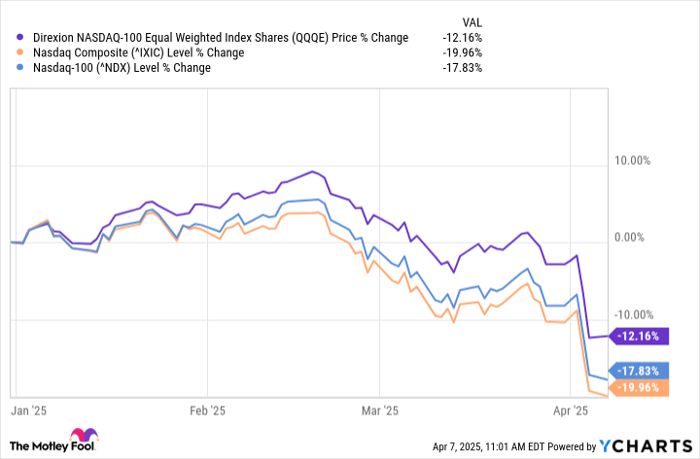

For those interested in investing in the Nasdaq during this market phase, consider an exchange-traded fund (ETF) like the Direxion NASDAQ-100 Equal Weighted Index Shares (NASDAQ: QQQE). This ETF tracks the Nasdaq-100, which focuses on the top 100 non-financial stocks within the Nasdaq.

While it holds the same stocks as the Nasdaq-100, the QQQE is equal-weighted. This means that investments are distributed evenly across all companies, rather than being influenced by their market capitalizations as in the standard Nasdaq-100.

This equal-weight approach addresses the risk tied to significant losses from mega-cap tech stocks, which currently dominate the standard Nasdaq-100 index. Companies like Apple, Nvidia, and Microsoft account for over a quarter of the index.

QQQE data by YCharts

It is risky to concentrate investments in a small number of companies. The equal-weight Nasdaq-100 ETF allows for diversified exposure to the Nasdaq without heavy reliance on high-cap tech stocks.

Investing Strategies in Uncertain Times

Given the current economic uncertainty, I recommend against investing a lump sum even if you want to buy the equal-weight Nasdaq-100 ETF. Instead, consider utilizing dollar-cost averaging.

This strategy involves determining an investment amount and scheduling regular investments. For instance, if you wish to invest $1,000 in the ETF, you could split this into ten $100 increments, four $250 portions, two $500 portions, or any combination that suits you.

By applying dollar-cost averaging amid market volatility, you mitigate the risks associated with one-time investments before potential market drops, easing the impact of market fluctuations.

Always remember: the focus should be on long-term gains. Don’t allow bear markets to deter your investment strategy. Approach the market steadily, and you may appreciate the benefits of current lower prices in the future.

Seize a Potentially Lucrative Opportunity

Do you feel you’ve missed opportunities to invest in top-performing stocks? If so, now is a crucial time to act.

Our expert analysts occasionally issue a “Double Down” Stock alert for companies poised for significant growth. If you worry you’ve missed your chance, consider investing before the opportunity closes. Here are some compelling figures:

- Nvidia: A $1,000 investment in 2009 would be worth $244,570!*

- Apple: A $1,000 investment in 2008 would be valued at $35,715!*

- Netflix: A $1,000 investment in 2004 would have turned into $461,558!*

We are currently issuing “Double Down” alerts for three exceptional companies, and this may be a limited opportunity.

Continue »

*Stock Advisor returns as of April 5, 2025

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool advises the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.