Falling Interest Rates Point to Corporate Bonds as Investment Opportunity

The current economic landscape presents an unusual contrast: even amid inflationary concerns, forecasts suggest that interest rates will likely decrease over the next year.

For investors seeking income, this trend signals a clear opportunity in corporate bonds. A preferred method for accessing this market is through discounted closed-end funds (CEFs) that offer substantial dividend yields.

Most investors familiar with corporate-bond CEFs have certainly heard of the PIMCO Dynamic Income Fund (PDI). As the largest CEF in this category with a market capitalization of $5.1 billion, it boasts an impressive yield of 13.3%.

PDI serves as a strong indicator of investor sentiment towards corporate-bond CEFs, and recent trends reveal growing interest in this area, which we will explore shortly. First, however, some might question why I predict falling interest rates amidst ongoing inflationary pressures. Let’s clarify that point.

My rationale stems partly from declining consumer confidence, which indicates that shoppers are starting to pull back. This shift raises the risk of a recession, which in turn would contribute to lower interest rates.

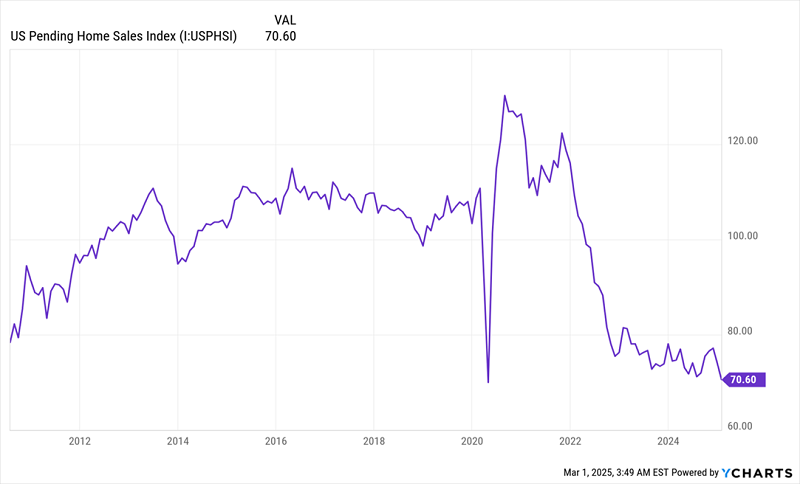

The more critical factor in my forecast of decreasing rates is evidenced by a significant decline in pending home sales in the United States. It is important to note that a decrease in rates correlates with rising bond prices, similar to how two ends of a teeter-totter move in opposite directions.

Pendings Home Sales Drop Significantly

Pending home sales have seen a prolonged downturn, now at levels lower than during the pandemic’s nadir.

This decline is largely attributed to high interest rates coupled with elevated home prices. Though these conditions can exist without immediately triggering an economic slowdown, they cannot persist indefinitely since household wealth remains heavily tied to home values.

A decrease in home sales is likely to prompt the Federal Reserve to lower rates, which in turn could uplift stock and corporate bond markets. Thus, this situation ultimately creates a supportive backdrop for investors while also indicating potential economic challenges.

The main takeaway is that, despite the disconnect between stock performance and economic indicators, it is prudent to remain in the market. Even amid anticipated increases in volatility, which we’ve recently observed, diversifying into corporate bonds might be a timely move.

Increased Likelihood of a Mild Recession

A recent chart reveals that the anticipated recession that many have discussed since 2022 might be approaching.

Data suggests a potential GDP decline in the first quarter of 2025, highlighting the risks accumulating within the U.S. economy after prolonged inflation, alongside persistent high house prices.

However, the employment situation remains solid, with unemployment at 4% and wages increasing at a rate of approximately 5% year-over-year.

In summary, while the economy shows signs of shrinking in early 2025, consumer spending could still play a crucial role in recovery.

Although the likelihood of experiencing a recession is on the rise, it remains relatively low compared to other regions, notably Europe and the UK.

With the U.S. economy performing better than its peers and recession probabilities around 25%, a cautious approach is advisable.

Strategies Moving Forward

Economists label this phase as “mid-cycle,” where recovery from a downturn is not evident (unlike in 2023 and 2024). It is also not the most favorable time for a stock purchasing frenzy.

In this context, corporate-bond CEFs emerge as an attractive option due to three key factors:

- High yields: An average coupon yield of 6.9% means investors in high-yield corporate bonds receive substantial cash flows, which remain relatively secure given low corporate-default rates.

- Future moves by the Fed: If the Federal Reserve decides to cut rates more aggressively in 2025, as indicated by housing data, companies will find it easier to service their debts. This circumstance lowers risks for investors and contributes to increasing asset values as rates decline.

- Potential shift from stocks: In an environment of heightened short-term volatility, demand for corporate bonds will likely rise. This dynamic implies more buyers for current bondholders, leading to price increases guided by supply and demand fundamentals.

These trends are already becoming apparent.

Corporate Bonds: A Step Up from Junk Bonds

As the corporate-bond market offers attractive yields, the corporate-bond benchmark SPDR Bloomberg High Yield Bond ETF (JNK) is outperforming the S&P 500 in 2025, which is a notably rare occurrence.

This trend is expected to persist if stock market volatility continues, as investors seek stable income streams and recognize the low default rates characterizing these assets.

However, to effectively capture this opportunity, CEFs are likely the best choice over JNK.

PDI Shines in CEF Market, Thriving with Strong Dividends

PDI has shown impressive performance since its launch in 2012, outperforming JNK and tripling its returns. This strong track record has led to PDI’s assets under management growing to $7 billion, all while the fund offers an appealing 13.3% dividend payout.

PDI’s Sustained Growth and Its Impact on CEFs

This growth is significant as it highlights increasing interest in Closed-End Funds (CEFs) that invest in high-yield bonds. Higher demand for corporate-bond CEFs is making their discounts to net asset value (NAV) shrink, and in more cases, transform into premiums. This trend signifies that previously undervalued bond CEFs are becoming “less cheap,” which is beneficial as it enhances their total returns.

Monthly Dividend Opportunities in CEFs

Interestingly, a notable feature of CEFs, including PDI, is their ability to offer monthly dividend payments. This characteristic not only provides investors with access to double-digit yields but also simplifies income management by eliminating the irregularities associated with quarterly payments.

Benefits of Monthly Dividend CEFs

Here are some compelling advantages that monthly dividend CEFs offer:

- Big yields: They provide significant returns through safe cash dividends.

- Discounts to NAV: Investing at a discount enables investors to benefit as NAV premiums develop, increasing returns.

- Instant diversification: CEFs give investors access to diversified portfolios for enhanced safety.

- MONTHLY payouts: They offer convenience with regular income streams.

Given these advantages, it’s clear why affluent investors lean towards CEFs. The public market allows all investors to access these potentially lucrative funds.

Top CEF Picks for Reliable Income

As a starting point, I present my selection of the 5 top monthly paying CEFs. Each of these funds is handpicked for their high yields—averaging 10%—along with attractive discounts and stable monthly payouts. With market volatility expected to continue, having these solid income sources can be advantageous.

Click here to learn more about these recommended picks and download a free special report detailing their names and tickers.

Additional Resources:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.