GraniteShares 2x Long NVDA ETF Faces Significant Decline

Shares of the GraniteShares 2x Long NVDA Daily ETF (NASDAQ: NVDL) plummeted in January 2025, dropping 26.1% over the month, according to S&P Global Market Intelligence. This decline serves as a reminder of the inherent risks that come with leveraged ETFs, which can experience larger declines than gains during volatile periods.

Tracking Nvidia’s Fluctuations

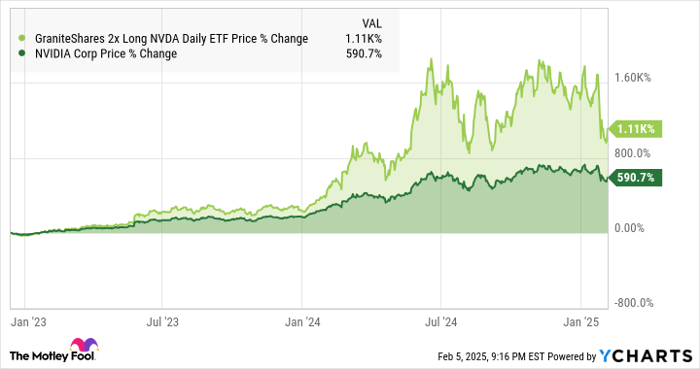

This GraniteShares ETF aims to double the returns of Nvidia (NASDAQ: NVDA) stock. With assets totaling $4.8 billion, the fund has been effective in hitting its target returns.

Nvidia’s stock has skyrocketed, yielding a return of 591% since the ETF’s launch in December 2022. The GraniteShares ETF closely matched this return, albeit impacted by its management fee of 1.15% and smaller fluctuations. However, achieving precise returns with leveraged instruments can be challenging due to these various factors.

NVDL data by YCharts

When Nvidia’s stock declines, the GraniteShares fund can fall even more sharply. Last month, Nvidia’s shares dropped significantly after a Chinese competitor unveiled a robust language model developed with a substantial computing budget.

The Risks of Leveraged ETFs

The introduction of DeepSeek’s AI model illustrated the fragility of investing in high-valued stocks like Nvidia. Competition is fierce; innovations can emerge rapidly, and this stirs varying opinions among investors. Those bearish on Nvidia worry about decreasing demand for its processors, while optimistic investors believe that competitive models could ultimately lead to greater advancements in AI.

This scenario highlights the heightened risks associated with leveraged ETFs, which are typically intended for short-term trading. Holding these funds for longer periods can lead to disappointing outcomes, especially if the market experiences a downturn. The potential for gains is enticing during bullish markets, but the reality is that losses can be equally substantial.

For example, the iShares US Regional Banks (NYSEMKT: IAT) index fund suffered during the inflation crisis two years ago and only returned to its prior levels in February 2023. The leveraged Direxion Daily Regional Banks Bull 3x (NYSEMKT: DPST) fund fell by 55% in that same timeframe.

IAT data by YCharts

While the lure of holding leveraged ETFs tied to growth stocks can be strong, it is crucial to remain aware of the risks involved. The sharp downturn of leveraged Nvidia funds in January is a clear illustration of those risks.

Is Investing in GraniteShares ETF Trust Worth It?

Before considering an investment in the GraniteShares ETF Trust – GraniteShares 2x Long NVDA Daily ETF, take note:

The Motley Fool Stock Advisor team has highlighted what they consider the 10 best stocks to buy right now, and GraniteShares ETF Trust – GraniteShares 2x Long NVDA Daily ETF is not among them. The selected stocks hold the potential for substantial returns in the coming years.

For instance, when Nvidia made the list on April 15, 2005, an investment of $1,000 would have grown to $727,150!*

Stock Advisor offers straightforward investment strategies, regular analyst updates, and two new stock picks monthly. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500, making it a valuable resource for investors looking to enhance their portfolio.

Learn more »

*Stock Advisor returns as of February 3, 2025

Anders Bylund has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.