Understanding the Economic Rally: Insights and Predictions Ahead

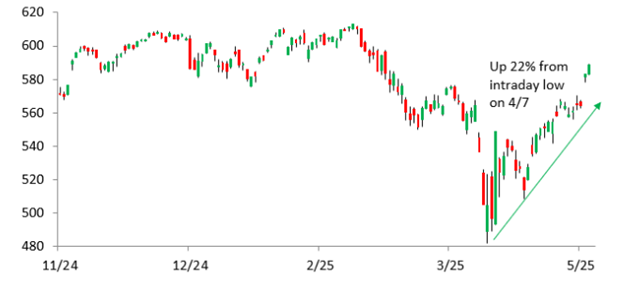

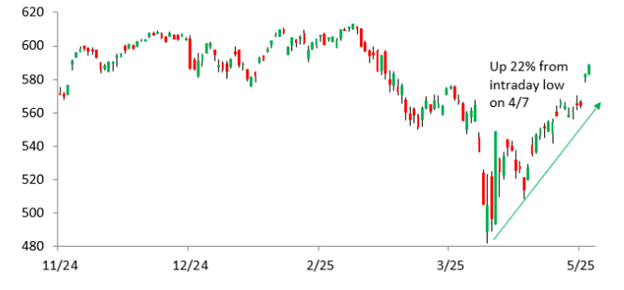

Amidst a media frenzy attempting to explain the latest market rally, some have been closely monitoring the underlying economic shifts for months. Following the significant “Liberation Day” selloff on April 3, a bold prediction was made regarding an impending rally. The sentiment was that patience would be essential until the markets stabilized.

Observations from Bespoke Investment Group noted that the S&P 500 had fallen more than 15% year-to-date by April 8. However, in the subsequent 25 trading days, the S&P 500 recovered, effectively erasing those earlier losses.

Contrary to popular belief, this rally was not an unpredictable event. Over the last two years, significant predictions were made—ranging from Joe Biden’s exit from the presidential race to Donald Trump’s potential return to office and the current trade revisions. These forecasts have proven to be quite accurate, suggesting a deeper understanding of market trends and political dynamics.

In this context, it is critical to explore these predictions and their impact on the market.

Key Predictions Realized

1. Biden’s Withdrawal: In December 2023, it was forecasted that President Biden would not reach the 2024 general election. Insights from decades of market and political experience indicated that party insiders would avoid risking an unfit candidate. A prediction was made that a Democrat from California would take his place. While the expected candidate was Gavin Newsom, it ultimately turned out to be Kamala Harris. Nevertheless, the anticipated transition occurred as predicted.

2. Trump’s Comeback: Throughout 2024, the prediction that Donald Trump would win the presidential election stood firm. While others hedged their views, the forecast stated that investors must prepare for a second Trump term. Following his victory, further insights were provided regarding expected policies during Trump’s second term, including aims to revive manufacturing, roll back environmental restrictions, and focus on AI innovations.

3. Trade Strategy and Pivot: When Trump took office, the forecast of impending tariffs materialized in April 2025, followed by media concern and volatility. However, it was emphasized that these tariffs were part of a broader strategy to reshape global trade, bringing essential industries back to the U.S. The anticipated negotiation dynamics were also forecasted, leading to various trade truces that contributed to market recovery.

This recent rally is not the conclusion of the story but a precursor to broader economic changes on the horizon.

Anticipating the Next Steps in the Trump 2.0 Agenda

The ongoing developments signal the introduction of a larger framework dubbed Liberation Day 2.0. This encompasses several strategic initiatives:

1. Tax Liberation: The proposal to use tariff revenue for cutting income taxes for those earning under $150,000 could significantly boost consumer spending. Historically, this could elevate wages, encourage business investments, and potentially add trillions to GDP over the next decade.

2. Tech Liberation: The U.S. and various foreign governments have pledged over $2 trillion towards AI, crypto, and cloud technologies since the election. Regulatory frameworks are being amended, fostering a return to innovation-friendly policies.

3. Energy Liberation: The U.S. holds over $100 trillion in untapped energy and mineral resources. New executive orders are streamlining processes for mining and drilling, heralding a potential generational boom in strategic materials and domestic energy production.

Investors are posed with the challenge of positioning their portfolios to leverage these wealth-creation opportunities.

Recommended Stock: Powell Industries Inc. (POWL)

In December 2023, Powell Industries Inc. (POWL) was recommended due to its track record of exceeding earnings expectations. The Houston-based company specializes in equipment and systems for electrical infrastructure, showcasing earnings surprises of 305.6%, 400%, 233.3%, 130.3%, and 62.5% over the preceding five quarters.

Since then, Powell Industries has seen remarkable growth, achieving peak gains of 300%.

Powell Industries Sees Growth Fueled by AI Market Demand

Typically, earnings surprises don’t lead to substantial profit gains. However, the surge in the artificial intelligence sector is an exception.

While my initial “buy” alert for Powell Industries did not mention “AI,” it became clear that the company’s products are essential for large AI data centers, known as “hyperscalers.” By June 2024, Powell was recognized as a key beneficiary in this growing market, leading to a doubling of its stock price in subsequent months.

As AI technology continues to expand, the need for reliable, scalable data centers becomes critical. These facilities require customized electrical solutions that guarantee efficiency and performance. Powell’s clientele includes petrochemical plants, oil and gas producers, utilities, and transportation facilities, positioning it well to benefit from current tax and energy policies.

Positive Financial Results Reflect Growth Strategy

The groundwork laid by Powell to establish relationships within the AI sector is yielding significant results. In the second quarter of fiscal year 2025, Powell reported new orders amounting to $249 million, maintaining a solid backlog of $1.3 billion. The company’s second-quarter revenue reached $279 million, a 9% increase compared to the same period last year, slightly below analyst estimates of $282.68 million.

Earnings for the quarter rose 38% year-over-year to $46 million, or $3.81 per share, up from $33.5 million, or $2.75 per share. Analysts had forecasted earnings of $3.44 per share, resulting in a notable 10.8% surprise.

Despite some pullback from its all-time highs earlier this year, Powell is expected to maintain a solid growth trajectory. Analysts project 2025 revenue to reach $1.12 billion, increased from $1.01 billion in 2024. Earnings are anticipated to rise to $14.17 per share, up from $12.29 the previous year.

Stock Rating and Future Opportunities

Currently, Powell earns a “B” rating in my Stock Grader system, making it a solid “buy” under $227. However, for those seeking higher returns, I invite investors to join my broadcast on Wednesday, May 28, at 1 p.m. Eastern, where I will discuss more about the Liberation Day 2.0 strategy and reveal additional stocks with high “buy” ratings.

This quantitative engine, used for nearly five decades, has identified major winners, including Apple Inc. (AAPL) and Amazon.com, Inc. (AMZN). In 2024 alone, my system guided premium members to achieve significant gains, including:

- A $2,093 gain on Novo Nordisk A/S (NVO).

- A $5,500 gain on Axcelis Technologies Inc. (ACLS).

- A $14,000 gain on YPF SA (YPF).

- A remarkable $45,360 gain on Vista Energy (VIST).

These results were achieved without high-risk strategies such as options or penny stocks. As Wall Street catches up with the evolving market, my system is already identifying the next great opportunities.

More details will be discussed on May 28. I recommend registering now to ensure you don’t miss any important information.

Click here to register for the Liberation 2.0 summit now.

Louis Navellier

Editor, Market 360

Disclosure: As of the date of this email, I own securities mentioned in this communication, including shares of Powell Industries Inc. (POWL).