“`html

The U.S. government has taken a significant step by acquiring a 10% stake, valued at $8.9 billion, in Intel Corp. (INTC), a move aimed at bolstering national security and the domestic semiconductor industry. This investment comes from CHIPS Act grants and signals a commitment to secure chip manufacturing on U.S. soil, especially as Intel plans to build new factories in Ohio.

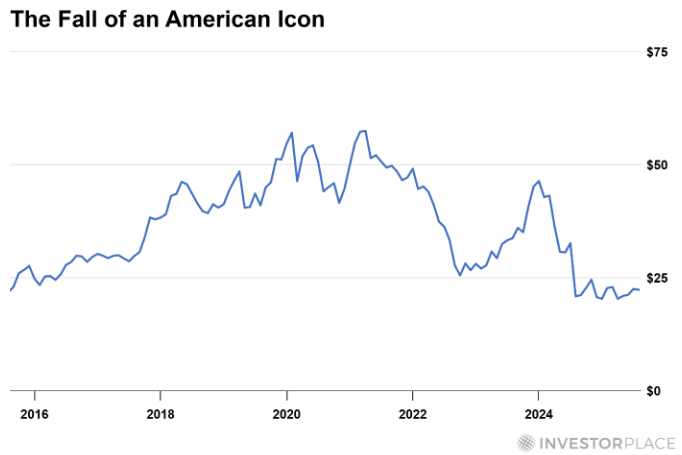

Despite facing substantial challenges, including a 15% workforce reduction and the abrupt retirement of CEO Pat Gelsinger, analysts expect Intel to return to profitability, projecting earnings of $0.12 per share on $52 billion in revenue in the coming year. In contrast, competitor Nvidia Corp. (NVDA) is forecasted to report a 46% increase in earnings on $203 billion in revenue.

As part of a broader strategy, the U.S. government is also considering equity stakes in defense contractors, highlighting a shift in industrial policy. This move intends to ensure that critical defense supply chains are not solely reliant on the private sector, emphasizing the need for national security amid increasing geopolitical tensions.

“`