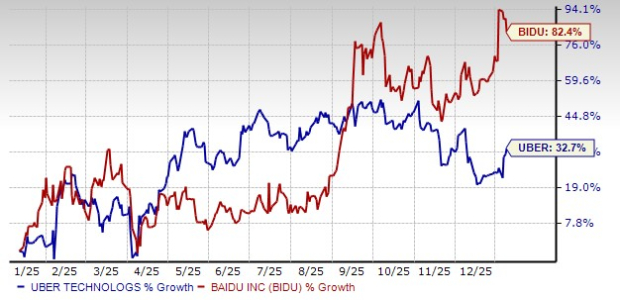

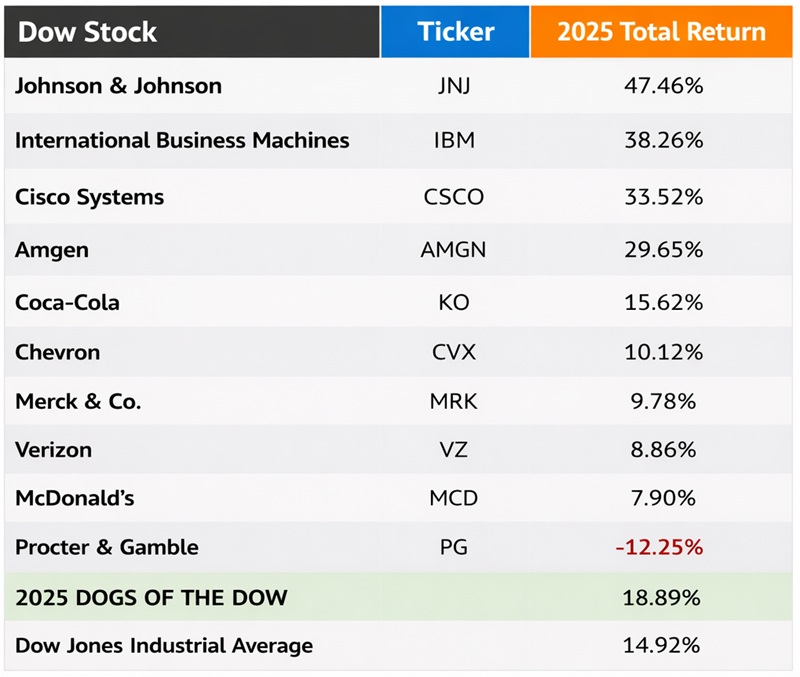

The period from 2000 to 2009 is referred to as “The Lost Decade” for the S&P 500, which saw stagnant returns despite the dot-com boom. Major companies like Microsoft, Cisco, and Intel failed to recover their prior highs during this time. In contrast, some lesser-known stocks like Monster Beverage and Freeport-McMoRan significantly outperformed, gaining over 1,000% and 1,400%, respectively.

Current market analysis suggests a similar “Hidden Crash” could emerge by 2026, indicated by a narrowing of market leadership. This anticipated environment involves slowing earnings momentum among leading stocks, potentially trapping capital in low-growth investments akin to the Lost Decade. Analysts are urged to recognize early signs and adapt to shifting market dynamics to avoid stagnation.

Investors are advised to diversify by identifying stocks with declining momentum and reallocate resources to companies positioned for growth, particularly in emerging tech sectors linked to trends like AI.