Market Turmoil: Key Insights Following April’s Tariff Crisis

The first five trading days of April were profoundly challenging for investors. Major indices, including the S&P 500, Dow, and NASDAQ, all experienced significant sell-offs, each declining over 10%. This steep drop affected a wide array of stocks, demonstrating a broad market downturn.

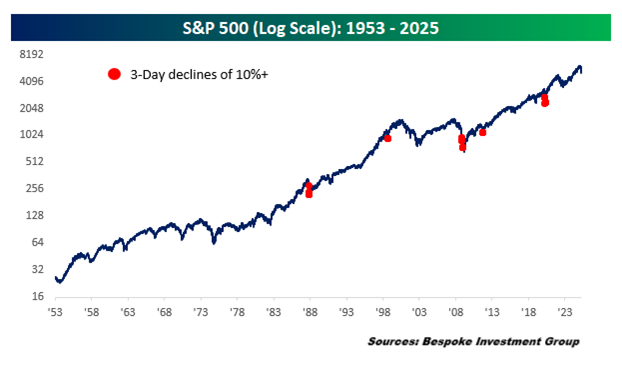

According to Bespoke Investment Group, the market’s three-day plunge from April 3 to April 7 was one of the worst since late 1952, comparable to the declines seen during the COVID-19 pandemic and the 2008 financial crisis. The only three-day decline that surpassed it occurred during the crash of 1987.

The drastic market reaction was fueled by President Trump’s recent “Liberation Day” tariff announcement, which sent ripples through Wall Street. Despite this tumult, the administration has set several strategic objectives regarding the tariffs, which I will review briefly. Furthermore, I’ll highlight three signs of recovery that may emerge from this volatile environment, along with what investors should monitor going forward, as these developments could significantly impact portfolios.

Negotiating Equally: The First Objective

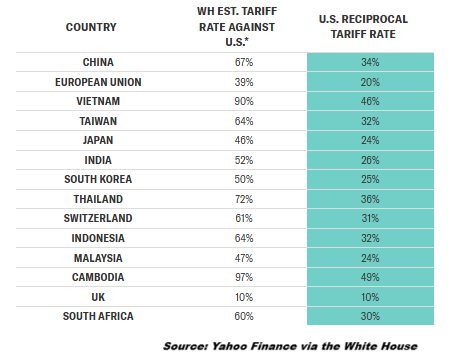

The reciprocal tariffs introduced by Trump serve primarily as a negotiating tool. A detailed comparison of U.S. tariffs and those imposed by other nations reveals clear trade imbalances. In fact, some of the new tariffs are still less than what other countries impose on U.S. goods.

In a surprising move, Trump imposed a minimum of 10% tariffs on all trading partners, applying even larger tariffs to those with persistent trade deficits. For example, China faced a 34% tariff, while Vietnam’s tariff was set at 46%. Despite worldwide backlash, many nations, including the EU, the UK, Switzerland, and Singapore, have shown a willingness to engage in negotiations rather than retaliate with their own tariffs.

Encouraging Onshoring: The Second Objective

On April 3, the enforcement of a 25% tariff on U.S. auto imports prompted significant responses from manufacturers. Companies are starting to invest in onshoring operations, aligning with Trump’s vision. Earlier in March, Hyundai announced plans to invest approximately $21 billion in U.S. projects, including a $5.8 billion steel plant. Similarly, Mercedes-Benz and Volvo are considering increasing their manufacturing presence in the U.S.

Increasing Revenue: The Third Objective

White House aide Peter Navarro recently suggested that the new tariffs could generate $6 trillion in revenue for the U.S. over the next decade, excluding vehicle tariffs, which are poised to generate an additional $100 billion per year. The administration appears committed to a blanket 10% tariff, akin to a value-added tax (VAT), to help address the deficit. While gaining political support for a VAT has been challenging, the administration is pursuing tariff options to stimulate revenue.

The potential increase in onshoring may also bolster revenue, allowing for future income tax reductions if corporate investment increases within the U.S.

Signs of Recovery: Three Emerging Green Shoots

Despite Wall Street’s continued apprehension about the tariff landscape, there are early indications of resilience. Here are three key developments:

1. Limited Retaliation: China’s Response

China is currently the only nation to respond with retaliatory tariffs, initiating a series of counter-tariffs in response to Trump’s measures. Following the announcement of a 34% tariff on Chinese goods, China reciprocated with its own 34% tariff. The Trump administration subsequently escalated the situation with an additional 50% tariff on Chinese goods, raising the total to 104%. Other nations, however, have shown a readiness to negotiate, with over 50 countries expressing interest in reducing their tariffs in discussions with the White House, suggesting potential progress in trade relations.

2. Declining Treasury Yields: Economic Implications

The 10-year Treasury yield dropped to 3.9% on Friday from 4.37% in late March and 4.79% earlier in the year. This decline is significant as it reduces government borrowing costs and makes financing cheaper for consumers and businesses alike. Importantly, the Federal Reserve typically does not counteract market rates, and a continued decrease in Treasury yields could prompt the central bank to lower key interest rates multiple times this year, potentially benefiting the broader economy.

Investors should stay vigilant and on the lookout for how these developments may unfold, as they hold substantial implications for the market and portfolio performance.

Market Volatility and Rate Cuts: A Look Ahead

Recent developments suggest significant changes may occur in the financial landscape. There’s speculation that the Federal Reserve could implement at least four rate cuts this year, a view shared by many in the market. After last week’s tariff announcement raised concerns about slowing global growth, investors briefly anticipated five 0.25% cuts. This shift reflects a growing uncertainty surrounding economic conditions.

Trends in Energy and Housing Markets

Falling energy prices, egg prices, and mortgage rates signal potential recovery. Crude oil prices have reached their lowest levels in three years, with Brent crude at around $62 per barrel and West Texas Intermediate at approximately $59 per barrel. Additionally, wholesale egg prices have dropped by 43% since January. The 30-year fixed mortgage rates have also decreased by 20 basis points in the past week, possibly reigniting activity in the housing market.

Although these changes may not appear immediately in upcoming inflation reports—set to release later this week—subsequent data could reveal a more favorable economic environment. Such trends might bolster the Fed’s confidence in pursuing rate cuts.

Market Reactions and Future Projections

Overall, the stock market’s response to the Trump 2.0 tariffs has been tough for investors to navigate. Recent sell-offs were substantial, marked by high trading volumes. This could suggest a potential market reversal, as seen in today’s trading session. However, it’s likely that the market will need to revisit its recent lows, leading to ongoing volatility in the short term.

Volatility may decrease as trading volume settles over the coming weeks. Positive news regarding tariffs or the Federal Reserve cutting interest rates could act as catalysts, encouraging investment back into the market.

However, it’s crucial to understand that the troubles stemming from President Trump’s tariffs may only be scratching the surface.

A significant financial shift could be on the horizon.

This emerging tech threat poses risks that could significantly impact many Americans’ financial well-being but may also create opportunities for a select few. It threatens to exacerbate income inequality, altering the relationship between corporate entities, their employees, and government action.

The implications for your investment portfolio and retirement strategy could be profound. Therefore, I urge individuals to invest in their knowledge, businesses, and portfolios to navigate this anticipated wave of change successfully.

Click here to access my urgent warning now.

Sincerely,

Louis Navellier

Editor, Market 360