Analysts Predict Gains for ProShares Online Retail ETF Amid Stock Price Evaluation

In our latest analysis at ETF Channel, we evaluated the ETFs within our coverage area. We compared the trading prices of the underlying stocks to the average 12-month forward target prices set by analysts. For the ProShares Online Retail ETF (Symbol: ONLN), we determined that the implied analyst target price based on its holdings stands at $53.18 per unit.

Current Pricing Insights and Potential Upside

As ONLN currently trades around $45.07 per unit, this suggests that analysts anticipate a 17.99% upside based on the expected performance of the ETF’s holdings. Notable stocks within the ETF include ODDITY Tech Ltd (Symbol: ODD), Wayfair Inc (Symbol: W), and Alibaba Group Holding Ltd (Symbol: BABA), all of which show significant upside potential according to analysts’ targets.

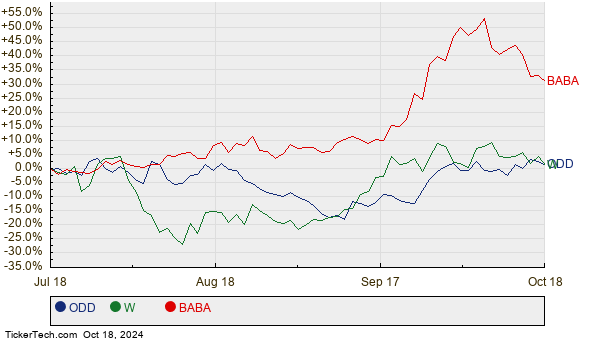

For instance, ODD trades at $40.70 per share, with a target of $52.28, indicating an upside of 28.46%. Wayfair, priced at $52.57, has a target of $64.57, reflecting a potential increase of 22.83%. Meanwhile, Alibaba’s recent price is $100.07, and analysts predict it could reach $118.50, an 18.42% increase. The following chart illustrates the historical price performance of these stocks:

Holding Overview and Analyst Target Summary

Collectively, ODD, W, and BABA account for 10.68% of the ProShares Online Retail ETF. The summary table below outlines the current analyst target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ProShares Online Retail ETF | ONLN | $45.07 | $53.18 | 17.99% |

| ODDITY Tech Ltd | ODD | $40.70 | $52.28 | 28.46% |

| Wayfair Inc | W | $52.57 | $64.57 | 22.83% |

| Alibaba Group Holding Ltd | BABA | $100.07 | $118.50 | 18.42% |

Considering Analyst Targets: Optimism or Reality?

Should investors trust these optimistic targets, or are analysts too hopeful about future stock prices over the next year? It’s essential to understand whether these forecasts are grounded in recent developments or outdated assumptions. High target prices can reflect positive sentiment, but they may also hint at potential downgrades if expectations prove unrealistic. Further exploration is necessary for investors to navigate these nuanced insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding ILPT

• Camden Property Trust MACD

• Funds Holding FEBO

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.