Analysts Project Significant Upside for IWX and Key Holdings

At ETF Channel, we analyzed the underlying holdings of various ETFs in our coverage universe. We compared the trading price of each holding with the average analyst 12-month forward target price. As for the iShares Russell Top 200 Value ETF (Symbol: IWX), our calculations indicate an implied analyst target price of $93.77 per unit based on its components.

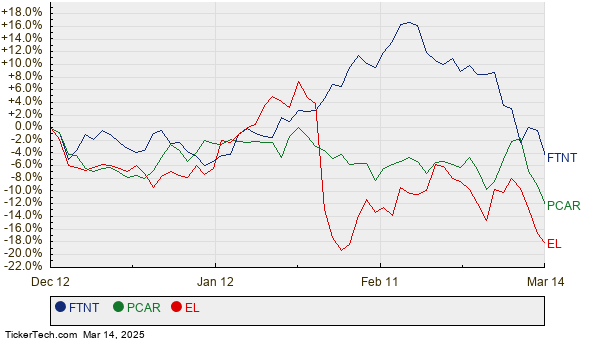

Currently, IWX is trading around $79.79 per unit. This suggests that analysts anticipate a 17.52% upside based on the average target prices of the ETF’s underlying holdings. Notably, three of IWX’s holdings show significant potential for price appreciation: Fortinet Inc (Symbol: FTNT), PACCAR Inc. (Symbol: PCAR), and Estee Lauder Cos., Inc. (Symbol: EL). FTNT, trading at $93.42 per share, has an analyst target of $114.47 per share, reflecting a potential upside of 22.53%. Similarly, PCAR, with a recent price of $98.42, could rise 20.68% if it meets its target price of $118.78 per share. Estee Lauder has a target of $76.68, implying an 18.22% increase from its current price of $64.86. Below is a twelve-month price history chart showing the performance of FTNT, PCAR, and EL:

The table below summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell Top 200 Value ETF | IWX | $79.79 | $93.77 | 17.52% |

| Fortinet Inc | FTNT | $93.42 | $114.47 | 22.53% |

| PACCAR Inc. | PCAR | $98.42 | $118.78 | 20.68% |

| Estee Lauder Cos., Inc. | EL | $64.86 | $76.68 | 18.22% |

Are analysts justified in these target prices, or are they perhaps overly optimistic about future trading levels? It’s essential to consider whether analysts have valid reasoning for their projections, especially in light of recent company and market developments. A high target price can signal optimism but may also lead to future downgrades if it turns out to be based on outdated expectations. Investors should conduct further research to navigate these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

GGAA market cap history

Institutional Holders of NLSP

PEO Split History

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.