Vanguard S&P Small-Cap 600 Growth ETF Shows Potential for Growth with 14% Upside

By analyzing the underlying stocks within the Vanguard S&P Small-Cap 600 Growth ETF (Symbol: VIOG), we’ve identified a promising average analyst target price and the implications for investors.

Implied Target Price Offers Encouraging Outlook

The current implied analyst target price for VIOG stands at $135.64 per unit. This projection suggests that the ETF could increase significantly from its recent trading price of $118.93 per unit, indicating a potential upside of 14.05% according to analyst forecasts. Noteworthy among its holdings are Dynavax Technologies Corp (Symbol: DVAX), Xencor, Inc (Symbol: XNCR), and Schrodinger Inc (Symbol: SDGR), all showing substantial upside potential.

Individual Stock Insights

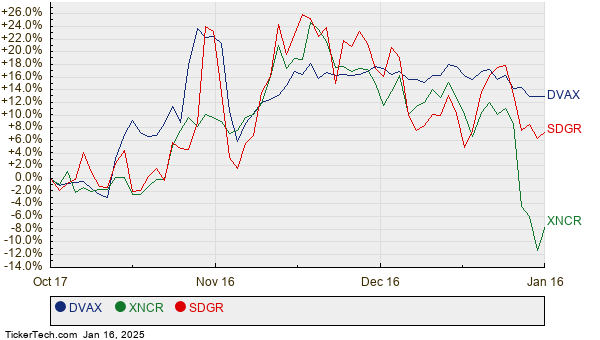

Dynavax Technologies Corp (DVAX) is currently priced at $12.48 per share, yet analysts anticipate a target of $24.50, reflecting an impressive 96.31% upside. Furthermore, analyzing Xencor, Inc (XNCR), which trades at $20.05, presents a target price of $35.17, signifying a possible 75.39% increase. Meanwhile, Schrodinger Inc (SDGR) has a recent price of $19.30, with analysts eyeing a target of $31.82—a 64.86% growth potential. Below is a chart depicting the recent stock performance of these three companies:

Summary of Analyst Targets

Here’s a table summarizing the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Small-Cap 600 Growth ETF | VIOG | $118.93 | $135.64 | 14.05% |

| Dynavax Technologies Corp | DVAX | $12.48 | $24.50 | 96.31% |

| Xencor, Inc | XNCR | $20.05 | $35.17 | 75.39% |

| Schrodinger Inc | SDGR | $19.30 | $31.82 | 64.86% |

Analyzing Analyst Optimism

Given these potential price increases, a key question arises: Are analysts too optimistic about these targets? Understanding the rationale behind these forecasts is crucial as high targets can indicate predictions of future success, but they may also lead to downward adjustments if market conditions change. Investors are advised to conduct thorough research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• DAY DMA

• APAC YTD Return

• Top Ten Hedge Funds Holding ELYS

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.