Potential Upside for Materials Select Sector SPDR Fund ETF (XLB)

Recent analysis reveals that analysts foresee a positive trend for the Materials Select Sector SPDR Fund ETF, projecting a significant upside based on its underlying holdings.

According to a recent assessment from ETF Channel, the implied analyst target price for the Materials Select Sector SPDR Fund ETF (Symbol: XLB) stands at $104.81 per unit. Currently, XLB is trading around $94.47 per unit, which indicates that analysts expect a rise of 10.94% for the ETF, based on the average targets for its underlying holdings. Notably, three key holdings within XLB show promising potential: International Flavors & Fragrances Inc. (Symbol: IFF), Eastman Chemical Co. (Symbol: EMN), and Smurfit Westrock plc (Symbol: SW).

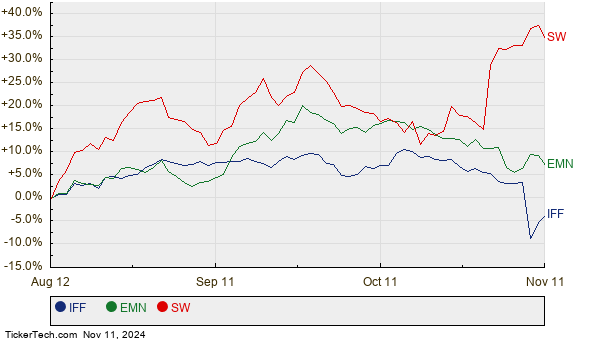

For instance, IFF’s recent trading price of $92.28 per share is significantly lower than its target price of $105.21/share, suggesting an upside of 14.01%. Similarly, EMN is trading at $101.47, with a target suggestive of a 13.62% upside to $115.29. Meanwhile, SW is currently priced at $52.39 and has a target of $58.73, indicating a potential increase of 12.10%. Below is a twelve-month price history chart comparing the stock performance of IFF, EMN, and SW:

Together, IFF, EMN, and SW constitute 6.30% of the Materials Select Sector SPDR Fund ETF. The following table summarizes the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| The Materials Select Sector SPDR Fund ETF | XLB | $94.47 | $104.81 | 10.94% |

| International Flavors & Fragrances Inc. | IFF | $92.28 | $105.21 | 14.01% |

| Eastman Chemical Co. | EMN | $101.47 | $115.29 | 13.62% |

| Smurfit Westrock plc | SW | $52.39 | $58.73 | 12.10% |

These targets raise essential questions. Are analysts being realistic, or are they too optimistic about these stocks’ future performance? Understanding whether these projections are based on solid reasoning or outdated assumptions about the companies and industry trends requires thorough research from potential investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• RIOT Historical Stock Prices

• SOHOO Historical Stock Prices

• ETFs Holding AWI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.