Analysts See Room for Growth in iShares ESG MSCI KLD 400 ETF

In a recent analysis from ETF Channel, a comparative review of underlying holdings in various ETFs was conducted. For the iShares ESG MSCI KLD 400 ETF (Symbol: DSI), the weighted average implied analyst target price is calculated to be $123.49 per unit based on its holdings.

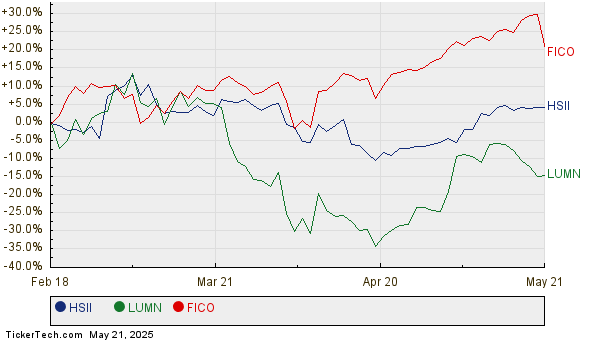

As DSI currently trades around $111.23 per unit, analysts predict an 11.02% upside, indicating positive growth potential based on average target prices. Among the notable underlying holdings poised for gains are Heidrick & Struggles International, Inc. (Symbol: HSII), Lumen Technologies Inc (Symbol: LUMN), and Fair Isaac Corp (Symbol: FICO). At a recent price of $43.19 per share, HSII has an average target price of $50.67 per share, suggesting a potential upside of 17.31%. Similarly, LUMN’s recent price of $3.99 indicates a 13.46% upside to its average target of $4.53. FICO shows a target of $2281.28 per share, reflecting an expected growth of 12.54% from its recent price of $2027.00. The following chart illustrates the twelve-month price history for HSII, LUMN, and FICO:

Below is a summary table highlighting the analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares ESG MSCI KLD 400 ETF | DSI | $111.23 | $123.49 | 11.02% |

| Heidrick & Struggles International, Inc. | HSII | $43.19 | $50.67 | 17.31% |

| Lumen Technologies Inc | LUMN | $3.99 | $4.53 | 13.46% |

| Fair Isaac Corp | FICO | $2027.00 | $2281.28 | 12.54% |

The outlook suggests analysts are optimistic about these projections. However, investors should critically assess whether these targets are realistic or overly ambitious based on recent company performance and market trends. A high price target may signal positive expectations, yet it could also hint at potential downgrades if the underlying performance falls short. Continued investor research is essential in evaluating these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Related Information:

• GCV Dividend History

• GBF Shares Outstanding History

• Funds Holding KYTX

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.