Analysts Project Strong Upside for SPDR S&P Global Natural Resources ETF

In our analysis of the ETFs at ETF Channel, we compared the trading price of each underlying holding against its average analyst 12-month forward target price. For the SPDR S&P Global Natural Resources ETF (Symbol: GNR), the implied analyst target price based on its holdings is $59.99 per unit.

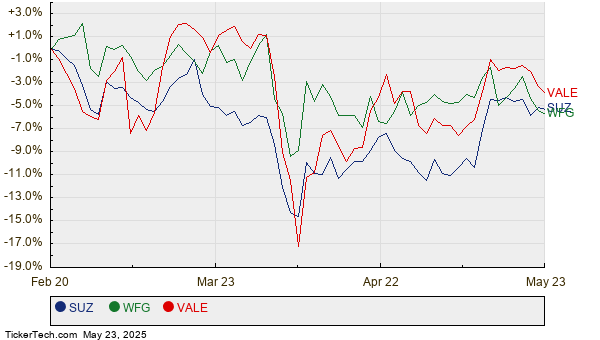

With GNR trading recently at around $52.99 per unit, this indicates a potential upside of 13.21% according to analyst targets for the ETF. Notably, three holdings in GNR exhibit significant upside potential: Suzano SA (Symbol: SUZ), West Fraser Timber Co Ltd (Symbol: WFG), and Vale SA (Symbol: VALE). Currently priced at $9.40/share, SUZ has an average analyst target of $16.00/share, reflecting a potential increase of 70.21%. Similarly, WFG’s recent share price of $73.37 suggests a 37.34% upside towards its target price of $100.76/share. Lastly, VALE, trading at $9.58, has a target price of $12.60/share, equating to a potential increase of 31.57%. Below is a twelve-month price history chart that compares the stock performance of SUZ, WFG, and VALE:

The table below summarizes the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P Global Natural Resources ETF | GNR | $52.99 | $59.99 | 13.21% |

| Suzano SA | SUZ | $9.40 | $16.00 | 70.21% |

| West Fraser Timber Co Ltd | WFG | $73.37 | $100.76 | 37.34% |

| Vale SA | VALE | $9.58 | $12.60 | 31.57% |

These targets raise important questions for investors. Are analysts justified in their optimistic projections, or might they be overly ambitious? Given recent developments within the companies and the broader industry, analysts’ price targets may need closer scrutiny. A high target relative to a stock’s current trading price could indicate optimistic forecasts but could also precede potential downgrades if those targets seem outdated.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Stocks Held By Victor Mashaal

• SOXQ market cap history

• Institutional Holders of QVMM

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.