September Inflation Report: Insights and Implications for Investors

This morning, we received the September Consumer Price Index (CPI) figures, showing a seasonally adjusted increase of 0.2% for the month and 2.4% for the year. Both of these numbers were 0.1 percentage point higher than what the Dow Jones consensus predicted.

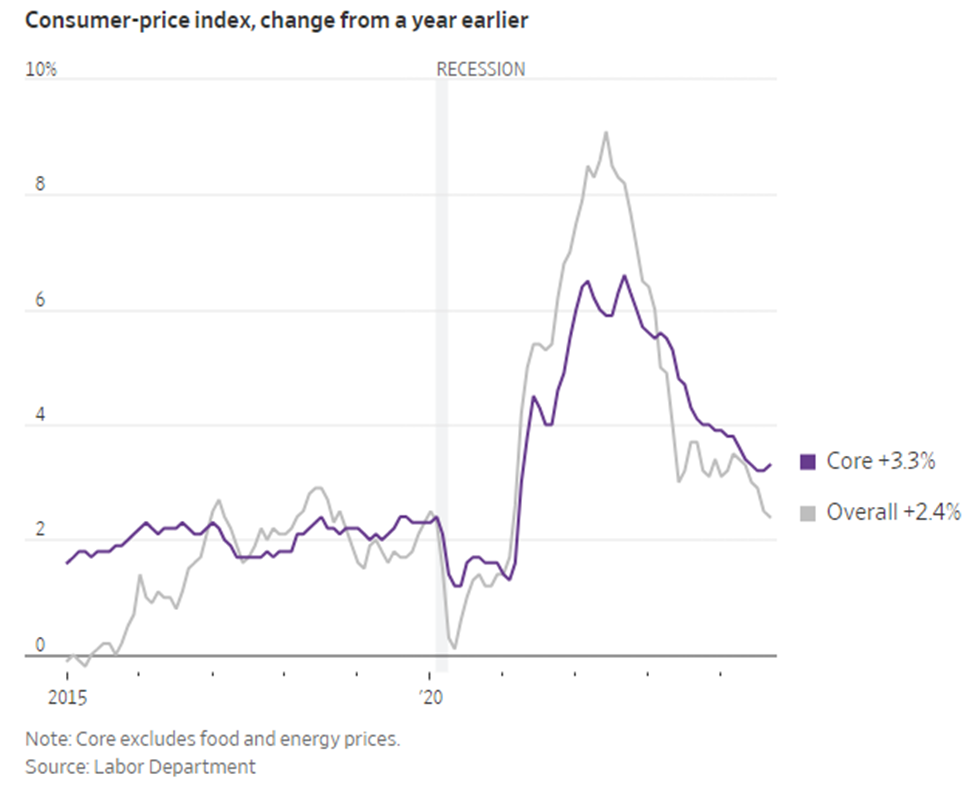

Core CPI, which excludes food and energy prices and is especially significant to the Fed, rose by 0.3% month-over-month and 3.3% year-over-year. These figures also surpassed estimates.

Interestingly, initial unemployment benefit claims saw an unexpected rise, reaching 258,000—the highest level since August 5, 2023.

What does this mean for investors? While the report is not alarming, it doesn’t provide much comfort either.

A glance at a chart from The Wall Street Journal reveals a mixed picture: headline inflation, depicted in gray, continues to fall towards the Fed’s 2% target. In contrast, core inflation, shown in purple, has made a noticeable upward turn.

Source: WSJ

It is crucial to maintain perspective: overall inflation is still on a downward trend. Yet, a single month of increasing core inflation shouldn’t be dismissed lightly.

Inflation may be receding, but it has not disappeared, and Federal Reserve officials are keenly aware of this reality.

Fed Divided Over Rate Adjustments

Yesterday, the Fed released minutes from its September meeting, revealing disagreements over the decision to cut interest rates.

According to CNBC:

Members [were] divided over the economic outlook.

Some officials advocated for a cautious approach, suggesting a smaller quarter-percentage-point cut as they sought confidence that inflation was dropping sustainably.

Notably, only one Federal Open Market Committee member, Governor Michelle Bowman, opposed the larger half-point reduction.

The minutes hinted that others shared her preference for a smaller cut.

This internal conflict helps explain the mixed signals from Fed members. In a statement from September, Federal Reserve Chairman Jerome Powell noted:

As inflation has declined and the labor market has cooled, the upside risks to inflation have diminished, and the downside risks to employment have increased.

Contrastingly, Richmond Federal Reserve President Thomas Barkin recently expressed:

I’m more concerned about inflation than I am about the labor market… I do think getting stuck is a very real risk.

These statements showcase the varying perspectives within the Fed.

Furthermore, Bowman mentioned two weeks ago:

Core inflation remains uncomfortably above our 2% target… I cannot rule out the risk that progress on inflation could continue to stall.

As investors, we must prepare for the possibility of stalling inflation.

The latest CPI figures urge us to stay vigilant. Current trends suggest that upward pressure on prices is not over yet. Consider the following factors impacting October:

- Rising oil prices

- Increasing home prices

Anticipating Next Month’s CPI Increases

The main drivers of the overall CPI are housing and transportation costs. Housing accounts for about one-third of the CPI, while transportation, which includes fuel costs, represents roughly 17%.

In October, costs in these sectors are trending upwards.

Regarding fuel expenses, oil prices have been climbing steadily. In September, the average price for West Texas Intermediate Crude was $70.23 per barrel. Currently, in October, the average price rose to $73.63.

Source: StockCharts.com

While this increase may not seem drastic, it does indicate a potential hurdle for inflation’s downward momentum, as noted by Bowman.

Additionally, the geopolitical landscape may further complicate matters. Should Israel strike Iran’s oil production capabilities, we could see a substantial spike in prices.

Shifting focus to housing, higher prices appear likely. Investor Louis Navellier highlighted this trend in his recent publication, Accelerated Profits:

There’s been tremendous demand for mortgages recently, especially since the Federal Reserve cut key interest rates last month.

Mortgage rates have dipped to a two-year low, resulting in a 20% increase in refinancing applications during the week of September 16. Meanwhile, home-buying applications increased by 1% from the previous week and by 2% year-over-year.

All else being equal, increased demand for homes will exert upward pressure on prices.

Real Estate Data from Redfin

As we compile this information, it’s important to examine the median sales prices for homes in Redfin markets, highlighting both week-to-week fluctuations and changes in median home prices over the past year.

Home Prices Stabilize While Inflation Concerns Rise

The Real Estate Market Shows Signs of Change

One key observation from the recent housing market is how the downward trend in median home prices, which persisted from June 10 through September 29, has plateaued at the end of last month. This change likely stems from a wave of new buyers entering the market following the Federal Reserve’s rate cut, suggesting a potential increase in weekly prices for October.

Additionally, a noticeable year-over-year price spike occurred between August 19 and September 29, indicating a likely upward trend in prices for the current month.

Source: Redfin

While the exact impact of these trends on inflation remains uncertain as we head into the next month, it is clear that they will not contribute to a decline in inflation.

The bond market appears to share this concern, leading to a sharp rise in the 10-year yield, which has surged above 4%. As of Thursday, it is trading at 4.10%.

Bonds expert Jim Bianco offers this straightforward explanation:

A reasonable interpretation is the market is “rejecting” the cut, fearing it will overstimulate and spur more inflation.

This morning’s Consumer Price Index (CPI) reading has done little to allay these worries.

Shifting Expectations on Federal Reserve Rate Cuts

The market’s perspective is evolving quickly, with new headlines suggesting that the Federal Reserve may not reduce rates at all in November. Just three weeks ago, traders were confident that a 50-basis-point cut would happen in one of the remaining two meetings of the year, with some even anticipating two such cuts.

Now, a striking 12% of traders believe that there will be no rate cut in November. Furthermore, projections for December indicate that only 13% of traders expect one additional quarter-point cut in 2024.

In an article from Barron’s, titled, “The Fed May Not Cut Rates in November. What to Do With Treasury Bonds Now,” it states:

The best-laid plans often go awry, and that goes even for the Federal Reserve, whose rate-cut intentions were thrown for a loop by a surprisingly strong jobs report…

Historically, the Fed has never embarked on a rate-cutting cycle without implementing at least three consecutive cuts. After the initial rate reduction in September, Wall Street was prepared for a gradual decline, expecting at least a quarter-point cut in November and December. Now, however, traders are reconsidering the urgency of these cuts, contributing to volatile movements in the bond market. Yields on both 10-year and two-year government bonds have climbed above 4%. The current yields on 10-year bonds reach levels not seen since July 31, indicating that market estimates for the fed-funds rate are rising.

Higher terminal rates demand higher long-term yields to mitigate the increased interest rate risk. Additionally, investors are questioning the stability and predictability of the Fed’s policy direction.

Labor Market Dynamics and Their Implications

While there are growing concerns about inflation and bond yields, we should also consider potential shifts in the labor market. Fed President Barkin recently noted:

I’m more concerned about inflation than I am about the labor market… I do think getting stuck is a very real risk.

Given that statement, does it mean the labor market is in good shape? It appeared so last week, as the Dow Jones consensus forecast anticipated 150,000 new jobs. The actual figure was a striking 254,000, which caused the unemployment rate to decline to 4.1% in September.

However, two important details need attention:

First, the impressive job figure was influenced by seasonal adjustments.

MarketWatch elaborates:

Every year since 1997, the private sector has lost jobs in September, with the exception of the pandemic year in 2020.

Typically, young workers leave summer positions to return to school, and educational roles also come back into play. Although adjustments are made for seasonal trends, discrepancies can distort the job growth view. In reality, the private sector lost 458,000 jobs in September before the annual adjustments. In contrast, government employment saw an unadjusted increase of 918,000.

Secondly, it’s crucial to analyze the nature of job growth, focusing on the balance between full-time and part-time employment.

Indeed, there seems to be a trend of moving from full-time jobs to part-time positions. According to The Kobeissi Letter:

The number of people working MULTIPLE jobs in the U.S. hit 8.66 million in September, a new record.

This number surpasses pre-pandemic figures by approximately 300,000 and exceeds the 2008 peak by around 600,000. Additionally, the tally of part-time positions has risen by about 3 million over the last three years, reaching nearly 28.2 million. Alarmingly, full-time employment has dropped by 1 million since November 2023. This trend indicates many Americans are resorting to multiple jobs to cope with soaring living costs.

Record Number of Americans Hold Multiple Jobs as Economy Faces Uncertainty

Workers from coast to coast are juggling more than one job, setting a new record and highlighting both opportunities and challenges in today’s economy.

Will we face rising inflation alongside a strong labor force?

Could we see lower inflation at the expense of workforce stability?

Or will we find ourselves in a balanced growth environment with manageable inflation?

Although many hope for the last scenario, the data remains unclear.

Despite Uncertainty, the Bull Market Holds Strong

Contrary to what might be expected, the current market conditions show that we are not abandoning this bull market. Recent data indicates that we are amidst one of the most robust bull markets in decades. In fact, the S&P is experiencing its strongest year-to-date performance of the 21st century.

Source: The Daily Shot

Ultimately, performance is what guides our investment decisions. In 2024, investors are pushing prices upward, and it’s critical for us to take advantage of this trend.

However, it’s essential to remain vigilant about potential economic pitfalls. Successful investors prioritize preparing for risks over merely chasing profits. It’s a wise approach to strategy that could protect us during unexpected downturns.

Thus, it’s crucial to manage your stop-loss orders, practice smart position sizing, and maintain a diverse, non-correlated portfolio. Staying in the market for as long as possible can also prove beneficial as this bull market continues.

Don’t Miss Out on Key Insights for the Future of Transportation

This evening, Tesla will unveil its latest innovation at the “We, Robot” event, introducing its first dedicated robotaxi, known as the “Cybercab.”

Our expert, Luke Lango, has conducted extensive research on the transformative impact of this technology. Earlier this week, he shared these insights during a live event.

Should self-driving vehicles succeed, stocks in the autonomous vehicle sector may experience significant growth in the years ahead.

On Monday, I detailed how developments in the autonomous vehicle market, particularly the upcoming robotaxi launch, are set to change transportation, improve safety, and potentially generate substantial passive income opportunities.

Some projections suggest this robotaxi initiative could unlock $9 trillion in value, surpassing even the combined worth of all of Elon Musk’s companies.

While there has been skepticism regarding Elon Musk’s promises for self-driving technology, I believe a small $3 company could play a pivotal role in realizing this vision.

Today is the final day to access Luke’s research on the autonomous vehicle sector. If you’re interested in his strategic guide for investing in this developing field, be sure to check it out before it’s no longer available.

Have a great evening,

Jeff Remsburg