United Natural Foods, Inc. UNFI exemplified its focus on growth with its latest move. The company unveiled that it has extended its wholesale grocery distribution partnership with Whole Foods Market by inking an eight-year extension deal.

This new agreement, which makes United Natural Whole Foods Market’s (an affiliate of Amazon.com) primary distributor, extends the partnership until May 2032, replacing the previous deal terms.

UNFI remains enthusiastic about its long-standing partnership with Whole Foods Market, through which it can offer high-quality foods and other valuable items to consumers nationwide. The company remains dedicated to supporting Whole Foods Market and working together to cater to customers’ evolving demands. Meanwhile, Whole Foods Market remains committed to enhancing its ties with United Natural, which plays a vital role in its supply chain.

United Natural Treads Growth Path

United Natural is on track with its comprehensive transformation journey that involves several strategic elements. As part of this process, the company is rapidly implementing near-term value-creation initiatives that are expected to contribute significantly to its operating efficiencies. In this regard, the company has actioned $150 million in run-rate savings.

These initiatives are not just about immediate gains but serve as a foundation for the company’s long-term transformation goals, providing a robust platform for future growth and efficiency. A key aspect of the company’s transformation strategy is the focus on maintaining operational and transformation momentum. This is crucial for sustaining long-term value creation for stakeholders, including customers, suppliers and shareholders.

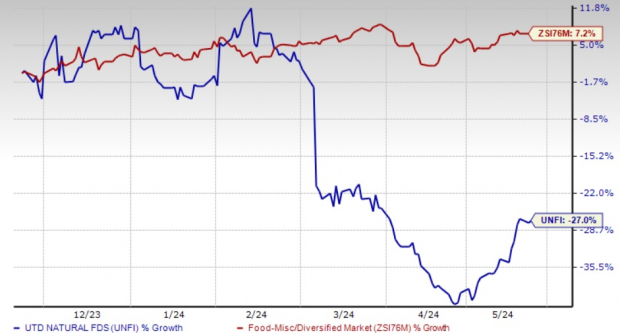

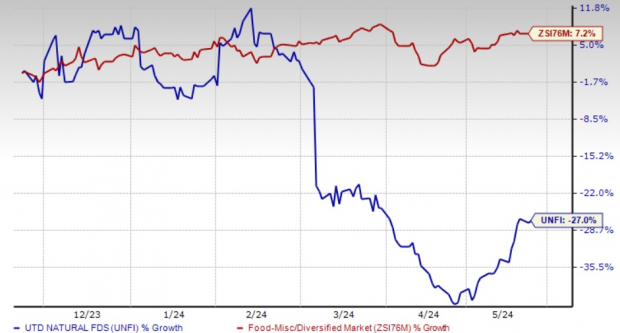

Image Source: Zacks Investment Research

Moving on, UNFI expects to incur nearly $400 million in capital and cloud implementation, which includes investments in transformation plans, with significant spending on network optimization and automation. The upgrade in the technology infrastructure is likely to drive higher efficiency. The company is progressing well with its key transformation investments that are likely to increase efficiency and service levels.

United Natural is on track to improve its supply chain processes and management disciplines to fuel growth. In this regard, the company is achieving a major reduction in shrink, which is positively impacting its financial performance and operational efficiency. In the second quarter of fiscal 2024, net shrink as a percentage of sales declined year over year as well as sequentially. Apart from this, the company is improving its commercial go-to-market programs to enhance supplier connections.

Wrapping Up

United Natural’s strategic endeavors, such as the latest extension of the agreement with Whole Foods Market, keep the company well-placed amid a challenging backdrop. Incidentally, consumers are buying less to manage their budgets and shifting away from traditional grocery stores, possibly seeking more affordable options like discount stores, bulk buys or online shopping. On its lastearnings call management highlighted that it anticipates a more prolonged recovery for volume.

Shares of this Zacks Rank #3 (Hold) company have tumbled 27% in the past six months against the industry’s growth of 7.2%.

3 Appetizing Bets

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Ingredion Incorporated INGR, which manufactures and sells sweeteners, starches, nutrition ingredients and biomaterial solutions, currently carries a Zacks Rank #2 (Buy). INGR has a trailing three-quarter earnings surprise of 10.1%, on average.

The Zacks Consensus Estimate for Ingredion Incorporated’s current fiscal year earnings indicates growth of 2.7% from the year-ago reported figure.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks and currently carries a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 24.6% from the year-ago reported numbers.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.