Market Performance Overview

As the closing bell rang, United Rentals (URI) stood tall at $683.61, showcasing a robust +1.19% surge from the day prior. This uptick outshone the S&P 500’s 0.63% daily advancement, surpassing the Dow’s 0.2% climb and the Nasdaq’s 0.82% growth.

Month-on-Month Comparisons

Over the past month, shares of this equipment rental titan have seen a commendable 3.89% surge. While lagging behind the Construction sector’s 5.28% progress, URI has effectively outpaced the S&P 500’s 1.76% upswing.

Projections and Insights

Investors and analysts are eagerly awaiting United Rentals’ upcoming earnings disclosure. Initial estimates put the company’s EPS at $8.35, marking a 5.03% rise from the corresponding quarter last year. Furthermore, revenue predictions stand at $3.41 billion, indicating a healthy 3.9% escalation from the prior year’s equivalent.

Looking ahead, the Zacks Consensus Estimates paint a promising picture with projected earnings of $42.90 per share and revenue of $14.98 billion for the full fiscal year. These estimates signify a positive trajectory, reflecting increases of +5.3% and +4.55%, respectively.

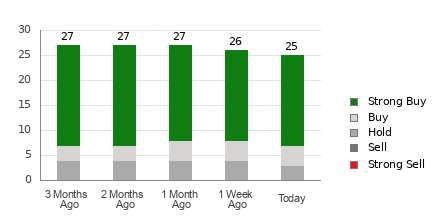

Analyst Estimate Revisions and Zacks Rank

Modifications in analyst estimates can be indicative of shifting business landscapes. Positive adjustments often bode well for a company’s future prospects. These revisions can directly influence short-term share price dynamics, giving investors valuable insights. With a current Zacks Rank of #3 (Hold), United Rentals remains under the Zacks radar for now.

Valuation Metrics and Industry Position

Valuation metrics are crucial for investors, and URI boasts a Forward P/E ratio of 15.75 – a markdown from the industry average of 18.83. Additionally, the stock’s PEG ratio of 2.52 showcases potential growth opportunities surpassing the industry’s metric of 1.81.

Belonging to the Construction sector’s Building Products – Miscellaneous industry, URI finds itself in a robust position with a notable Zacks Industry Rank of 11. This places the industry in the top 5% of all sectors, hinting at a promising outlook.

The Future of Infrastructure and Investment Opportunities

The impending infrastructure overhaul in the U.S. presents a golden opportunity for investors. With trillions set to be allocated for rebuilding, the potential for wealth creation is immense. Identifying stocks poised to benefit from this mammoth undertaking early on could yield substantial gains.

Zacks offers a Special Report to guide investors in identifying key companies positioned to capitalize on the infrastructure boom. The report, available for free, unveils 5 companies set to thrive amidst the construction resurgence.

For the latest stock recommendations and in-depth analysis, Zacks Investment Research remains a trusted resource for investors navigating the markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.