UnitedHealth Group Sees Power Inflow Despite Market Downturn

UnitedHealth Group, Inc. (UNH) experienced a notable Power Inflow today, which highlights significant movements in institutional trading as investors assess order flow analytics. This development is particularly relevant for those focused on tracking where major market players invest.

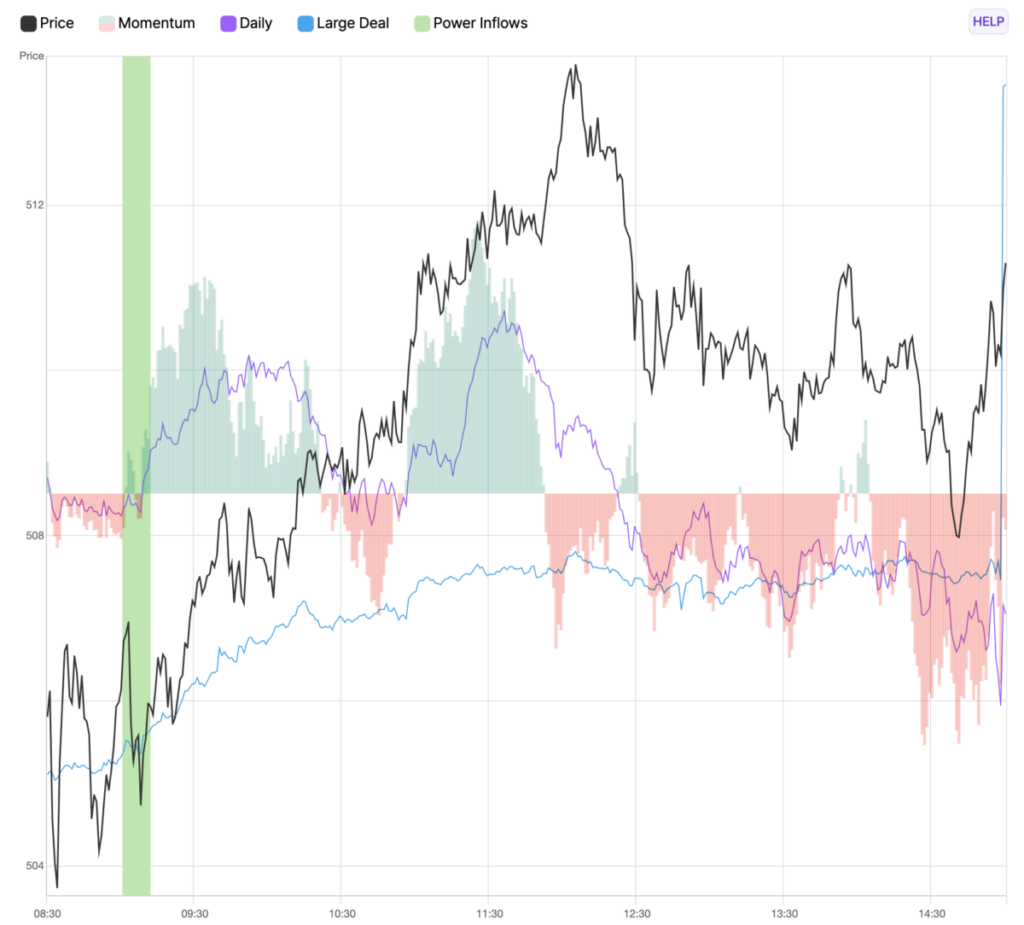

At 10:11 AM on March 20th, UNH exhibited a Power Inflow at a price of $505.54. This trading signal is critical for investors looking for insights into institutional moves—commonly referred to as “smart money.” Traders are recognizing the significance of order flow analytics as a tool for making informed investment decisions. The presence of a Power Inflow suggests a potential uptrend for UNH’s stock, indicating a possible strategic entry point for those anticipating continued gains. Investors are advised to monitor UNH’s stock price closely, interpreting this signal as a bullish indicator.

Understanding the Power Inflow

Order flow analytics, also known as transaction flow analysis, examines the rate of retail and institutional order volumes. This method analyzes the movement of buy and sell orders, considering aspects such as size and timing to derive actionable insights for traders. Active traders typically interpret this specific indicator as a positive sign for market movement.

The Power Inflow usually manifests within the first two hours of the trading session, signaling a trend that reflects the stock’s overall direction influenced by institutional activity for the remainder of the day.

Leveraging Analytics for Trading Success

By integrating order flow analytics into their strategies, market participants can more effectively interpret current market conditions, identify trading opportunities, and enhance their trading performance. However, it’s essential to incorporate robust risk management strategies to safeguard investments and minimize losses. A well-established risk management plan allows traders to navigate market uncertainties strategically, increasing the chances of long-term success.

For those interested in real-time updates regarding options trading for UNH, Benzinga Pro offers instant alerts for options trades.

Market News and Data is provided by Benzinga APIs and includes contributions from various firms, including TradePulse, which offers relevant data featured in this article.

© 2024 Benzinga.com. Note that Benzinga does not offer investment advice. All rights reserved.

After Market Close Update

At the time of the Power Inflow, UNH was valued at $505.54. Following this, the stock peaked at $514.38 and closed at $511.30, yielding returns of 1.8% and 1.2%, respectively. This underscores the importance of a solid trading plan that includes clearly defined Profit Targets and Stop Losses tailored to individual risk tolerance.

Past Performance is Not Indicative of Future Results

Market News and Data brought to you by Benzinga APIs