“`html

UnitedHealth Group Incorporated (UNH) has intensified its lobbying efforts in Washington amid ongoing criminal and civil investigations into its Medicare Advantage business. The company has nearly doubled its lobbying budget in 2023 and is seeking a meeting with President Trump to discuss issues surrounding its operations, while also undergoing changes in its legal team to mitigate regulatory risks.

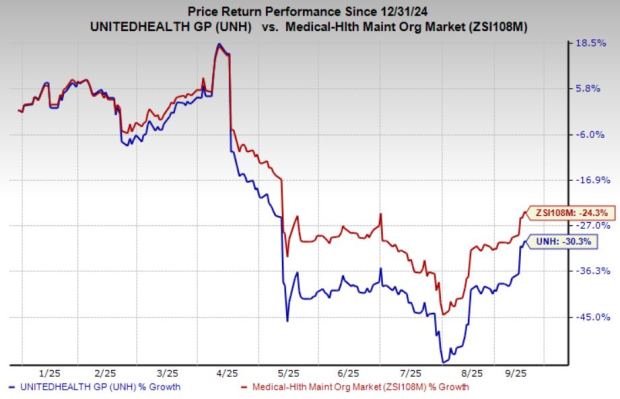

Key developments include a significant investment from Berkshire Hathaway, which purchased over 5 million shares in Q2 2023—valued at approximately $1.57 billion. Meanwhile, UnitedHealth’s year-to-date share price decline has been reduced to 30.3%, compared to an industry average decline of 24.3%.

As of the latest estimates, UnitedHealth’s forward price-to-earnings ratio stands at 20.65, surpassing the industry average of 16.36, with anticipated earnings of $16.21 per share for 2025, indicating a 41.4% drop from the previous year.

“`