Editor’s note: Seeking Alpha is proud to welcome Inevitable Investor as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

The Year That Was

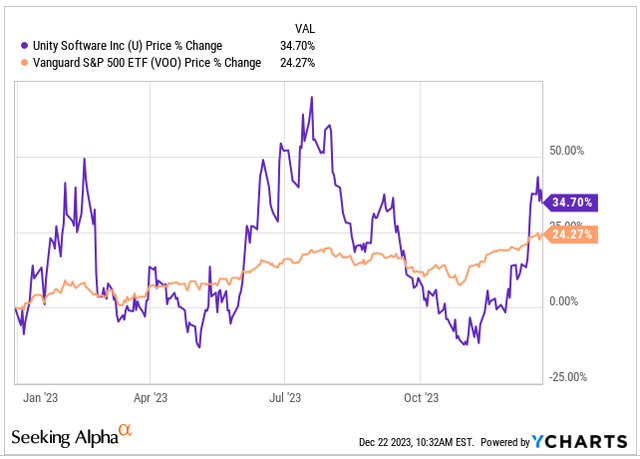

The year 2023 was nothing short of a roller-coaster ride for Unity Software (NYSE:U). While the partnership with Apple (AAPL) for the Apple Vision Pro headset was a high point, the ill-fated pricing structure rollout caused turmoil, with over 1,000 developers threatening to leave the platform. However, amidst the chaos, management upheaval, and a remarkable share rebound, Unity has managed to outpace the S&P 500 by 10% year-to-date.

Despite my longstanding optimism about Unity’s role in the Metaverse and gaming industry, recent signals from management have shaken my faith. Consequently, I view Unity as overvalued and recommend SELL, given the current weak fundamentals in its business.

Unity’s Impact On The Metaverse And Gaming Industry

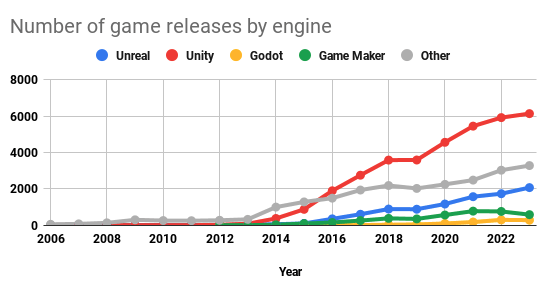

Unity is a leading game engine for creating 2D and 3D games and has been instrumental in developing 53 of the top 100 grossing mobile games. Renowned titles developed using Unity’s game engine include Pokémon Go, Monopoly Go, Call of Duty Mobile, and Fall Guys. With an affordable pricing structure and robust monetisation capabilities, Unity is the go-to solution for aspiring game developers and smaller to mid-sized game companies seeking a scalable and reliable game engine.

My prior bullish stance on Unity was grounded in its competitive advantage in the growing digital creator economy due to high switching costs. The fervent backlash from the developer community against the runtime fee introduction bore testimony to this, demonstrating the substantial switching costs for game developers.

So, despite commanding a dominant market share, a product with high switching costs, and a market projected to grow well into the next decade, why am I now bearish on Unity?

Unveiling The True Picture

During the 3Q earnings call, Unity’s new management withheld guidance for 4Q’23 and deferred giving guidance for 2024. CEO Jim Whitehurst’s remarks during an analyst’s probing hint at potential business winding down or divestment, indicating a shift in the company’s strategy.

Reflecting on the impending changes, he said, “Look, the problem when you are looking to bluntly wind down or get rid of some businesses, which is part of what we’ll do is the longer you wait to do it, the better your revenue looks in the short run. I want zero incentive for anybody here to slow anything down. We need to move, and we need to move fast. And the faster we move, the better shape we are.”

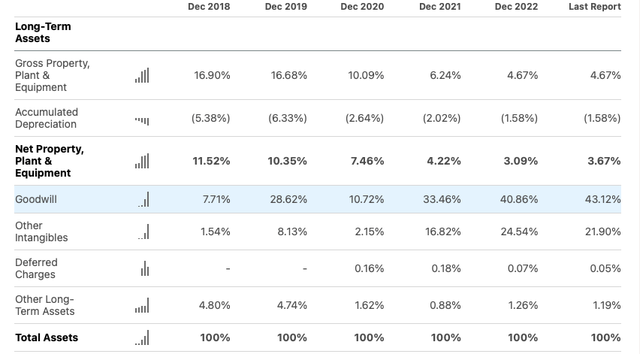

The mention of “wind down or get rid of some businesses” points to Unity’s acquisition spree under the previous CEO, leading to an escalating goodwill of $3.2 billion, now representing 43% of total assets, resulting from acquisitions like Ironsource and Weta Digital. A potential slowdown or divestment in these acquisitions could prompt a significant impairment charge, impacting the company’s financials.

However, proponents of a long-term perspective might argue that a goodwill impairment charge is non-cash, and the focus should be on the company’s revenue outlook and free cash flow.

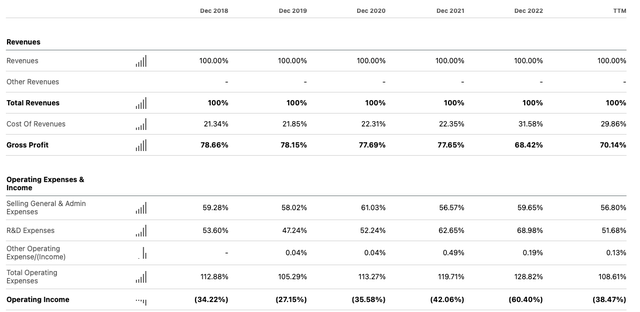

Financials: Evident Weakness In Pricing Power And Profitability

Unity’s gross profit margins, which were approximately 78% at its IPO in 2022, have contracted by 7 percentage points in the last two years, possibly influenced by increased server hosting costs. What’s more concerning is the trajectory of the operating income, which has worsened from -36% at IPO to -38% in the last twelve months, indicating that operating costs have outpaced the 38% revenue growth.

As of January 5th, 2024, Unity Software traded at a forward price-to-sales multiple of 6.6x times, appearing significantly overvalued when juxtaposed with the sector median of 2.9x times, as well as against competitors like AppLovin (APP) at 3.9x times and Take-Two Interactive (TTWO) at 4.9x times.

Unity Software: A Thorn in the Side of Investors

A Closer Look at Revenue Growth

Unity Software, known for its robust growth and rich multiple, has experienced a surge in revenues over the past few years. In December 2019, revenues stood at $380.8 billion, skyrocketing to $1,391.0 billion in the last twelve months (TTM).

Remarkably, this represented a year-over-year growth of 42.29% in December 2019, climbing to 12.24% in the TTM period. The meteoric rise in revenues has been a focal point for investors, as the company carved a path through the competitive gaming and entertainment market.

The Dark Clouds of Uncertainty

However, despite its revenue growth trajectory, there are lingering doubts regarding the sustainability of its current valuation. The strategic shift in the company’s direction has raised concerns about the reliability of the TTM revenue as a credible proxy for 2024.

Furthermore, the absence of operating leverage within its business model has cast a shadow over its rich valuation, leaving many investors questioning the justification for such lofty figures.

The Rollercoaster of Risks

Delving into potential risks, the adoption of the metaverse stands as a significant factor. The utilization of Unity Software in developing games for Meta’s Oculus or Quest headset and the rollout of Apple’s Vision Pro present both opportunities and risks to the investment thesis.

While the success of Apple’s Vision Pro could potentially drive more developers to adopt Polyspatial, the high introductory price point and production complexities pose substantial challenges, potentially dampening the widespread adoption of the metaverse.

Another risk factor centers around the prospect of a potential sale of Unity to a strategic buyer. While this could change sentiment to the upside, regulatory scrutiny over M&A deals raises concerns about the feasibility of such an event.

The Final Verdict

In conclusion, Unity Software’s uncertain future leads to a somber recommendation – a “Sell”. Despite its promise in the gaming and entertainment market, the company’s fundamental issues and need for urgent reformation place it in the penalty box for investors.