Unity Software Stock Shows Potential Amid Market Challenges

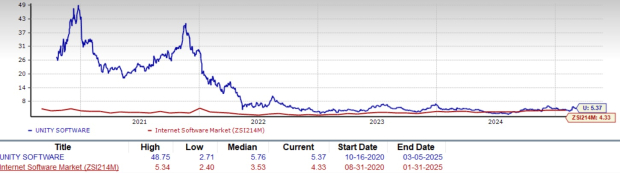

Unity Software U shares have seen a 9.3% decline since the company announced its fourth-quarter 2024 earnings, presenting what may be an appealing opportunity for long-term investors. Over the past year, the Stock has dropped 48.2%, contrasting with a 23.4% return in the Zacks Computer and Technology sector. Despite this negative market reaction, an in-depth examination of Unity’s financial performance and strategic initiatives indicates considerable growth potential ahead.

Understanding 1-Year Performance

Image Source: Zacks Investment Research

Evaluating Q4 Results and Underlying Strength

In its fourth quarter, Unity reported revenues of $457 million, outperforming analyst expectations of $433.47 million. The adjusted EBITDA reached $106 million, which corresponds to a 23% margin and well exceeds the high-end of the forecast. Although total revenues fell by 25% year over year, this was largely attributed to a strategic portfolio reset, with the company’s core strategic portfolio actually growing by 4% compared to the same quarter last year.

The Create Solutions segment demonstrated resilience as subscription revenues increased by 15% year over year. Additionally, revenues from the Industry strategic segment soared by 50%. This growth is notable, especially since it does not yet include the benefits of the recently announced price increases which are expected to take effect gradually through 2025 and 2026.

Under the leadership of new CFO Jarrod Yahes, Unity Software has displayed enhanced financial discipline. In the fourth quarter, free cash flow reached $106 million, showing a 74% increase from $61 million in the prior year. For the year 2024, free cash flow is projected to hit $286 million, marking a 60% rise from 2023.

Unity strengthens its balance sheet with $1.5 billion in cash and has repurchased $415 million of debt. Furthermore, stock-based compensation dilution has dropped from 3% in 2023 to under 2% in 2024, with expectations for further improvement in 2025.

The Zacks Consensus Estimate for U’s 2025 revenues is set at $1.78 billion, indicating a slight year-over-year decline of 1.8%. Loss estimates are centered on $1.22 per share, improving from a loss of $1.68 per share reported the previous year.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Unity Software faces significant competition, primarily from Epic Games’ Unreal Engine, noted for its strength in high-end console and PC gaming. Additionally, it competes with Amazon AMZN-owned Lumberyard (now the Open 3D Engine), as well as open-source alternatives like Godot and graphic-centric CryEngine. In the mobile advertising tech sector, U is up against companies like AppLovin APP and Alphabet GOOGL-owned Google’s AdMob.

Vector: A New Era for Unity’s Advertising Business

Unity Software’s introduction of Vector, its AI-driven advertising platform, signals a important step forward in competitive capabilities. CEO Matt Bromberg noted that Vector will utilize data across Unity’s ecosystem and incorporate self-learning AI models to enhance insights and optimize performance.

This platform enhances targeting accuracy through improved analysis of comprehensive data sets and is capable of real-time adaptation, aiding customers in navigating a competitive mobile marketing landscape. Although the first-quarter guidance reflects caution regarding the transition, Vector positions Unity as a stronger competitor in the digital advertising arena moving forward.

Strategic Partnerships Driving Growth Beyond Gaming

Unity Software is making strides beyond the gaming sector, securing significant wins in automotive and manufacturing industries. Recently, Toyota selected U to enhance its next-generation human-machine interface, improving in-dash user experiences. Likewise, Raytheon has begun utilizing Unity for 3D simulations in facilities planning and factory layouts.

These noteworthy partnerships demonstrate Unity’s adaptability and expanding impact in profitable enterprise markets. The Industry segment, showing remarkable performance, achieved 50% revenue growth year-over-year, making it Unity’s fastest-growing subscription segment.

Why Investors Should Consider Buying U

Trading at a forward P/S ratio of 5.37X, higher than the Zacks Internet – Software industry average of 4.33X, Unity Software still presents an appealing investment prospect.

Unity Software’s P/S F12M Ratio

Image Source: Zacks Investment Research

The Unity 6 platform is quickly gaining traction, with nearly 38% of active users having upgraded and 2.8 million downloads since its launch. This rapid uptake outstrips prior releases and reflects strong customer acceptance after the cancellation of the controversial runtime fee.

Notably, Unity Software remains a dominant force in global game development, powering roughly 70% of the top 1,000 mobile games and 30% of the leading PC games on Steam. This solid market positioning underpins a reliable pathway for revenue growth.

Furthermore, Unity is establishing leadership in emerging technologies such as mixed reality and spatial computing, with seven out of the top 10 AR games of 2024 created using Unity. Its partnership with Google for Android XR support enhances Unity’s foothold in this high-growth segment. As extended reality technologies expand, Unity Software is well-positioned to profit from this market evolution.

The introduction of the Vector platform offers a transformative opportunity, potentially expanding Unity’s share of the digital advertising market. Leveraging its unique data from almost five billion daily active users, Unity can enhance targeting and conversion rates for advertisers, which may lead to significant revenue growth in its Grow Solutions segment.

Conclusion: Short-Term Challenges Could Lead to Long-Term Gains

While short-term volatility might persist as Unity Software adapts to its new advertising platform, robust market positioning, expanding enterprise collaborations, and enhanced financial management establish a strong case for long-term investment. Following the post-earnings decline could represent a strategic entry point for investors interested in future growth potential. Unity Software carries a Zacks Rank #1 (Strong Buy). To explore the complete list of today’s Zacks #1 Rank stocks, you can click here.

Only $1 for Full Access to Zacks’ Recommendations

We mean it.

Several years ago, we surprised members by offering a 30-day access to all our recommendations for just $1, with no strings attached.

Thousands have embraced this chance; others hesitated, suspecting a catch. Yes, we have a reason: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which identified 256 positions with double- and triple-digit gains in 2024 alone.

Interested in the latest picks from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days. Click to receive this free report.

Amazon.com, Inc. (AMZN): Access Free Stock Analysis report.

AppLovin Corporation (APP): Access Free Stock Analysis report.

Alphabet Inc. (GOOGL): Access Free Stock Analysis report.

Unity Software Inc. (U): Access Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.