Investing Smart: Exploring Opportunities with SoundHound AI

For many investors, starting off with a limited budget is the norm. Achieving the goal of becoming a millionaire often demands a gradual approach, allocating a portion of your income after covering everyday expenses. You likely recognize that investing in stocks is one of the most reliable ways to outperform inflation; historically, the S&P 500 yields an average annual return of about 10%.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider today. Learn More »

But what if you could enhance your portfolio with a growth Stock that may outperform the broader market for an extended period? These stocks often entail more risk but come with the potential for significant rewards. One such emerging company is SoundHound AI (NASDAQ: SOUN), which recently experienced a 60% decline from its December peak.

Understanding SoundHound AI

If you haven’t heard of SoundHound, you’re not alone. It doesn’t have the same visibility as major AI players like Nvidia or Microsoft. Currently, SoundHound has a market capitalization of around $3.8 billion, which may seem small in comparison. However, many may have unknowingly used its technology.

This company excels in converting spoken words into actionable digital data. SoundHound enhances the drive-thru ordering experience at fast food restaurants, enables voice commands in vehicles, and transforms homes into smart environments controlled by voice instructions.

Notable partners utilizing SoundHound’s technology include Honda, fast food chain White Castle, and music streaming service Pandora, with new partnerships emerging regularly.

Though voice recognition isn’t new, as it has existed since the 1990s, earlier versions often faced obstacles in reliability. The introduction of advanced language model-based AI has allowed the technology to finally reach its full potential.

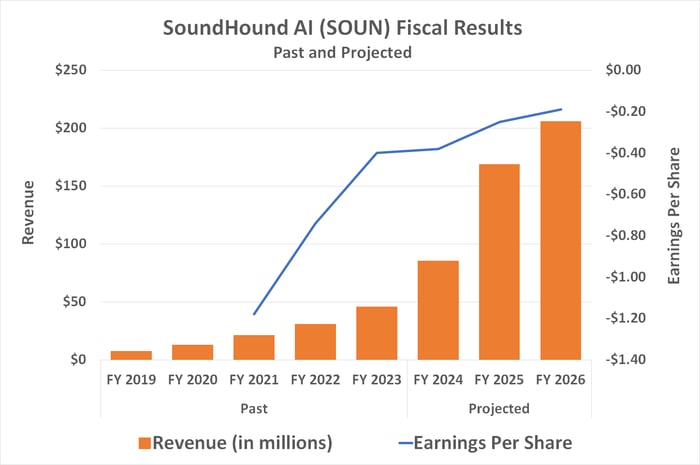

According to Straits Research, the global market for voice and speech recognition technology is set to expand at an average annual growth rate of 17% through 2033. Recently, SoundHound reported a remarkable 85% increase in revenue to $84.7 million in 2024, and it anticipates doubling that figure this year. While growth may stabilize afterward, it will be due to SoundHound’s capacity aligning with demand.

Data source: StockAnalysis.com. Chart by author.

Examining the Recent Stock Decline

Despite SoundHound’s positive growth narrative, its shares have dropped around 60% from a record high in December. To understand this sell-off, one must look back to October last year, when investors first began to take notice of the previously undiscovered company, leading to a significant surge in interest. SoundHound became somewhat of a meme Stock, contributing to a heated rally.

As often happens, this inflated rally eventually collapsed. Additionally, Nvidia’s announcement of selling its SoundHound shares unsettled existing investors. Concerns over the recent earnings report further fueled fears—though it ultimately proved unfounded.

Such stock fluctuations are not uncommon. SoundHound isn’t the first pre-profit tech Stock to see its value soar due to investor enthusiasm, only to plummet when overhyped expectations aren’t met.

The optimism surrounding SoundHound’s future remains intact, however. While volatility may persist, analysis from industry experts shows they are generally bullish on the company, with the consensus rating indicating a ‘buy,’ and none recommending less than a ‘hold.’ The average price target of $14.06 suggests a potential upside of over 50% from current levels.

Preparing for Market Volatility

The fluctuations in SoundHound’s stock price following its latest earnings release create an interesting scenario. Although investors generally prefer entering positions at lower prices, the reality is that this stock might not return to its pre-report levels.

Focusing too much on minute price variations—such as buying at the absolute lowest—may detract from your long-term investment strategy. For those seeking high-growth opportunities, it will matter less where you bought in compared to the company’s future performance. Recent price movements confirm that SoundHound shares will display significant volatility, which was already apparent.

In conclusion, if you’re open to taking on additional risk for a stock with the potential for greater-than-average gains, consider investing in SoundHound AI.

A Second Chance for Investment

If you’ve ever felt that you’ve missed opportunities to invest in top-performing stocks, you may want to pay attention. Occasionally, our team of analysts identifies a “Double Down” Stock that they believe is about to take off. If you think you’ve missed your chance, now could be an ideal time to invest.

For example:

- Nvidia: If you invested $1,000 when we first recommended it in 2009, you would have $323,920!

- Apple: Investing $1,000 when we doubled down in 2008 would yield $45,851!

- Netflix: A $1,000 investment following our recommendation in 2004 would be worth $528,808!

Currently, we are issuing “Double Down” alerts for three remarkable companies, and you may not find another opportunity like this soon.

Continue »

*Stock Advisor returns as of February 28, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.