Consider Selling Puts on Zillow Group for Alternative Strategy

Investors eyeing Zillow Group Inc (Symbol: ZG) shares at the current market price of $62.19 may want to explore alternative strategies, such as selling put options. One noteworthy option is the November put at a $45 strike price, which is currently bid at $2.90. Accepting this premium results in a 6.4% return against the $45 commitment, translating to a 10.7% annualized rate of return, a term we refer to as YieldBoost.

Selling puts differs from owning shares as it does not provide direct access to ZG’s potential appreciation. An investor who sells a put will only acquire shares if the option is exercised. In that case, the buyer would exercise the option at the $45 strike only if it is financially more advantageous compared to selling at the market price. If Zillow Group shares do not decrease by 27.6%, leading to the exercise of the contract, the put seller’s only advantage comes from the premium received, reflecting that 10.7% annualized return.

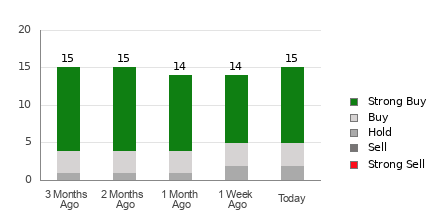

The chart below illustrates Zillow Group’s trailing twelve-month trading history, highlighting the $45 strike location in green:

Integrating the above chart with Zillow Group’s historical volatility and fundamental analysis can help assess whether selling the November put at the $45 strike for a 10.7% annualized rate of return is a favorable trade given the associated risks. An analysis of the last 251 trading days, coupled with today’s price of $62.19, calculates a volatility of 51%. For additional put options ideas with various expirations, check the ZG Stock Options page on StockOptionsChannel.com.

During mid-afternoon trading on Wednesday, put volume among S&P 500 stocks reached 1.15 million contracts, while call volume was 1.43 million, creating a put:call ratio of 0.80. This ratio indicates a higher-than-normal interest in put buying compared to calls, given the long-term median of 0.65. Today’s trading suggests that considerably more traders are purchasing puts than would typically be the case.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

also see:

- Institutional Holders of KTB

- IP DMA

- Institutional Holders of OIBR

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.