Exploring Put Options as an Alternative for Archrock Inc Investors

Investors considering Archrock Inc (Symbol: AROC) may find its current market price of $21.94 per share unappealing. Instead, they might consider an alternative strategy by selling put options. Among various options, the May put contract at the $17.50 strike stands out, currently offering a bid of $0.55. This premium translates to a 3.1% return based on the $17.50 obligation, which annualizes to a notable 32.8% rate of return—coined as the YieldBoost at Stock Options Channel.

However, it’s critical to understand that selling a put does not unlock the same upside potential as owning shares of Archrock. The put seller will only acquire shares if the contract is exercised. The counterparty would only exercise at the $17.50 strike if it leads to a more favorable outcome compared to selling at the current market price. A significant decline of 20.8% in Archrock’s share price would need to occur for the seller to face the contract being executed, resulting in an effective cost basis of $16.95 per share after accounting for the premium received.

Interestingly, the annualized yield of 32.8% from selling the put surpasses Archrock’s 3.5% annualized dividend yield by 29.3%, calculated using the same current share price. If an investor were to purchase shares exclusively for the dividend, they would face increased risk, as the stock price would need to decline by 20.78% to hit the $17.50 strike price.

When evaluating dividends, it’s essential to note that they are not guaranteed and may fluctuate based on the company’s profitability. A review of Archrock Inc’s dividend history chart, provided below, can offer insights into the likelihood of the most recent dividend sustaining over time.

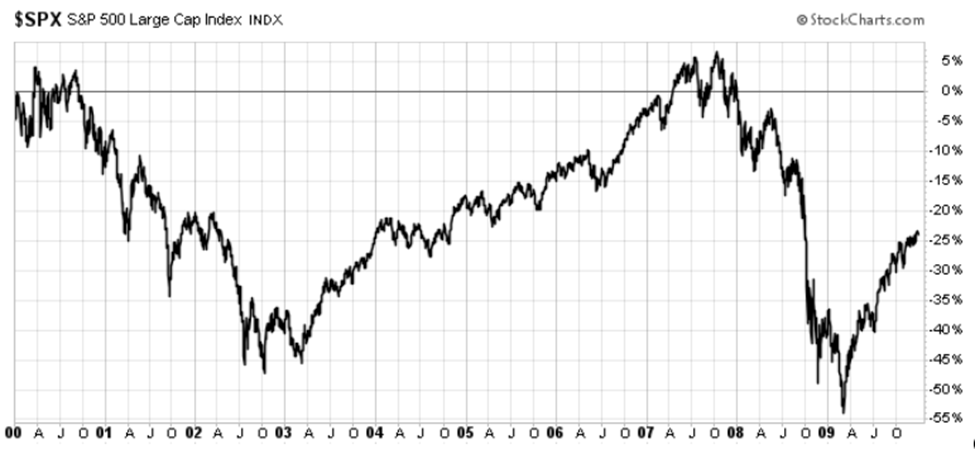

The following chart depicts the trailing twelve-month trading history for Archrock Inc, indicating the $17.50 strike in green relative to its price movements:

This chart, combined with Archrock’s historical volatility, can assist investors in evaluating whether the May put at the $17.50 strike presents a favorable risk-reward scenario for the annualized 32.8% return. The trailing twelve-month volatility for Archrock, considering data from the last 251 trading days along with the current price of $21.94, stands at 44%. For other put options across varying expiration dates, investors can explore the AROC Stock Options page at StockOptionsChannel.com.

During mid-afternoon trading on Friday, the put volume for S&P 500 components reached 1.12 million contracts, matched by call volume, resulting in a put-to-call ratio of 0.74. This figure slightly exceeds the long-term median ratio of 0.65, indicating a higher than expected number of put buyers in the options market today.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

Also See:

- Live Cash Dividend Declarations Feed

- SPSC Videos

- ETFs Holding DWSN

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.