Crypto Surge: Stocks to Capture the Digital Asset Boom

As cryptocurrency markets rally, investors are eager to find avenues for exposure. The recent U.S. elections, notably with President-elect Donald Trump’s supportive view on digital assets, have significantly boosted market sentiment.

Despite their well-known volatility, cryptocurrencies can still be accessed through established stocks like Robinhood Markets (HOOD) and Coinbase (COIN). Both companies are well-positioned to profit from a rising crypto market, as their trading services capitalize on increased activity and fees. Here’s a closer look at each option for potential investors.

Robinhood Reports Significant Crypto Revenue Growth

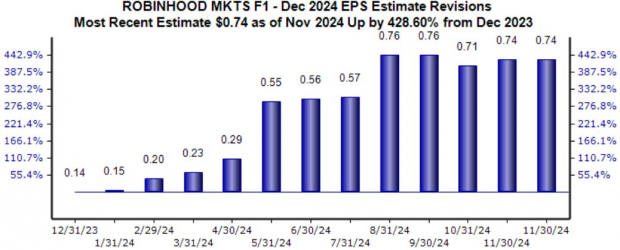

Robinhood’s user-friendly platform allows investors to trade various assets, including cryptocurrencies. Analysts are optimistic about the company’s prospects for the year, with earnings per share (EPS) expected to reach $0.74, marking an impressive 430% increase from last year.

Image Source: Zacks Investment Research

In its latest quarterly report, Robinhood shared encouraging results, although it slightly missed EPS and sales forecasts. The EPS rose to $0.17, with sales totaling $637 million—a 36% year-over-year growth.

This sales figure marks the second-highest total in the company’s history, and the year-to-date net deposits of $34 billion have surpassed previous full-year records. The growth in cryptocurrency revenues is particularly notable, surging 165% year-over-year to $61 million. Furthermore, notional trading volumes in crypto reached $14.4 billion, doubling compared to the previous year.

While recent periods have seen Robinhood struggle to meet expectations, the company is currently rebounding strongly, as illustrated in the following chart.

Image Source: Zacks Investment Research

Coinbase Upholds Positive Market Outlook

As the largest cryptocurrency exchange in the U.S., Coinbase has experienced fluctuating forecasts over the past year, but the outlook remains encouraging. Projections for the current fiscal year indicate earnings may reach $5.39 per share, an astounding 920% increase compared to last year.

Image Source: Zacks Investment Research

Following its recent quarterly results, Coinbase reaffirmed its commitment to supporting favorable crypto policies. The company remarked, “We continue to be a trusted partner to policymakers and organizations like Fairshake, and StandWithCrypto. We are ready to work with any administration and believe the prospects for pro-crypto legislation are improving.”

Coinbase’s transaction revenues have shown mixed results against consensus predictions lately, yet expectations for robust performance are high in the upcoming quarters due to the current active trading landscape.

Image Source: Zacks Investment Research

Final Thoughts

The recent surge in cryptocurrency has captivated investor interest once again, marking a significant run-up over past months. Amid this momentum, both Robinhood Markets (HOOD) and Coinbase (COIN) present viable options for those looking to invest indirectly in cryptocurrency through stocks.

Both firms are positioned to greatly benefit from increased trading volumes, which is expected to be evident in their forthcoming quarterly results.

Trending: Solar Stocks Set for Growth

The solar sector is ready to rebound as industries shift from fossil fuels to renewable energy to support technological advancements, notably in the AI field.

Investment in clean energy is projected to soar into the trillions over the upcoming years, with solar predicted to account for 80% of this growth. This presents lucrative investment opportunities, but choosing the right stocks is crucial.

Explore Zacks’ top solar stock recommendation for free.

Get the latest insights from Zacks Investment Research. Download 5 Stocks Set to Double for free.

Coinbase Global, Inc. (COIN): Receive a free stock analysis report.

Robinhood Markets, Inc. (HOOD): Get a free stock analysis report.

Read this article on Zacks.com for more information.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.