“`html

Unlocking Savings: Navigating Tax Brackets to Keep More of Your Income

Imagine it’s February and you’re looking at your W-2, happy to see higher earnings compared to last year. But then, a voice warns, “You’re in a higher tax bracket. Expect to owe more!” It’s easy to feel uneasy. Have your financial gains turned into a tax burden?

Relax. There’s positive news here. Tax brackets don’t mean your entire income is taxed at that increased rate. Visualize it as stepping up a staircase—only the income in each step gets taxed at the corresponding rate.

This awareness is important. Grasping how tax brackets function will empower you to make better financial choices—whether it involves negotiating your salary, planning your deductions, or knowing when to accept a bonus. Ultimately, this knowledge can help you retain thousands of dollars.

Let’s explore how understanding tax brackets benefits your finances, specifically for 2025.

Understanding Tax Brackets

Think of tax brackets as a series of buckets of different sizes. The first bucket fills with income taxed at the lowest rate. Once it’s full, the next bucket begins filling at a slightly higher rate, and this continues. The takeaway? Only the income that fills each bucket is taxed at its specific rate, and the excess spills into the next bucket.

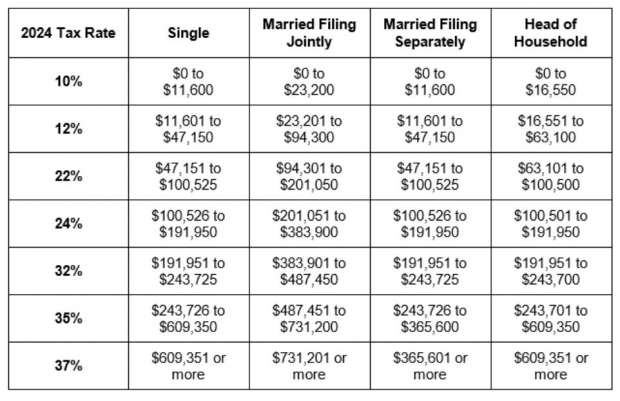

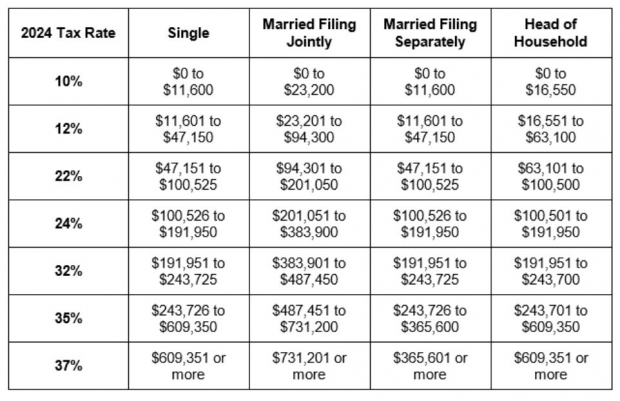

Image Source: Zacks Investment Research

How to Read This Table: These tax rates apply to income earned during 2024. For example, a single filer earning $120,000 will only see income above $100,525 taxed at 24%. If a couple files jointly with $390,000, income exceeding $383,901 will be taxed at 32%.

Now, let’s analyze how a single filer earning $50,000 in 2024 will be taxed:

– The first $11,600 is taxed at 10%, resulting in $1,160 owed.

– The next $35,550 (from $11,601 to $47,150) is taxed at 12%, contributing $4,266 more.

– The final $2,850 (from $47,151 to $50,000) incurs a tax of 22%, adding $627.

Overall, the tax bill equals $6,053. Notice that despite the top bracket being 22%, most income was taxed at lower rates, leading to an effective tax rate—average across all income—around 12.1%.

This illustrates the advantage of our “progressive tax system.” Designed to have higher earners pay a larger percentage on greater income, lower rates still apply to the initial portions of everyone’s earnings. Recognizing this can change your outlook; earning more doesn’t have to feel like a curse—it simply means higher taxes on the additional income.

Now, let’s further clarify the concept with more examples that show the real impact of tax brackets on your take-home pay.

Real-World Scenarios: The Impact of Tax Brackets on Income

For clarity, consider a single filer earning $75,000 in 2024. That amount falls in the 22% tax bracket for single filers.

However, you won’t pay 22% on your whole salary. Here’s how the taxation breaks down:

– First $11,600: Taxed at 10%, leading to $1,160 owed.

– Next $35,550 (from $11,601 to $47,150): Taxed at 12%, adding $4,266.

– Last $27,850 (from $47,151 to $75,000): Taxed at 22%, resulting in $6,127.

Your total federal income tax would be $11,553.

Thus, even though the top bracket is 22%, your effective tax rate would be around 15.4%, showing a favorable tax structure.

Now consider a friend earning $120,000:

– First $11,600: Taxed at 10%, owing $1,160.

– Next $35,550 (from $11,601 to $47,150): Taxed at 12%, adding $4,266.

– Next $53,375 (from $47,151 to $100,525): Taxed at 22%, resulting in $11,742.

– Final $19,475 (from $100,526 to $120,000): Taxed at 24%, adding $4,674.

Altogether, your friend’s tax bill reaches $21,842 with an effective tax rate of 18.2%.

This means that even with a higher income, your friend’s effective tax rate only rises by about 3%. This is the essence of the progressive tax system: while higher earnings bring slightly elevated taxes, most income is still taxed at lower percentages.

Debunking Common Misconceptions About Tax Brackets

While tax brackets may seem simple, many misconceptions cloud understanding. Let’s address some common myths:

1) “If I get a raise, I’ll actually lose money!”

Many believe this, including some financially savvy individuals. The reality? Only the money that enters the higher bracket is taxed at the elevated rate. If a raise pushes part of your income into the next bracket, the remainder remains taxed at lower rates. Overall, your take-home pay still increases.

2) “Tax brackets are for salaried workers only.”

That’s incorrect! Tax brackets apply to all types of income, including hourly wages, self-employment earnings, and investment income. No one escapes these buckets; they ensure fair contributions based on earnings.

3) “Receiving a big bonus will hurt my tax return.”

This myth persists, yet like raises, bonuses can cause a temporary tax spike. However, the progressive system still applies, ensuring most income remains in the lower brackets.

4) “Only the wealthy can lower their taxes.”

Not true. Although the extremely wealthy utilize advanced strategies, there are accessible ways for everyone to reduce taxable income. From contributing to retirement accounts like a 401(k) or IRA to maximizing deductions and credits, minor adjustments can help you keep more. It’s about leveraging the tools at your disposal.

Grasping these concepts can help minimize anxiety during tax season and empower you to make sound financial decisions.

“`

Mastering Tax Brackets: Smart Strategies for Financial Success

Let’s explore how to make tax brackets work in your favor. By debunking common myths, you can implement strategies that keep more of your hard-earned money.

Effective Ways to Reduce Your Tax Liability

Understanding tax brackets opens doors to keeping more money in your pocket. The main goal is to lower your taxable income so you aren’t pushed into higher tax brackets. Here are some practical strategies:

1) Maximize Retirement Contributions for Long-Term Benefits. Contributing to accounts such as a 401(k) or traditional IRA effectively reduces your taxable income. In 2024, you can contribute up to $23,000 to a 401(k), or $30,500 if you are 50 or older. Every dollar saved not only decreases your current tax burden but also promotes future wealth.

2) Utilize Above-the-Line Deductions for Easy Savings. These deductions reduce your taxable income without itemizing. Among the most common are student loan interest (up to $2,500), Health Savings Account (HSA) contributions, and self-employed retirement contributions.

3) Claim Tax Credits for Direct Savings. Unlike deductions, tax credits subtract directly from your tax bill. Valuable options include the Child Tax Credit (up to $2,000 per qualifying child) and the Earned Income Tax Credit, aimed at low- to moderate-income earners.

[Don’t miss out on potential savings. Check out this comprehensive tax guide for details on deductions and credits to help minimize your tax bill.]

4) Contribute to an HSA for Triple Tax Benefits. If you have a high-deductible health plan, contributing to an HSA not only lowers your taxable income but allows for tax-free growth and withdrawal on particular health expenses.

5) Maximize Charitable Donations to Boost Deductions. If you’re close to the standard deduction limit, consider “bunching” donations into one year. This can significantly lower your taxable income while supporting charitable causes.

6) Strategically Time Income and Expenses. If a raise, bonus, or large gain is coming, plan when to receive it to stay in a lower tax bracket. Prepaying deductible expenses like mortgage interest could also help reduce this year’s income.

7) Invest in Tax-Advantaged Accounts. Options like municipal bonds, Roth IRAs, and 529 college savings plans provide tax benefits, allowing you to retain more of your earnings.

By employing these methods, you can significantly minimize the income taxed at higher rates, potentially saving thousands annually. Next, we’ll discuss how these strategies can influence your financial planning for 2025.

Planning Ahead: How Tax Brackets Affect Your Financial Strategy

Understanding tax brackets is not only about saving money; it allows you to make informed decisions to enhance your financial outcome. Here’s how to leverage your knowledge for 2025:

1) Timing Your Income Can Reduce Your Tax Bill. If you are nearing a higher tax bracket, consider delaying income such as a year-end bonus. This tactic helps in maintaining a manageable tax bill.

2) Adjust Withholdings for Improved Cash Flow. Check your W-4 form to ensure you’re not over or under withholding. The right balance prevents giving the IRS an interest-free loan or facing unexpected taxes. Aim for a small yet satisfying refund.

3) Utilize Deductions for Large Planned Expenses. If you’re planning significant expenses, such as home renovations, time these expenses to maximize itemized deductions, especially if you’re near the standard deduction threshold.

4) Monitor Investments to Avoid Higher Taxes. Selling investments may push you into a higher bracket. Consider holding onto investments longer or using tax-loss harvesting to offset gains, but don’t sacrifice good investments for tax reasons.

5) Make Early Contributions to Tax-Advantaged Accounts. Contributions to retirement accounts or HSAs can reduce your taxable income early and accelerate tax-deferred growth. Setting up automatic contributions can be beneficial.

6) Plan Charitable Contributions Carefully. If you anticipate a higher income in 2025, consider donating earlier in the year or establishing a donor-advised fund to maximize tax benefits.

With various tax strategies tailored for different financial situations, it’s crucial to discover what works best for you. While the tips here are useful, consulting with a tax professional can provide tailored insights to maximize your potential savings this tax season. Seeking professional advice may be one of the most astute financial moves you make.

Tax Brackets: Understanding Their Role

Tax brackets often receive a negative reputation, seen as penalties for earning more. However, upon demystifying them, you can appreciate their function within the tax system. They are not obstacles but opportunities to optimize your financial situation.

It’s not solely about maximizing every dollar; it’s about being wise. Properly timing your income, claiming rightful deductions, and setting up a financial strategy for the future are key steps to success.

Ultimately, tax season serves as a moment for reflection, strategic planning, and ensuring you are aligned with your financial goals. Understanding tax brackets offers you valuable insights — straightforward strategies that yield significant rewards.

Expert Strategies for Financial Growth

Would you like more practical tips to thrive in today’s economy? Zacks’ free Money Sense newsletter presents straightforward advice tailored to help you save money, reduce taxes, and create lasting wealth.

With insights ranging from timely investment suggestions to effective budgeting techniques, Money Sense is designed to help you build your wealth wisely. Sign up today without any cost to you!

Get Money Sense absolutely free >>

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.