Unlocking Potential: Why Taiwan Semiconductor Manufacturing Could Be Your Next Smart Investment

Finding a stock that could lead to millionaire status is challenging, but opportunities exist. For instance, a $10,000 investment in Nvidia 10 years ago would be worth approximately $2.72 million today. Similarly, a $10,000 investment in Tesla 12 years back has grown beyond $2 million. Many investors overlooked these stocks for years but those who held on through market fluctuations reaped significant rewards.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

To become a millionaire, it may be more practical to look for investments that can accelerate your journey. By focusing on stocks that consistently outperform the market, you’ll enhance your chances of success. For instance, investing $10,000 with an annual return of 10% (the market average) would take you 48 years to reach a million, while a 15% return could get you there in 33 years. Identifying strong performers can significantly reduce this time frame.

One noteworthy contender for rapid growth is Taiwan Semiconductor Manufacturing (NYSE: TSM). This company stands to benefit greatly from several ongoing technological trends.

Taiwan Semiconductor: A Key Player in Chip Manufacturing

Taiwan Semiconductor is the largest contract chip maker in the world. TSMC’s foundries produce chips for major technology companies such as Apple and Nvidia. The company consistently pushes the boundaries of technology, exemplified by its advanced 3 nanometer (nm) chips, which represent the highest capability chips available today. Looking ahead, its 2nm chips are slated for release in 2025, promising further revenue growth.

Management at Taiwan Semiconductor projects a revenue increase of 15% to 20% compound annual growth rate (CAGR) “over the next several years.” Typically, stocks cannot outpace their sales growth in the long term; thus, this optimistic revenue forecast suggests the potential for significant stock price appreciation.

An additional driver could be the growth of artificial intelligence (AI) revenue. In the second quarter of 2023, TSMC’s management predicted that AI-related revenue could grow at a 50% CAGR for the next five years, potentially contributing a low-teens percentage to total revenue. At that point, AI already accounted for roughly 6% of TSMC’s earnings. However, management’s last earnings call prompted an astonishing revision of these estimates.

According to the latest update, TSMC anticipates that AI revenue will triple in 2024, constituting a mid-teens percentage of total revenue. This swift growth reflects the enthusiasm surrounding AI applications and suggests positive momentum for TSMC’s stock.

Positive Analyst Outlook for TSMC

Currently, Wall Street analysts share a favorable view of TSMC’s future.

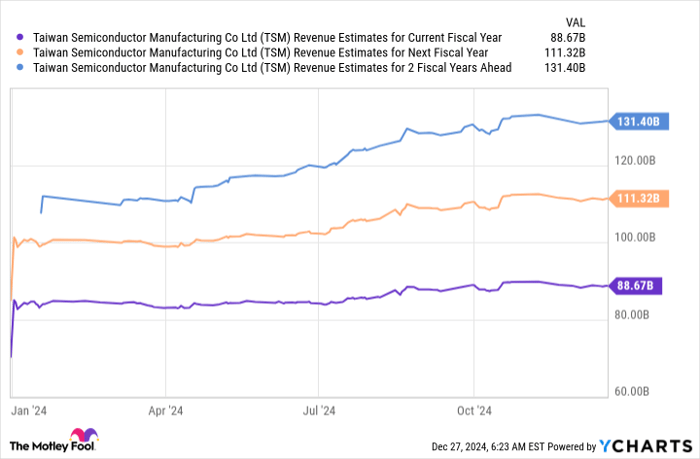

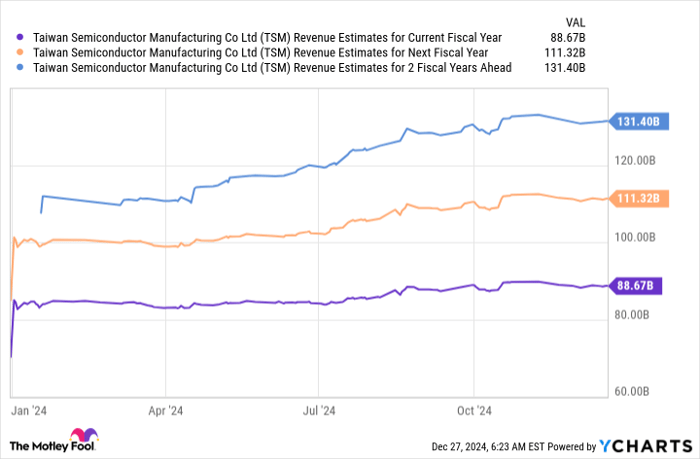

TSM Revenue Estimates for Current Fiscal Year data by YCharts

Forecasts indicate a 26% revenue increase in 2025 and an 18% rise in 2026, substantiating management’s claims and signaling strong potential for stock appreciation in the upcoming years.

Moreover, TSMC’s current stock price remains reasonably valued.

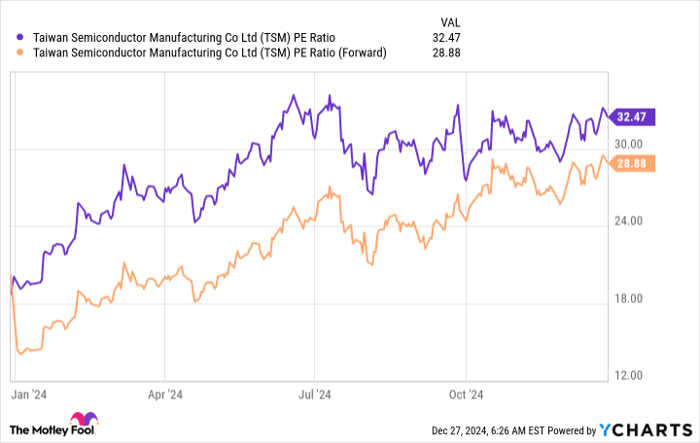

TSM PE Ratio data by YCharts

While TSMC stock was cheaper at the start of 2024, trading at 32.5 times trailing earnings and 28.9 times forward earnings offers good value for a leader in technology. It’s notably cheaper than many high-growth tech giants, including Apple and Microsoft.

Though Taiwan Semiconductor may not instantly make you a millionaire, its growth prospects indicate that it could deliver impressive market-beating returns. Coupled with a robust AI division, TSMC appears poised for an exciting year ahead in 2025.

Is Now the Right Time to Invest $1,000 in Taiwan Semiconductor Manufacturing?

Before considering an investment in Taiwan Semiconductor Manufacturing, it’s vital to evaluate your options:

The Motley Fool Stock Advisor research team recently identified what they consider the 10 best stocks to invest in currently, and Taiwan Semiconductor Manufacturing was not among them. The selected stocks are expected to yield substantial returns in the coming years.

For instance, when Nvidia made this list on April 15, 2005, a $1,000 investment then would be valued at approximately $839,670 today!*

Stock Advisor offers a structured approach to investment, featuring guidance on portfolio construction, periodic analyst updates, and two new stock recommendations each month. This service has outperformed the S&P 500 by more than four times since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Keithen Drury has positions in Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool advises the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.