SPDR S&P 500 ESG ETF Points to Potential Growth, Analysts Predict Upward Movement

Analyzing the SPDR S&P 500 ESG ETF (Symbol: EFIV) reveals promising insights as its underlying holdings show a significant upside based on analyst predictions.

Our analysis at ETF Channel compares each holding’s current trading price with the average 12-month forward target price from analysts. The results indicate that the implied target price for EFIV stands at $62.87 per unit, whereas it is currently priced near $56.83. This situation suggests a potential upside of 10.62% for investors looking at this ETF.

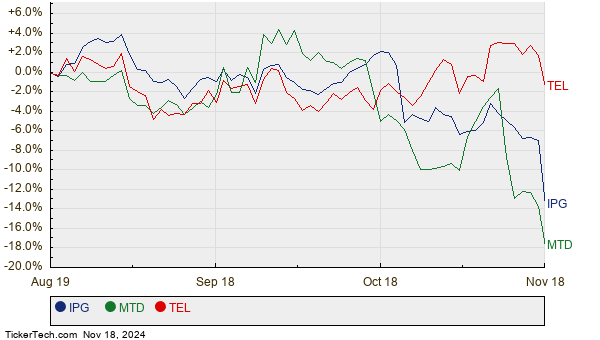

Three notable companies within EFIV are Interpublic Group of Companies Inc. (Symbol: IPG), Mettler-Toledo International, Inc. (Symbol: MTD), and TE Connectivity plc (Symbol: TEL). Each of these securities offers a considerable premium compared to their average analyst target prices. For instance, IPG currently trades at $27.09, but analysts have projected a target price of $30.80, reflecting an upside of 13.70%. MTD’s recent price of $1179.58 indicates an upside of 13.18% towards the average target of $1335.00. Similarly, TEL, priced at $148.35, has a target of $167.80, indicating a 13.11% potential increase.

Below is a chart showcasing the price history of IPG, MTD, and TEL:

Here’s a summary of the current analyst targets:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 500 ESG ETF | EFIV | $56.83 | $62.87 | 10.62% |

| Interpublic Group of Companies Inc. | IPG | $27.09 | $30.80 | 13.70% |

| Mettler-Toledo International, Inc. | MTD | $1179.58 | $1335.00 | 13.18% |

| TE Connectivity plc | TEL | $148.35 | $167.80 | 13.11% |

Questions remain about whether analysts’ optimistic targets are justified. Are they basing their predictions on solid evidence, or are they lagging behind recent developments in these companies or their industries? Investors should consider the implications of a high target price, which can signal confidence in future performance but also risk possible downgrades if it proves overly ambitious.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of BLOK

• Funds Holding Otis Worldwide

• Top Ten Hedge Funds Holding DHT

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.