ETFs Under Review: Analyst Targets Signal Potential Growth for VLUE

At ETF Channel, we’ve analyzed the performance of various ETFs by comparing their underlying holdings to analyst predictions. For the iShares MSCI USA Value Factor ETF (Symbol: VLUE), our findings show an implied target price of $125.66 per unit based on these holdings.

Current Trading Price and Analyst Predictions

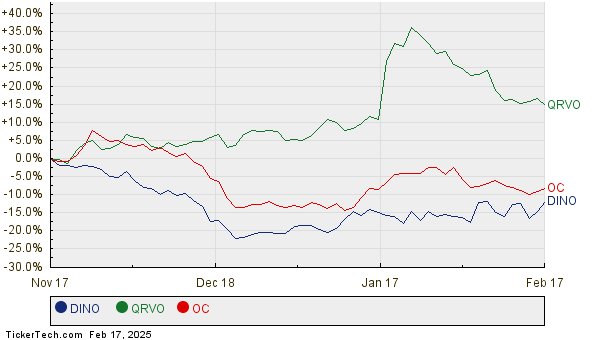

Currently, VLUE is trading at approximately $112.01 per unit, suggesting analysts anticipate a price increase of 12.18%. Specifically, three of VLUE’s holdings show significant expected gains based on their average target prices: HF Sinclair Corp (Symbol: DINO), Qorvo Inc (Symbol: QRVO), and Owens Corning (Symbol: OC). Notably, DINO is trading at $38.01 per share, while its average target is $47.25, indicating a potential upside of 24.31%. QRVO, with a recent price of $76.16, has a target price of $93.11, which represents an upside of 22.25%. Meanwhile, analysts project OC to reach $214.23 per share, up 19.43% from its recent price of $179.38. A chart of the twelve-month price history for these stocks is shown below:

Analyst Target Price Summary

The following table summarizes the current analyst target prices for the discussed holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares MSCI USA Value Factor ETF | VLUE | $112.01 | $125.66 | 12.18% |

| HF Sinclair Corp | DINO | $38.01 | $47.25 | 24.31% |

| Qorvo Inc | QRVO | $76.16 | $93.11 | 22.25% |

| Owens Corning | OC | $179.38 | $214.23 | 19.43% |

Analyst Predictions: Optimism or Realistic Targets?

These optimistic targets raise important questions for investors. Are the analysts justified in their predictions or overly optimistic given recent market shifts? Analysts’ targets can often indicate future growth, but they can also lead to reductions if they are based on outdated information. Investors should conduct further research to determine the validity of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Related Topics:

– HAP Historical Stock Prices

– RHHBY Stock Predictions

– PTCT YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.