Invesco S&P MidCap Low Volatility ETF Sees Analyst Upside

At ETF Channel, we’ve analyzed the underlying holdings of the ETFs we track. By comparing the trading prices of each holding to average analyst 12-month forward target prices, we calculated the weighted average implied target price for the Invesco S&P MidCap Low Volatility ETF (Symbol: XMLV) at $68.05 per unit.

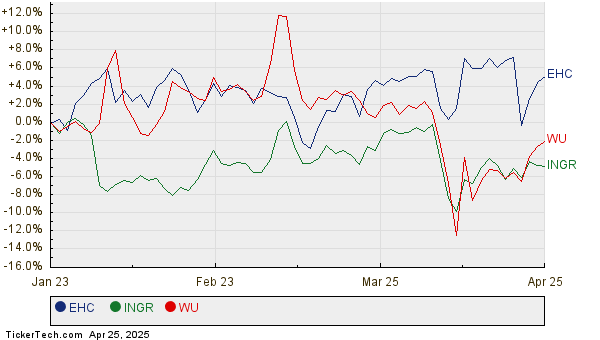

Currently, XMLV trades around $60.10 per unit, indicating a potential upside of 13.22% based on analyst projections for its underlying holdings. Among these holdings, three stand out for their significant upside potential: Encompass Health Corp (Symbol: EHC), Ingredion Inc (Symbol: INGR), and Western Union Co (Symbol: WU). Encompass Health recently traded at $101.41 per share, with an average analyst target of $117.25 per share, reflecting a potential upside of 15.62%. Ingredion, priced at $130.06, has a target price suggesting 15.49% upside to $150.20. Meanwhile, analysts expect Western Union shares to rise to an average target of $11.59, representing a 13.88% increase from its recent price of $10.18. The chart below illustrates the twelve-month price history of EHC, INGR, and WU:

Here’s a summary table of the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P MidCap Low Volatility ETF | XMLV | $60.10 | $68.05 | 13.22% |

| Encompass Health Corp | EHC | $101.41 | $117.25 | 15.62% |

| Ingredion Inc | INGR | $130.06 | $150.20 | 15.49% |

| Western Union Co | WU | $10.18 | $11.59 | 13.88% |

Investors might wonder if analysts are correct in their price targets or if they are being overly optimistic regarding these stocks’ prospects over the next 12 months. A high target price can indicate confidence in future growth, but it may also lead to potential downgrades if perceptions do not align with market realities. Investors should conduct further research to assess these variables.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

ARIA Price Target

CJ Options Chain

Institutional Holders of ENFR

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.