Analysts Predict Upside Potential for Xtrackers MSCI USA ESG Leaders ETF

In our analysis at ETF Channel, we examined the underlying holdings of several ETFs. For the Xtrackers MSCI USA ESG Leaders Equity ETF (Symbol: USSG), we determined that the weighted average implied analyst target price is $62.65 per unit.

Potential for Growth: USSG’s Current Price and Analyst Outlook

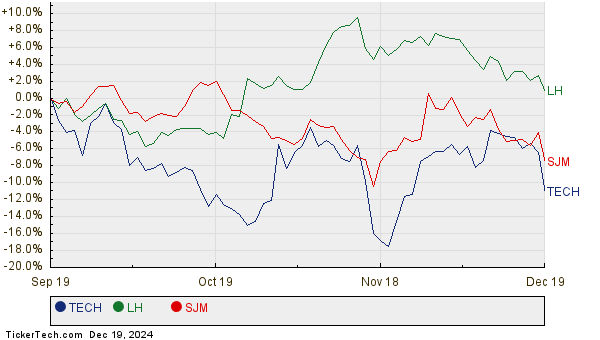

Currently trading at approximately $54.26 per unit, analysts anticipate a potential upside of 15.46% for this ETF based on the average target prices of its holdings. Among USSG’s key holdings with significant upside potential are Bio-Techne Corp (Symbol: TECH), Labcorp Holdings Inc (Symbol: LH), and J.M. Smucker Co. (Symbol: SJM). For instance, TECH trades at $71.41 per share, but the average target price is notably higher at $85.00, indicating a 19.03% upside. Similarly, LH shows 16.38% potential growth from its current share price of $226.31, expecting to hit an average target of $263.38. Meanwhile, SJM is projected to reach a target price of $128.00, reflecting a 16.12% increase from its current price of $110.23. The chart below illustrates the twelve-month price performance of TECH, LH, and SJM:

Summary of Analyst Targets

The following table displays the current analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Xtrackers MSCI USA ESG Leaders Equity ETF | USSG | $54.26 | $62.65 | 15.46% |

| Bio-Techne Corp | TECH | $71.41 | $85.00 | 19.03% |

| Labcorp Holdings Inc | LH | $226.31 | $263.38 | 16.38% |

| J.M. Smucker Co. | SJM | $110.23 | $128.00 | 16.12% |

Investors’ Considerations

Are analysts’ price targets realistic, or are they overly optimistic? It’s essential to understand whether these estimates are based on solid grounds or if they reflect outdated assessments of company performance and industry trends. A high price target can suggest optimism, but might also lead to future downgrades if market conditions change. Investors should conduct further research to make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Past Earnings

• Institutional Holders of CBMX

• Public Storage Technical Analysis

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.