Analysts Predict Strong Upside for First Trust Financials ETF

ETF Channel has analyzed the underlying assets of various ETFs within its coverage universe. By comparing the current trading price of each holding to the average analyst 12-month forward target price, we calculated the weighted average implied analyst target price for the First Trust Financials AlphaDEX Fund ETF (Symbol: FXO). The resulting implied target price for FXO is $62.13 per unit.

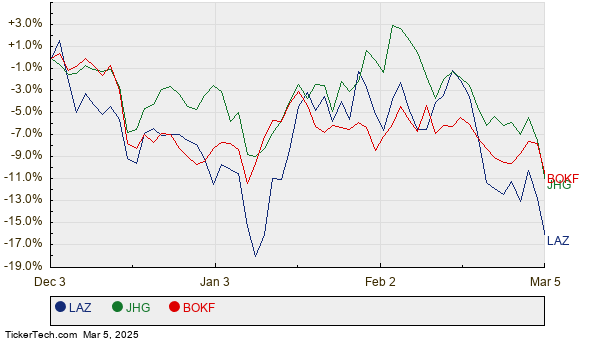

Currently, FXO is trading at approximately $53.28 per unit, indicating that analysts anticipate a 16.61% upside based on the average target prices of its underlying holdings. Among FXO’s significant holdings, three companies stand out due to their potential for price appreciation: Lazard Inc (Symbol: LAZ), Janus Henderson Group plc (Symbol: JHG), and BOK Financial Corp (Symbol: BOKF).

Lazard Inc is trading at $46.51 per share, while the average analyst target is considerably higher at $56.57 per share, reflecting a potential upside of 21.63%. Likewise, JHG shows a market price of $39.42, with analysts predicting a rise to an average target of $46.36, representing a 17.61% upside. For BOKF, the recent price of $104.74 comes with an analyst target of $122.88, translating to an expected increase of 17.31%. Below is a twelve-month price history chart that compares the stock performance of LAZ, JHG, and BOKF:

Here is a summary table displaying the current analyst target prices for the discussed companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Financials AlphaDEX Fund ETF | FXO | $53.28 | $62.13 | 16.61% |

| Lazard Inc | LAZ | $46.51 | $56.57 | 21.63% |

| Janus Henderson Group plc | JHG | $39.42 | $46.36 | 17.61% |

| BOK Financial Corp | BOKF | $104.74 | $122.88 | 17.31% |

Investors may wonder if analysts’ targets are justified or overly optimistic regarding future trading levels of these stocks. Equity price targets can indicate optimism about potential growth but might also suggest the possibility of future target downgrades if they don’t keep pace with recent developments. Such concerns highlight the importance of conducting thorough research before acting on these predictions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• Institutional Holders of MXN

• MNCL Historical Stock Prices

• Top Ten Hedge Funds Holding FCAP

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.