Analysts See Significant Upside in Vanguard ESG U.S. Stock ETF

At ETF Channel, we have analyzed the underlying holdings of various ETFs in our coverage universe. By comparing each holding’s trading price against the average analyst 12-month forward target price, we calculated the weighted average implied analyst target price for the ETF. For the Vanguard ESG U.S. Stock ETF (Symbol: ESGV), the implied analyst target price stands at $122.41 per unit.

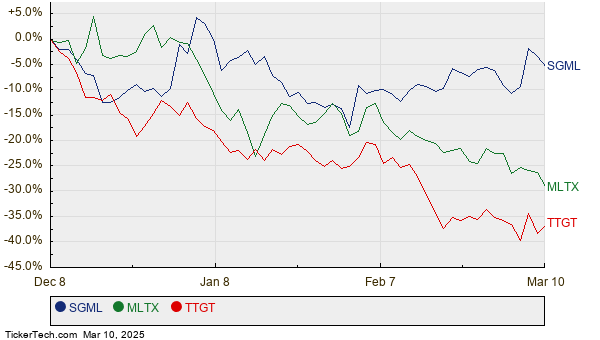

Currently, ESGV is trading near $101.86 per unit, indicating that analysts anticipate a 20.18% upside for this ETF based on the average targets of its underlying holdings. Notably, three holdings demonstrate considerable upside potential based on their analyst target prices: Sigma Lithium Corp (Symbol: SGML), MoonLake Immunotherapeutics (Symbol: MLTX), and TechTarget Holdings Inc (Symbol: TTGT).

For SGML, which has a recent trading price of $11.74 per share, the average analyst target is significantly higher at $24.50 per share, suggesting an upside of 108.69%. Similarly, MLTX, priced at $38.03, shows a potential upside of 102.04%, with an average target price of $76.85. Meanwhile, TTGT, with a recent price of $14.51, has an expected target price of $27.67 per share, reflecting a potential increase of 90.67%. Below is a price history chart comparing the stock performance of SGML, MLTX, and TTGT:

Here is a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard ESG U.S. Stock ETF | ESGV | $101.86 | $122.41 | 20.18% |

| Sigma Lithium Corp | SGML | $11.74 | $24.50 | 108.69% |

| MoonLake Immunotherapeutics | MLTX | $38.03 | $76.85 | 102.04% |

| TechTarget Holdings Inc | TTGT | $14.51 | $27.67 | 90.67% |

The question remains: Are analysts justified in these target prices, or are they being overly optimistic about these stocks’ potential over the next twelve months? Additionally, do analysts have valid justifications for their targets, or are they lagging behind recent company and industry developments? A significant gap between a target price and a stock’s current trading price could reflect optimism but may also indicate a risk of future price downgrades if those targets become outdated. Investors should conduct further research to address these concerns.

![]()

10 ETFs With Most Upside To Analyst Targets »

also see:

• LKOR Options Chain

• Institutional Holders of COR

• FHCO Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.